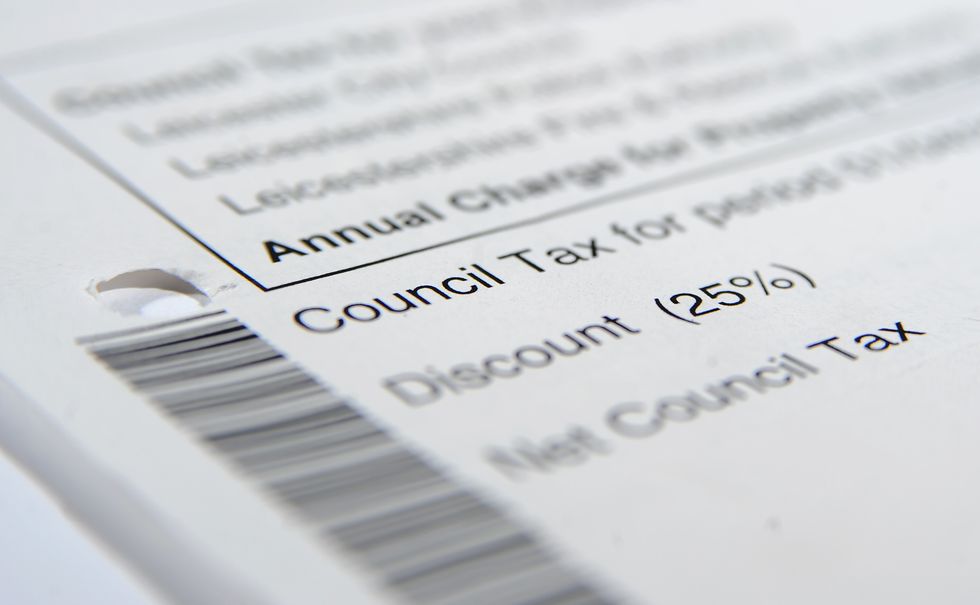

Council tax: Average bill to surpass £2,000 as levy hiked up

Rules changed last year to allow councils to put through higher rises

Don't Miss

Most Read

Families could see the cost-of-living crisis deepen with the average council tax bill set to top £2,000 for the first time.

The latest surge comes as Government statistics show the average council tax bill for a Band D property will reach a record high of £2,065 in 2023-24.

Households in metropolitan areas outside London will see bills rise by 5.1 per cent to an average of £2,059, and rural parts of the country will see an increase of five per cent to just below £2,140.

The biggest annual percentage rise will hit London as average bill jump by 6.2 per cent, but will remain below other areas at £1,789.

Bank of England Governor Andrew Bailey claims inflation will drop by the summer

|PA

The Conservative-led County Councils (CCN) Network, which represents local authorities that provide services to nearly half of the population in England, said the combination of a 4.8 per cent increase in local government funding and council tax flexibilities in 2023-24 was still not enough to cover rising costs and growing demand.

The CCN said the outlook for council finances looked “bleak” unless they were given greater financial certainty and the government delivers “fair funding” reforms.

Homeowners on variable rate mortgages will continue to see their payments go up by hundreds of pounds per year after the Bank of England bumped up interest rates to 4.25 per cent.

The move is supported by Chancellor Jeremy Hunt, who explained that rising prices were “strangling growth”.

Households across Britain are also battling with price rises from energy firms which are set to rise by £67 a month when the Government’s support scheme comes to an end.

And inflation rates rose again to 10.4 per cent in the year to February, which has been driven by surging food prices due to shortages of salad and vegetables.

The Governor of the Bank of England attempted to reassure the public over both rising price rises and fears of a banking crisis as he claimed that inflation will have fallen sharply by the summer.

Food prices have increased by 18.2 per cent - a 45 year high – amid salad and vegetable shortages.

Bank of England Governor Andrew Bailey said he expected inflation to decrease by the time families are heading for their holidays this summer but hinted that rates could continue to climb until it is brought under control.

“We know people are worried about the cost of living and they rightly think that inflation is too high,” he said.

“They may also be worried about what they have been hearing about banks in recent days.

The increase in council tax will add to the already heightened cost of living crisis

|PA

“That's why we have taken action on both.

“Low and stable inflation is the foundation of a healthy economy. Raising rates is the best tool to bring inflation down.

“We believe inflation will begin to fall quite rapidly before the summer.”

Chancellor Hunt said: “With rising prices strangling growth and eroding family budgets, the sooner we grip inflation the better for everyone.

“That's why we support the Bank of England's actions today and why we will continue to play our part in this fight by being responsible with the public finances, alongside providing cost of living support worth an average of £3,300 per household over this year and next.”