Budget tax raid breakdown: How Rachel Reeves could 'affect your wallet', pensions and savings next week

GB NEWS

Analysts are revealing how Britons can prepare for the likely tax hikes which will be included in the Chancellor's looming fiscal statement

Don't Miss

Most Read

Latest

British families face mounting financial pressure as Chancellor Rachel Reeves prepares to unveil her Autumn Budget on November 26, with Treasury seeking to address a £20billion fiscal shortfall.

Energy costs remain stubbornly high, with typical yearly bills approaching £1,800. At the same time, inflation continues to exceed four per cent, squeezing family budgets further.

These economic headwinds have prompted widespread concern about potential tax increases and benefit adjustments in next week's fiscal statement as speculation grows.

Personal finance specialist Aaron Peake from credit score provider CredAbility has broken down the five likely changes to taxes, savings and pensions in the Budget which could impact your finances.

Which taxes could the Chancellor target next week?

|GETTY / PA

Here is a full list of the five changes Mr Peake believes will "affect your wallet" after November 26:

- Tax threshold freeze, potential income tax tax and National Insurance cut

- Changes to tax-free pension cash and salary sacrifice

- Cuts to the tax-free savings allowance attached to ISAs

- Property tax reform

- Wealth taxes.

Rachel Reeves U-turned on potential income tax rises last week | PA

Rachel Reeves U-turned on potential income tax rises last week | PARetirement savings face potential restrictions based on recent reports. The current provision permitting tax-free withdrawal of 25 per cent of pension savings may face new limits.

"Popular pension boosting methods like salary sacrifice may also lose some tax perks, pushing up long-term costs for workers planning their retirement," Mr Peake explained.

The tax-free allowance linked to ISA products could drop from £20,000 to £10,000 for cash holdings, with greater emphasis on investment products.

Households can take several protective measures before the Budget announcement. Mr Peake recommends securing improved savings returns immediately.

"Savings rates can change quickly after a Budget. If your cash is stuck in a low-paying account, switch sooner rather than later. Even a 0.5 PER CENT boost makes a noticeable difference across a year," he advised.

Rather than making hasty financial decisions, families should carefully assess potential impacts. "Try an online tax calculator to see what different scenarios might mean for your take-home pay," Mr Peake suggests.

Budget reviews have become essential with elevated living costs. "If you've fallen into autopilot with subscriptions or unused memberships, trim those back.

"Freeing up £20 to £30 a month can help soften the blow if your costs rise after the Budget," he added.

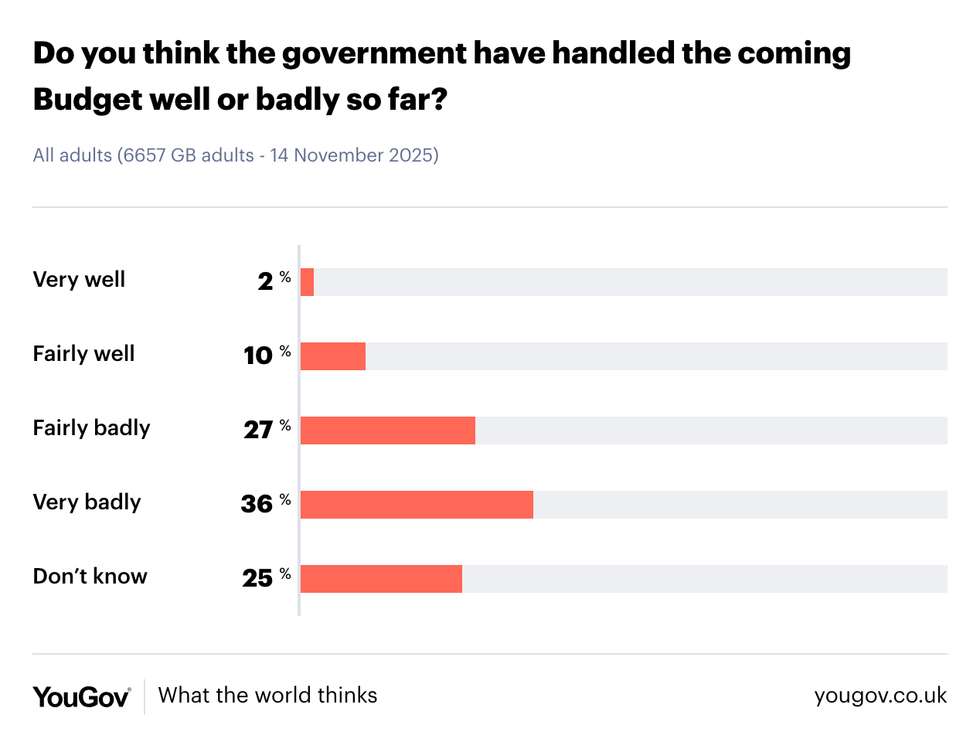

The poll shows more than a third of people think the Government has handled the Budget 'very badly' so far | YOU GOV

The poll shows more than a third of people think the Government has handled the Budget 'very badly' so far | YOU GOVProperty owners are also understood to be at risk of being targeted by the Treasury. An eight per cent National Insurance levy on rental earnings could generate substantial Treasury revenue.

Additionally, ministers are exploring a comprehensive overhaul that would eliminate stamp duty and council tax in favour of yearly charges on expensive properties. Investment income faces further pressure through potential adjustments to dividend taxation, capital gains levies and inheritance duties.

The capital gains tax (CGT) exemption has already fallen dramatically from £12,300 to £3,000, with additional reductions possible.

"It's easy to panic when there's talk of tax changes and benefit tweaks," Peake cautions. His key recommendation remains measured assessment rather than rushed decisions. "If you're worried about how changes might affect your tax position, pension, or investments, speak to an independent financial adviser. A short chat can help you understand your options and avoid mistakes."