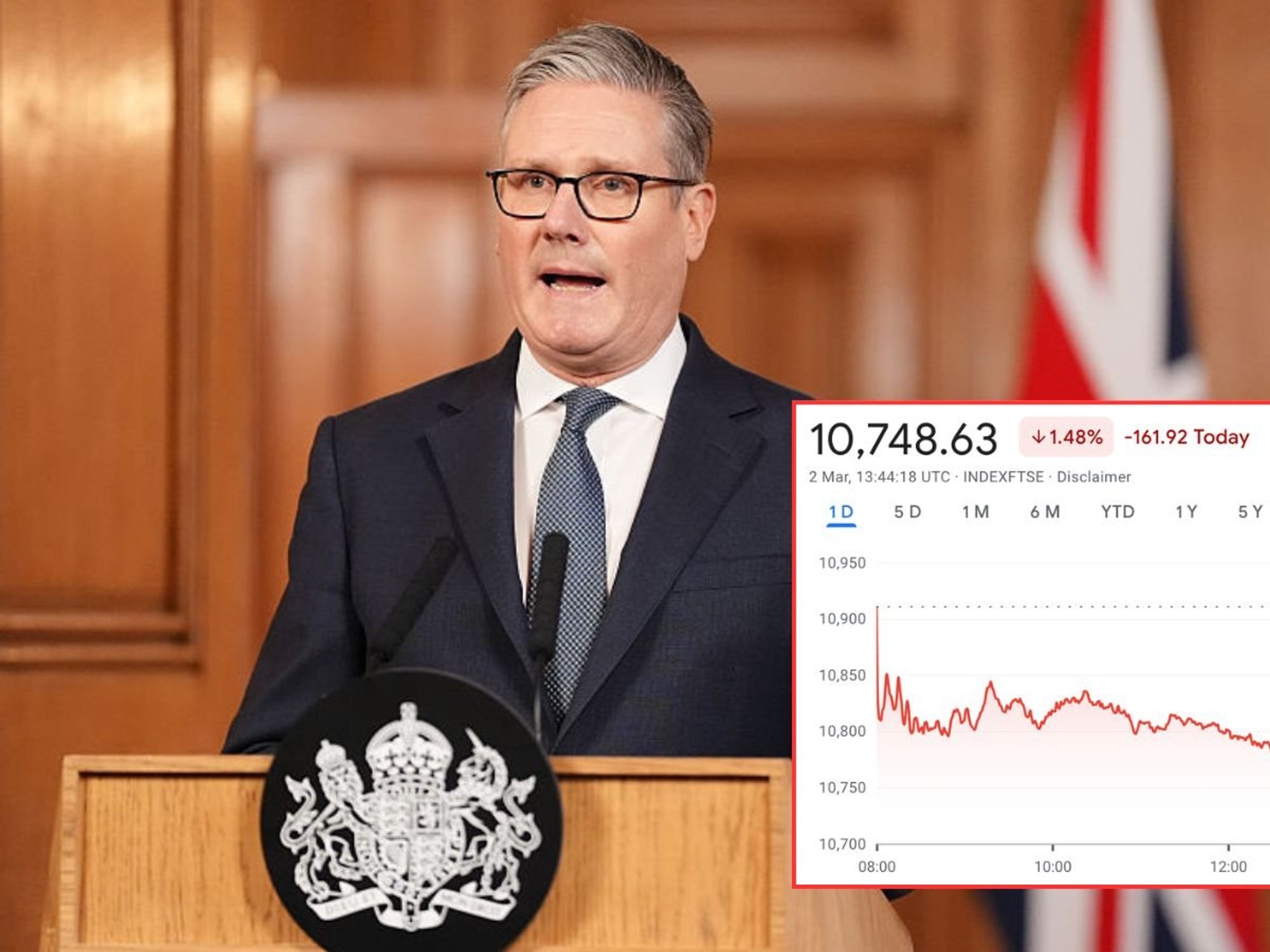

Britons issued mortgage rate warning as UK hurtles towards Bank of England bailout: ‘Labour risking it all’

WATCH NOW: GDP growth falls in blow for Rachel Reeves

|GB NEWS

Ministry of Justice (MoJ) figures revealed mortgage possession claims rose by 31 per cent year-on-year

Don't Miss

Most Read

Britons face a stark mortgage warning as Sir Keir Starmer’s Government edges dangerously close to requiring Bank of England support amid worsening economic conditions.

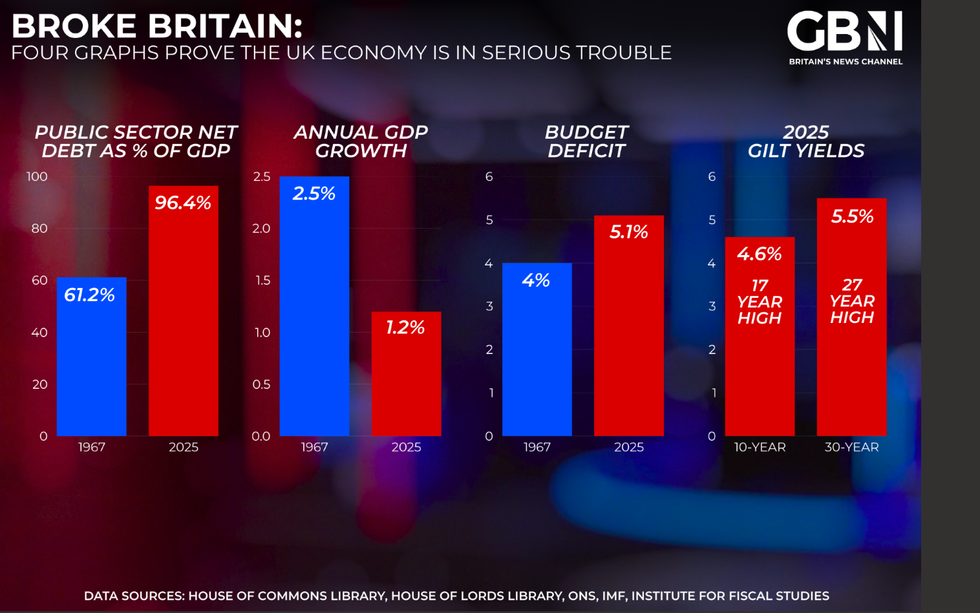

Official statistics show Britain’s finances are in deep trouble, with public debt reaching 96.4 per cent of GDP — significantly worse than 61.2 per cent in 1976 when Britain required IMF support.

Economic growth has slowed to 1.2 per cent, and the deficit currently stands at 5.1 per cent, both underlining economic weaknesses greater than Britain experienced under Labour Prime Minister James Callaghan.

Borrowing costs for the Government have skyrocketed, with ten-year gilt yields at 4.6 per cent and thirty-year gilts at 5.5 per cent.

This increases the possibility of a Bank of England bailout, which could impact interest rates and mortgages.

Independent economist and Institute of Economic Affairs fellow Julian Jessop warned the UK Government may again turn to the Bank of England for support.

“It is likely that the UK Government will call for indirect support from the Bank of England again,” he said.

“Quantitative easing brings its own problems, including the risk of higher inflation, the blurring of lines between fiscal and monetary policy, and the question of what interest rate to pay on money created to buy bonds. There are no easy fixes.”

Official statistics show Britain’s finances are in deep trouble

|PA

Jessop added: “In a crisis, the Government could force the Bank of England’s hand, in one way or another, but there would be a heavy price to pay.

“This could impact interest rates, including the cost of mortgages.”

Former Chancellor Kwasi Kwarteng described Britain’s finances as “concerning” and “serious”, warning the economic outlook remains “very weak”.

He said: “Labour have embarked on a full socialist programme, more taxes and more spending.”

Kwarteng added: “It’s a tired old formula that will lead to us seeking IMF support, just like in the ’70s.”

Four graphs prove the UK economy is in serious trouble

|GB NEWS

Economist Justin Urquhart Stewart told GB News: “The economy is hurtling towards the edge of the canyon; the result appears to be a forgone conclusion.”

He added: “To my knowledge, the Treasury hasn’t been in contact with the IMF, but they would be wise to.”

Chancellor of the Exchequer, Rachel Reeves, was urged by the International Monetary Fund (IMF) to introduce significant flexibility into her self-imposed fiscal rules.

The agency has recommended softening borrowing limits during economic shocks and switching to yearly forecasts.

The Government is edging dangerously close to requiring Bank of England support

|GETTY

Despite this, Reeves chose to stick to her original framework at a time of growing concerns over market confidence.

The IMF also issued a warning amid increasing economic risks, highlighting threats to economic growth and urging the Chancellor to allow more flexibility to react to downturns.

Some economists say Reeves has missed an opportunity to alter her approach without breaching the Treasury’s fiscal targets, raising fears of sustained instability in bond markets.

It is now feared that Reeves’s refusal to adapt could push up borrowing costs and increase pressure on mortgage rates.

With the UK economy facing fresh trade threats and public spending under strain, households may feel the impact as market jitters persist, and interest payments rise.

Chancellor Reeves has been criticised by her rival Sir Mel Stride MP, who accused her of “economic mismanagement” and warned that “families will pay the price”.

The Shadow Chancellor said: “Britain now has the third-highest deficit and the fourth-highest debt burden in Europe, with borrowing costs among the highest in the developed world.”

“Under Rachel Reeves’s economic mismanagement and Keir Starmer’s weak leadership, our public finances have become dangerously exposed — vulnerable to future shocks, welfare spending rising unsustainably, taxes rising to record highs and crippling levels of debt interest.”

Stride warned: “Labour’s recklessness risks it all — your pension, your job, your savings, your home.”

Mortgage arrears jumped to £22.1billion in the final quarter of 2024, according to the Bank of England, marking an 8.4 per cent increase compared to 2023.

Mel Stride told GB News that Britain has the third-highest deficit and the fourth-highest debt burden in Europe

|PA

New arrears accounted for more than 12 per cent of all outstanding mortgage balances.

UK Finance reported 2,030 property repossessions that took place in the first quarter of 2025, including 1,220 homeowners and 810 buy-to-let cases.

Ministry of Justice (MoJ) figures revealed mortgage possession claims rose by 31 per cent year-on-year.

Former Chancellor Lord Norman Lamont said: “The OBR has rightly highlighted the vulnerability of the UK’s financial position. History shows that if something looks unsustainable, it won’t be sustained.”

The economy shrank by 0.1 per cent in May, marking the second successive month of contraction, according to figures from the Office for National Statistics (ONS).

Market Analysts had expected growth, underlining new signs of economic problems. Inflation sits at 3.4 per cent, with housing costs up 6.7 per cent and rents rising 7 per cent, the ONS reports.

UK Finance says mortgage lending totals £1.7trillion, while the FCA warns 700,000 fixed deals will end this year, tightening the squeeze on households.

A Treasury spokesperson said: “The IMF welcomed the Government’s reforms to the fiscal framework as ‘enhancing its credibility and effectiveness’.

“The fiscal strategy focuses on delivering stability through an ironclad commitment to our robust fiscal rules and a single fiscal event a year, while increasing investment and pursuing ambitious structural reform to boost productivity and growth.

“Growth is the solution to the challenges we face, and this government is going further and faster to unlock growth that is sustainable in the long term.

“The IMF also highlighted support for the Government’s Growth Mission, noting it ‘focuses on the right areas to lift productivity’.

“Through the Growth Mission, the Government is restoring stability, increasing investment and reforming the economy to drive prosperity and living standards across every region of the UK.”

More From GB News