Economy alert: UK businesses hit by extra 10% tax as Donald Trump scraps US duty-free parcel threshold

GB News

British exporters are facing a major new barrier after the United States scrapped its long-standing duty-free threshold on low-value parcels

Don't Miss

Most Read

Latest

Companies in the UK will now be subject to President Donald Trump's tariffs on imports coming into the US, with some firms to be hit with an extra 10 per cent charge.

From August 29, goods worth less than $800 (£592) are no longer exempt from tariffs. UK shipments are now subject to a 10 per cent levy, regardless of value.

Business analysts note the sudden change has left small and medium-sized enterprises scrambling to adapt.

Many companies rely heavily on American sales, and industry groups warn the move could price them out of their biggest overseas market.

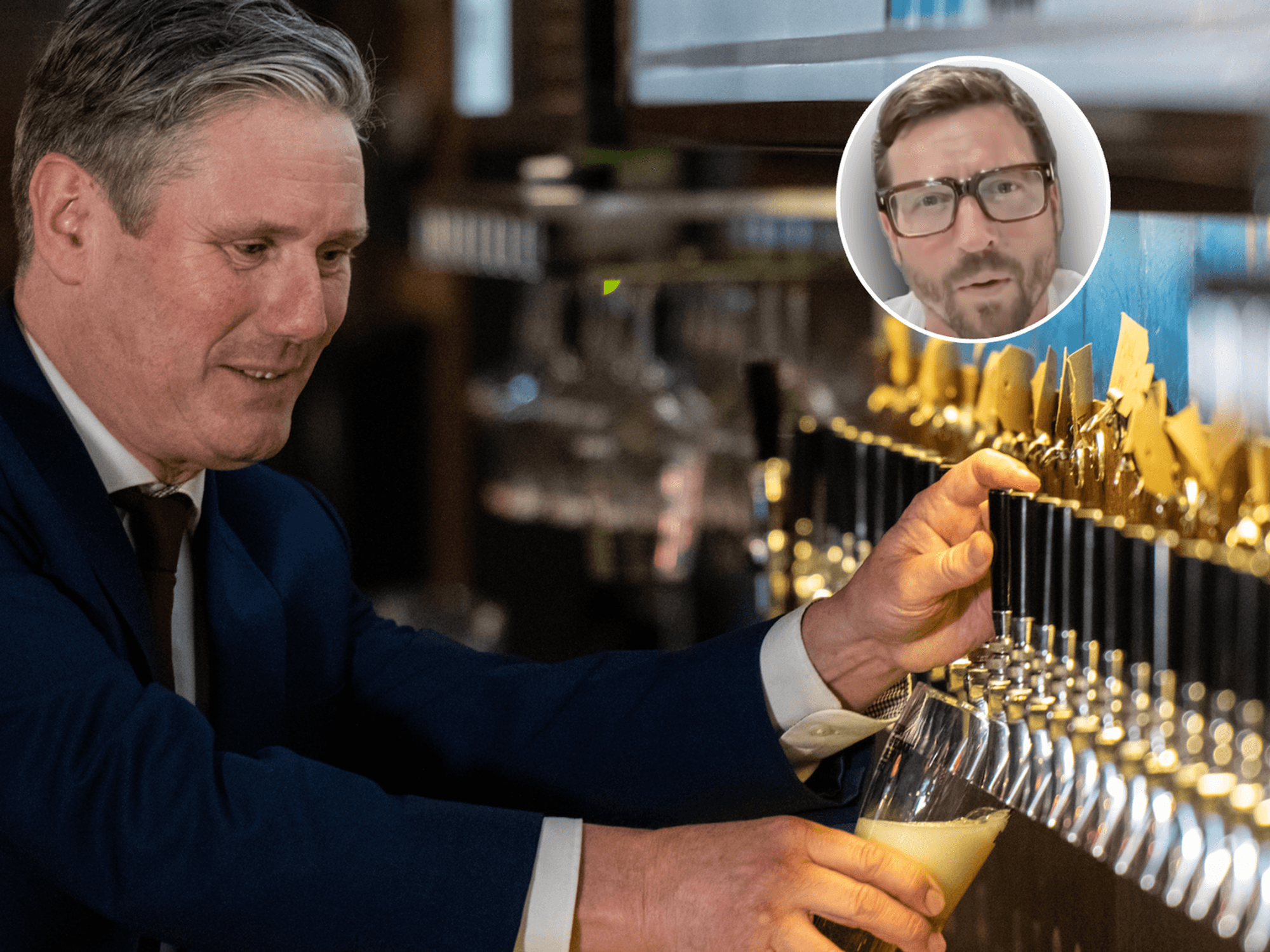

Martin Hamilton, the partner and head of retail at Menzies explained the move is "a major setback for UK exporters".

He told GB News: "Retailers with large American customer bases will be hit hardest, facing higher costs, disrupted logistics, and tougher competition against US rivals."

Mr Hamilton warned that British firms may be forced into new shipping models

"Customer acquisition just got more expensive. To offset higher return rates, many UK brands may turn to Delivered Duty Paid terms.

"That almost certainly requires raising prices for US consumers," the Menzies boss added.

Do you have a money story you’d like to share? Get in touch by emailing money@gbnews.uk.

Mr Hamilton warned that British firms may be forced into new shipping models

|Reuters/GB News

Mr Hamilton added: “A typical $100 order could now incur an additional $30 to $50 in costs, depending on the final sales tax rate adopted by US authorities."

"On top of that, brands will face extra fees from shipping providers for handling duties and taxes.”

Sean Turner, the director of transport and logistics at Menzies, said companies must be ready for complex new requirements.

"UK goods shipped to the US are now hit with tariffs — 10 per cent for non-postal shipments, and for postal deliveries either ad valorem duty, based on the tariff rate for the country of origin, or a flat $80–$200 per item," he explained.

SME's will struggle with the burden of these tariffs, economists warn.

| GETTY IMAGESHe noted that the flat-rate option will vanish on February 28, 2026. "Sellers need to stay sharp", he said.

"They must ensure the appropriate declarations are made, tariffs are paid by authorised parties to Customs and Border Protection, and factor in new carrier admin fees to avoid delays."

Mr Turner added: "Royal Mail has already introduced a handling charge per postal delivery. A few exemptions remain, such as for donations and informational material, but this is a continuously changing landscape.

"Businesses need to talk to carriers, customs brokers and advisers to adapt supply chains as best they can."

Ronald Kleijwegt, chief executive of Vinturas, warned that smaller firms would be the hardest hit. “With de minimis scrapped, EU exporters now face tariffs on low-value items, added customs paperwork and higher shipping costs when selling to the US,” he said.

He added: "Small businesses feel this the most. What was once a straightforward cross-border trade is now full of uncertainty. Larger companies may have the resources to adapt by absorbing costs, rerouting logistics, or investing in compliance."

"Smaller businesses often do not, which can limit their opportunities, slow innovation, and reduce consumer choice."

Mr Kleijwegt also highlighted the wider impact on American buyers. "US small businesses now lose out on cheaper European sourcing, while households could see reduced choice and higher prices," he said.

Government figures show the potential scale of disruption. According to HMRC, around 28,000 small UK firms exported goods to the US in 2023. For many, America is their single largest overseas market.

Some exporters have already taken drastic action. Helen Hickman, who runs hand-dyed wool business Nellie and Eve in Carmarthenshire, told the BBC she has stopped all American shipments, which once made up 30 per cent of her revenue. “I knew it was going to be an absolute chaotic mess,” she said.

The United States remains the UK’s single largest trading partner outside Europe, with exports worth more than £175billion in 2023.

According to the Office for National Statistics, around £6billion of this trade was made up of small parcels and low-value consignments.

LATEST DEVELOPMENTS:

Trump has put an emphasis on protecting American manufacturers.

| REUTERSThe "de minimis" exemption had been in place since 2016, making the US one of the most generous markets for low-value imports.

By comparison, the EU applies a much stricter €150 threshold for duty-free treatment of goods entering from outside the bloc.

China, one of the largest exporters of low-cost goods, has been the main beneficiary of the US exemption in recent years.

Critics in Washington argued that the policy undercut domestic manufacturers by flooding the market with cheap imports. he new tariffs are part of a broader US trade policy shift aimed at reshoring production and tightening control of supply chains.