Benefits warning as ‘honest mistake’ sees carer lose £16,000 and taken to court by DWP

Carer's Allowance is currently paid at a weekly rate of £81.90

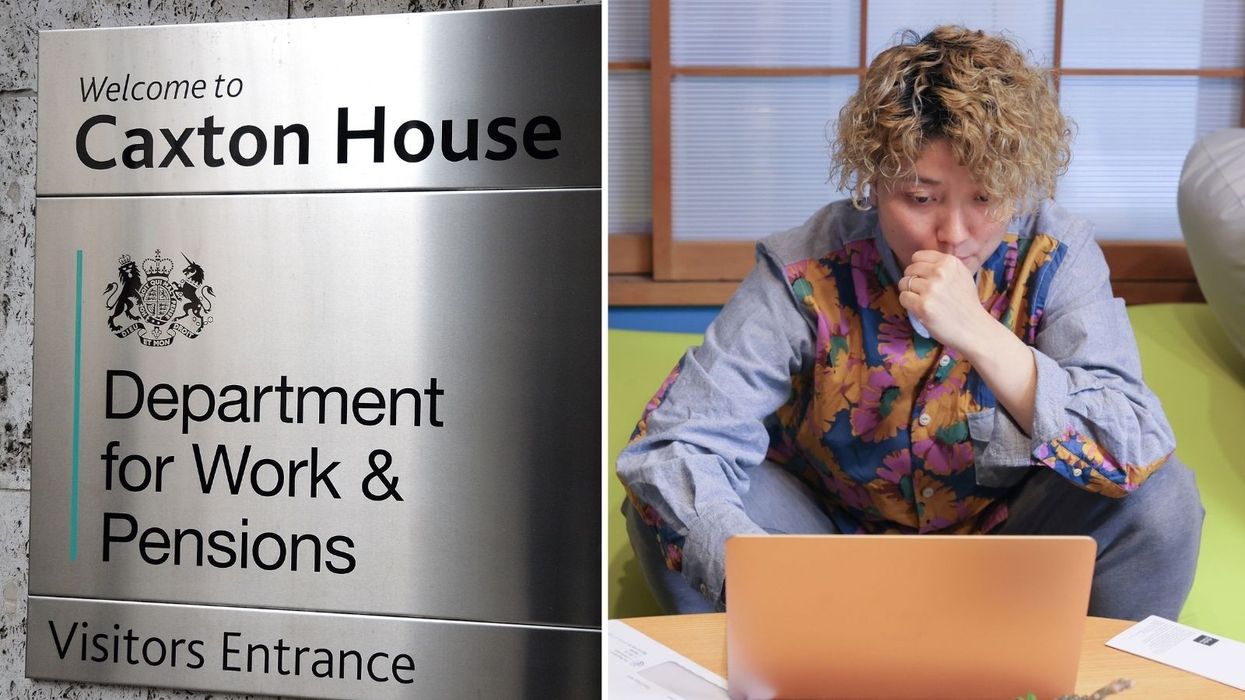

|GETTY/PA Images

Over 145,000 carers were asked to repay sums relating to earnings breaches last year, the DWP has said

Don't Miss

Most Read

Latest

Thousands of carers have had to repay thousands of pounds after inadvertently breaching Government rules.

Some Carer’s Allowance claimants have been found to owe money to the Department for Work and Pensions after going over the weekly earnings limit.

Carer's Allowance is currently paid at a weekly rate of £81.90 and anyone on the benefit is allowed to have a second income from a job.

However, claimants can't earn more than £151 a week, or they will lose all of their benefit allowance.

If a claimant earns more, the DWP can then seek to recover the overpayment by any means possible.

But this initial breach may take months or even years to spot, meaning in some cases, these carers are racking up a debt they have no idea is happening.

Benefit claimants are warned of the consequences if they do not report changes to the DWP

|GETTY

Even if the earnings limit is exceeded by £1, claimants become automatically ineligible for the entire Carer’s Allowance, resulting in a “cliff edge” repayment penalty.

In 2022/23, an extra 26,700 carers were asked to repay sums relating to earnings breaches on top of the total, DWP figures show.

More than 800 were repaying sums between £5,000 and £20,000, and 36 were repaying more than £20,000, The Guardian reported.

Although some carers did not report a change in their circumstances, charities and MPs are arguing that the Government are treating these individuals “draconianly”.

The DWP has IT systems that flag when a carer’s income breaches the threshold, however critics have said that in many cases they have failed to act on this information immediately.

Last week, Vivienne Groom was prosecuted for failing to declare her minimum wage Co-op job to the DWP while also caring for her mum and getting Carer’s Allowance.

In November 2023, a judge found that her omittance of the Co-op job was an “honest mistake” as she claimed she was told by her social worker that she did not have to tell the DWP about her job.

Ms Groom initially agreed a payment plan with the DWP at £30 per month to cover the overpayments.

But in the most recent hearing, the Government discovered she stood to inherit £16,000 from her mother after she passed away and they froze her accounts and seized the money.

Devastated by the result, Ms Groom told the BBC: “I mean, if people look after their parents they should be paid more money so they don't have to go to work as well.

"I had to go to work. We had bills to pay.”

Ms Groom was charged with benefit fraud offences and sentenced to a community order with unpaid work requirements in November 2023. She had to give up her inheritance of £16,000.

Ed Davey, the Liberal Democrat leader, said: “Most unpaid carers struggle financially, and for many it takes a toll on their mental and physical health too.

“The truth is, unpaid family carers underpin our entire care sector, and help to keep the NHS on its feet too. The government should value and support carers, not treat them like criminals.”

Ken Butler, Disability Rights UK’s Welfare Rights and Policy Adviser, said: “The fundamental issue is that, despite her carer responsibilities to her mother, due to the low level of benefit she was receiving, Ms Groom needed to work on top of this because she had bills to pay.

“Those in receipt of Carer’s Allowance are more likely to be cutting back on food and heating (35 per cent) compared to all carers (25 per cent), according to statistics from Carers UK.

“Meanwhile, nearly eight per cent of unpaid carers in receipt of carer’s allowance are using food banks to cope with the cost-of-living crisis, compared to five per cent of all unpaid carers.

“The persecution of unpaid carers like Ms Groom must end together with the harsh carers allowance earnings rules.”

Helen Walker, chief executive of Carers UK said: “A wholescale reform and review of Carer’s Allowance and other carers’ benefits is needed to ensure these adequately support unpaid carers during the time they spend caring for someone so that the system does not punish them for misinterpreting complicated and harsh earnings rules.”

The DWP states Carer’s Allowance claimants must report changes in circumstances when:

- they change, start or leave a job

- they start earning more than £151 a week

- they stop being a carer

- they stop providing at least 35 hours of care a week

- they take a holiday or go into hospital - even if they arrange care while they’re away

- the person they care for goes into hospital, into a care home or takes a holiday

On their website, the DWP warns: “You could be taken to court or have to pay a penalty if you give wrong information or do not report a change in your circumstances.”

If an individual has been overpaid, they may have to repay the money if they did not report a change straight away, if they gave wrong information or if they were overpaid by mistake.

A DWP spokesperson has said: “We are committed to fairness in the welfare system, with safeguards in place for managing repayments, while protecting the public purse.

“Claimants have a responsibility to inform DWP of any changes in their circumstances that could impact their award, and it is right that we recover taxpayers’ money when this has not occurred.”

The DWP remains committed to working with anyone who is struggling with their repayment terms and will always look to negotiate sustainable and affordable repayment plans.

When a customer makes contact, they may be able to reduce the rate of repayment, or temporarily suspend repayments depending on the customer’s financial circumstances.