Keir Starmer to block UK financial services from EU talks amid push for 'closer alignment' post-Brexit

The Prime Minister is understood to be considering closer links to the EU single market

Don't Miss

Most Read

Prime Minister Keir Starmer is understood to have blocked UK financial services from being included in upcoming business talks with the European Union (EU) amid a push for "closer alignment" between the UK and the economic bloc.

The Prime Minister appears to be responding to Labour Government minister pressure from financial services companies opposed to readopting Brussels regulations..

Government officials confirmed to the Financial Times that despite ministerial interest in enhanced cooperation with the EU on financial matters, the Prime Minister has ruled out bringing the sector back under European regulatory frameworks.

The decision follows after Mr Starmer suggested earlier this week that Britain should consider tighter single market alignment where it serves national interests.

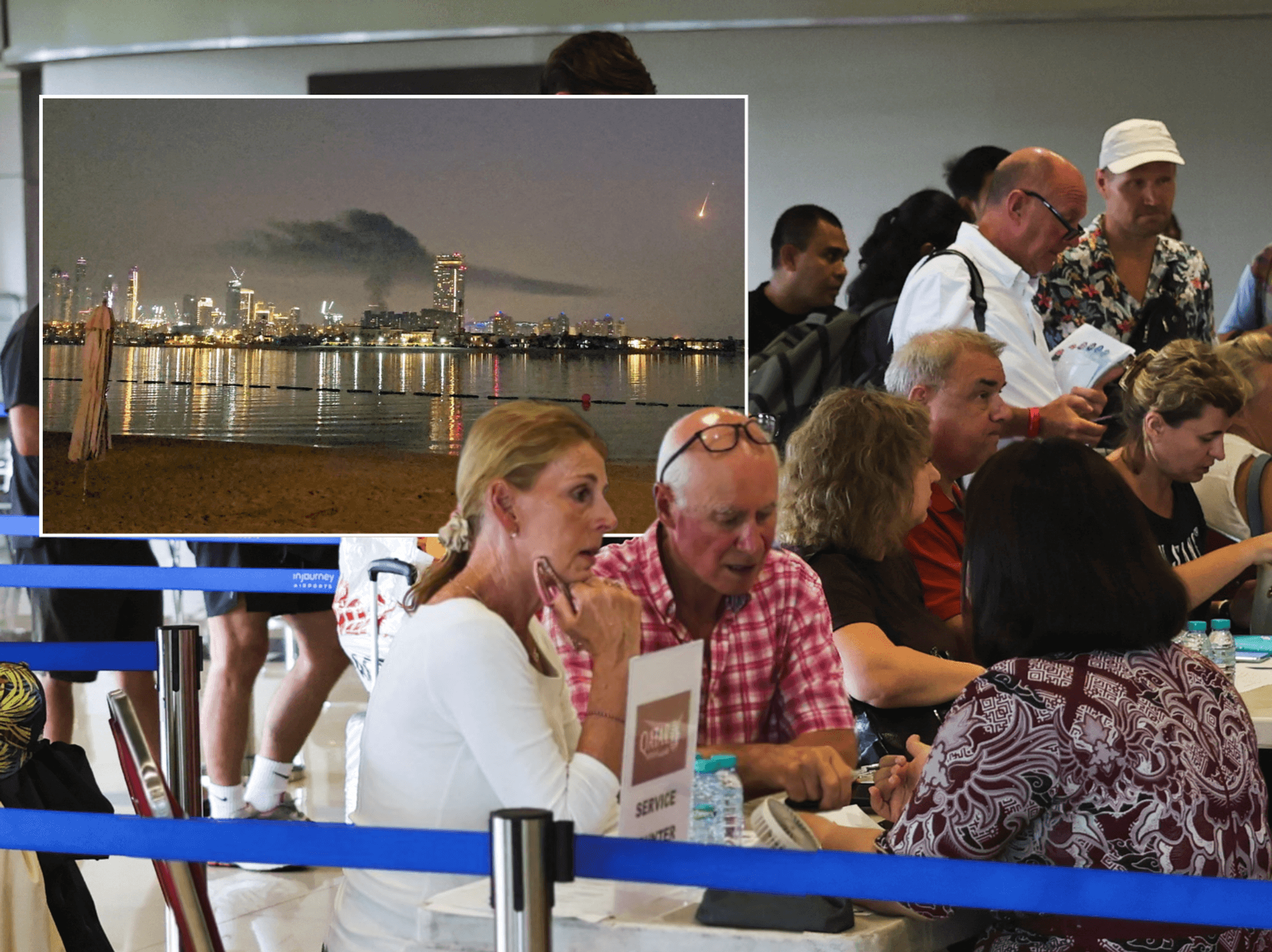

The PM is excluding the UK's financial services sector from upcoming EU discussions

|GETTY / PA

The prospect of Westminster once again accepting rules dictated by Brussels has reignited political tensions, with Conservative and Reform UK politicians strongly resisting any such arrangement.

Meanwhile, some Labour backbenchers and Liberal Democrats continue advocating for deeper economic ties with the continent, with ministers preparing to introduce legislation in the coming weeks permitting the adoption of EU standards in targeted areas, including food regulations and animal welfare, to ease trade friction.

The financial sector's appetite for regulatory alignment has diminished considerably since the immediate aftermath of Brexit, when banks actively sought equivalence arrangements to preserve European market access.

Kerstin Mathias, international affairs director of the UK Finance trade body, said: "Ten years ago equivalence would have been very valuable, but now the world has moved on."

The City of London is unlikely to be subject to stricter regulations

| PAMiles Celic, the chief executive of TheCityUK, acknowledged cooperation with Brussels remained sensible but cautioned: "But rejoining the single market or a customs union would not be a simple upgrade.

"The UK would risk trading flexibility for uniformity: less scope to shape its own rules and fewer chances to cut bespoke deals beyond Europe."

Government officials have acknowledged the financial sector's reservations as legitimate, confirming that ministers are not pursuing regulatory alignment for the industry.

One official noted this represented an area where Britain had substantially diverged from European frameworks since leaving the bloc.

Another Government source questioned the logic of following EU regulations, pointing out that the UK constitutes the larger market in financial services.

A Government spokesperson clarified that last year's UK-EU "common understanding", which paved the way for Britain to adopt Brussels standards on food and energy — was deliberately narrow in scope and excluded the financial sector.

The spokesperson added: "However, the EU is the UK's second largest trading partner for financial services and we continue to explore areas of co-operation where it is in our economy's interest."

Earlier this week, figures revealed Eurozone inflation eased to two per cent in December, edging down from November’s 2.1 per cent pace and landing on the European Central Bank’s long-term target.

The Government is floating closer ties to the EU

| BRUCE TANNERProfessor Emeritus Joe Nellis, an economic adviser at accountancy firm MHA, said: "This reflects a broad cooling in goods prices and continued restraint in energy costs, while services inflation remains the main source of underlying momentum.

"The key takeaway is that price pressures have normalising after several turbulent years. Policymakers remain wary of declaring victory too soon. Wage pressures, shifts in global energy markets, and uneven demand across member states still pose risks to the outlook.

"However, with headline and core inflation now moving in a relatively narrow band, the ECB faces fewer immediate triggers to adjust interest rates. The ECB is unlikely to cut interest rates further — unless there is a deep slump in the European economy — meaning it will aim to keep borrowing costs steady in the coming months while closely monitoring the direction of travel.

"The evolving geopolitical landscape could have a further impact on global inflation. If the US administration’s actions in Venezuela go to plan, Venezuela’s vast resources of oil and gas could be unlocked. This would increase global supply and apply pressure on energy prices. While the outcomes remain uncertain, this could influence Eurozone prices later in the year."

More From GB News