Nationwide Building Society issues property market update as 'house prices will continue to stall in 2026'

Data from Nationwide found annual property price growth slipped to just 0.6 per cent last month

Don't Miss

Most Read

Latest

Mortgage analysts are warning that "house prices will continue to stall in 2026" after data from Nationwide Building Society found a dip in property prices towards the end of last year.

Property values across the United Kingdom dropped unexpectedly last month, with annual growth decelerating sharply to just 0.6 per cent in December compared with 1.8 per cent the previous month, according to the latest Nationwide House Price Index figures.

The data revealed a 0.4 per cent month-on-month decline when seasonal factors were taken into account. Robert Gardner, Nationwide's Chief Economist, said: "UK house prices ended 2025 on a softer note, with annual price growth slowing to 0.6 per cent, from 1.8 per cent in November, the slowest pace since April 2024."

He attributed part of the slowdown to comparison effects, noting that December 2024 had recorded robust annual growth of 4.7 per cent. Industry analysts cautioned that property values are expected to remain flat throughout the coming year.

Nationwide Building Society's latest report found property prices are falling

|GETTY

Northern Ireland emerged as the standout performer in the housing market for the third consecutive year, recording price increases of 9.7 per cent during 2025, Nationwide reported.

David Stirling, an independent financial adviser at Belfast-based Mint Wealth Ltd, told Newspage: "Northern Ireland outperformed the rest of the UK in 2025 for the third year running, supported by lower average prices, strong demand and a chronic lack of housing supply."

He noted that demand remained particularly strong among first-time buyers despite ongoing pressures from borrowing costs and household finances. At the opposite end of the spectrum, East Anglia posted the poorest results nationwide, with property values falling by 0.8 per cent over the twelve-month period.

Mr Stirling suggested that weaker performance across other regions indicated many prospective purchasers and movers held back during 2025, likely discouraged by Autumn Budget uncertainty.

Will mortgage rates drop below 3.5 per cent in 2026? | GETTY

Will mortgage rates drop below 3.5 per cent in 2026? | GETTYMortgage experts pointed to a combination of factors behind the market's sluggish performance towards the tail end of 2025 and going into the New Year.

Elliott Culley, the director at Hayling Island-based Switch Mortgage Finance, said: "House prices slowing in the majority of the UK is unsurprising as higher interest rates, coupled with the changes to stamp duty and lack of incentives for first-time buyers has left the market in neutral."

Justin Moy, a managing director at Chelmsford-based EHF Mortgages, observed that the property sector had experienced a marked deceleration over recent months, with numerous buyers waiting for Budget announcements before committing to purchases.

Kundan Bhaduri, an entrepreneur, investor and landlord at London-based The Kushman Group, said: "The reality is that buyers sat on their hands through autumn last year, waiting to see whether Rachel Reeves would deliver the property tax raid that never actually materialised, and prices duly reflect that paralysis."

Looking ahead, property specialists anticipate continued stagnation in the housing market over the coming months.

Mr Culley said: "With no changes to the housing market from the Government on the horizon, it's likely house prices will continue to stall.

"Lower interest rates which appear to be on their way this year may stimulate the market but it remains to be seen if this will be enough to bring buyers back."

Bob Singh, the founder at Uxbridge-based Chess Mortgages, predicted three Bank of England base rate reductions during 2026, describing this prospect as a key factor that could keep the market moving forward.

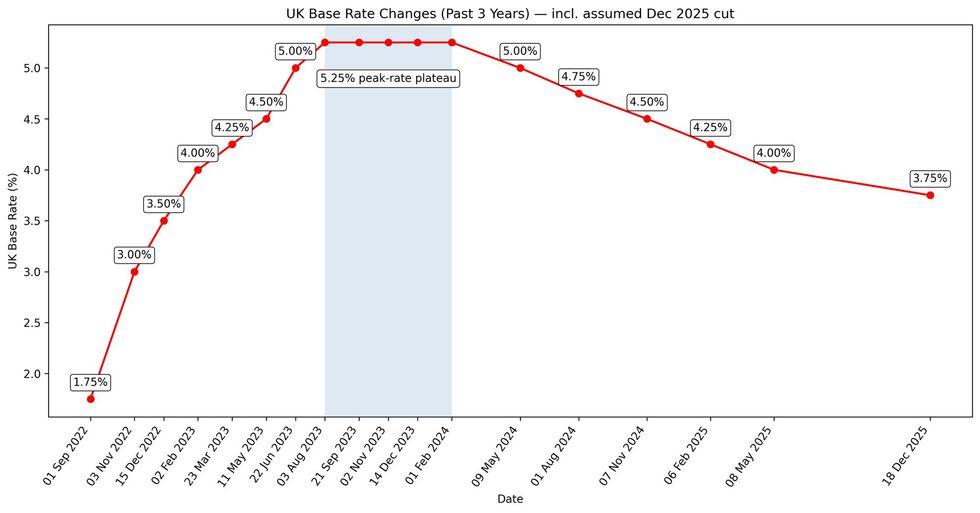

The Bank of England has made changes to the base rate in recent years | CHAT GPT

The Bank of England has made changes to the base rate in recent years | CHAT GPT However, Mr Singh cautioned that approximately 1.9 million homeowners will transition off low fixed-rate deals this year, facing substantially higher monthly payments. He warned that the UK housing market remains vulnerable despite signs of resilience.

Mortgage holders have been forced to contend with record high repayments as a result of the Bank of England's decision-making when it comes to interest rates since the pandeimc.

In an effort to bring down inflation, the central bank's Monetary Policy Committee (MPC) has voted to hike to the base rate to as high as 5.25 per cent but this has since fallen to 3.75 per cent.

Property experts predict the cost of borrowing could be reduced to sub-three per cent later this year as the consumer price index (CPI) is expected to fall closer to two per cent.