Tax raid warning as digital ID cards open door for £600million HMRC grab

Digital ID's branded 'a prison for society' after GB News live audience member delivers brutal verdict : 'I just don't understand it!' |

GBNEWS

Critics have issued warnings about the risks to privacy and Government overreach

Don't Miss

Most Read

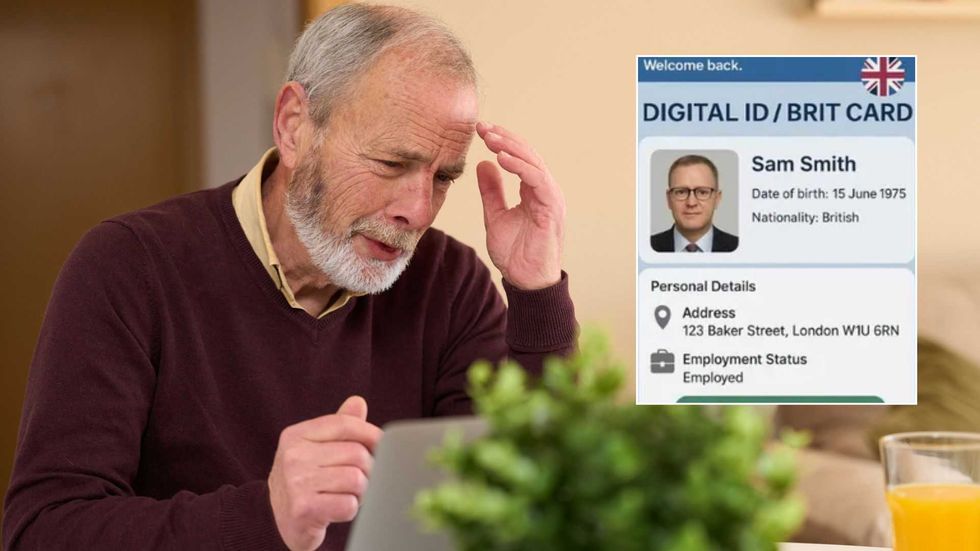

Digital identity cards could hand the Treasury an extra £600million a year, with HMRC considering plans to use the technology to automatically fill in parts of tax returns.

Officials say the move would cut errors and help recover unpaid revenue.

HMRC is looking at how digital ID systems could be used to make paying tax simpler and cut down on mistakes. Officials say the technology could also improve customs processes by linking up more data across government. The tax authority wants to use the scheme to automatically fill in tax returns as part of a push to claw back unpaid revenue and reduce so-called "errors".

The idea is part of a wider push to modernise public services through digital systems. The Tony Blair Institute for Global Change has estimated that stronger data sharing could bring in an extra £600million a year in tax that currently goes uncollected.

The think tank has been closely involved in shaping the proposals and was consulted by Whitehall before the Prime Minister announced his digital ID plans.

The think tank's analysis suggests that comprehensive digital ID could deliver at least £2billion annually to public finances through improved identity verification.

Jo Puddick, a former senior Labour Party official who now serves as the TBI's director of political insight, co-authored key papers outlining the economic benefits. The institute's reports detail how the system could enable HMRC to "better target tax-compliance activity", particularly in addressing under-taxed offshore income.

Sir Tony Blair has championed ID cards since his time as Prime Minister, when his government introduced voluntary cards in the 2000s before the Conservative-led coalition abolished them in 2011.

Digital ID cards could exclude over two million elderly people 'out of vital services' |

Digital ID cards could exclude over two million elderly people 'out of vital services' | GETTY

Civil liberties groups are warning that Labour’s digital ID plans could spiral into a surveillance state. Big Brother Watch branded the idea a "sprawling surveillance system that is frankly chilling", even likening elements to a social credit model that would "make Orwell blush".

The public is also turning against the scheme, with a petition against mandatory ID cards topping 2.6 million signatures. Polling shows support has plummeted from 35 per cent in the summer to just 14 per cent after the Prime Minister’s announcement.

Opposition parties including the Conservatives and Reform UK have lined up alongside privacy campaigners, voicing fears of government overreach and mission creep well beyond immigration checks.

The proposed system would function by connecting taxpayer information already held by government departments to individual digital identities.

Digital ID cards spark tax grab fears as HMRC eyes £600million claw back

| GETTYPlans for a digital ID system could see parts of tax returns filled in automatically, a move the Treasury claims would save billions lost through errors each year.

The project, expected to cost £1billion to set up and £100million a year to run, would link government databases to flag discrepancies and target compliance more aggressively. Officials say the technology could eventually expand far beyond tax, making it easier to apply for driving licences, childcare and welfare.

One government paper described the idea as building a "smarter state that knows when and how to help, without citizens having to ask".

Government officials maintain that the digital ID system will initially focus solely on verifying work eligibility as part of immigration enforcement measures.

The proposal would require all UK citizens and legal residents aged 16 and over to hold a free national ID card | PA

The proposal would require all UK citizens and legal residents aged 16 and over to hold a free national ID card | PAA government spokesman stated: "Digital ID will help us address key challenges we face, supporting people to access the services they're entitled to and tackling illegal working."

Ministers have committed to launching a public consultation on the scheme's implementation and design, promising appropriate safeguards for data protection. Any savings generated would be reinvested into public services, officials confirmed.

A government source emphasised that HMRC's "Transformation Roadmap" outlining digital identification usage for tax purposes "predates" the Prime Minister's digital ID announcement and the two "should not be conflated".

The source described the HMRC plans as focused on creating more efficient and automated tax processes to support economic growth.

More From GB News