Best savings accounts of the week: Savers must 'bag' high interest rates as banks offering 7.5% - full list

Who is offering the best savings accounts for Britons?

Don't Miss

Most Read

Latest

Savers are being reminded ton "bag" competitive interest rates while they still can as some banks and building societies continue to offer competitive interest rates of up to 7.5 per cent.

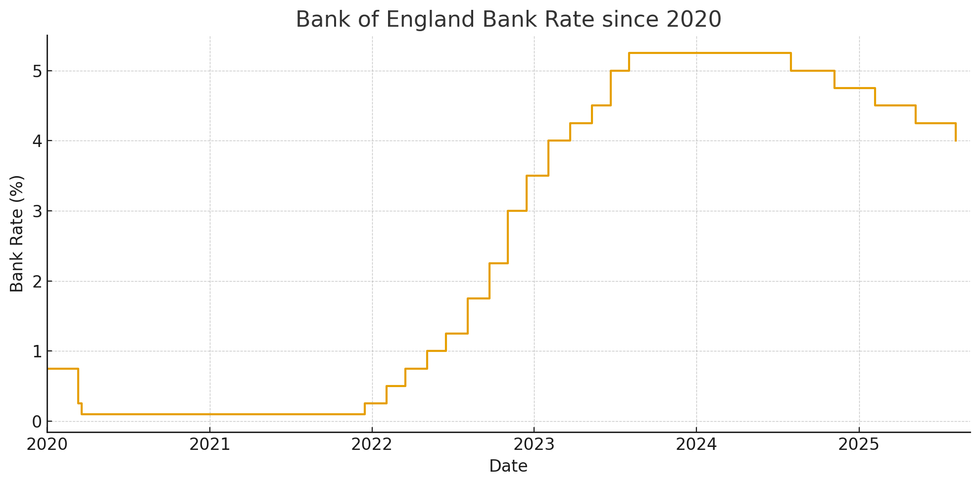

While detrimental to borrowers, the Bank of England's base rate being hiked over a period of time has been beneficial to savings account customers over recent years.

Ahead of expected interest rate cuts from the central bank in the months ahead, analysts are urging savers to take advantage of high interest accounts while they remain on the market.

Experts from Moneyfactscompare have compiled a list of the best savings accounts for the week beginning September 8, 2025:

Britons are encouraged to check they are getting the best deal available

| GETTYBest regular savings accounts:

Here is a list of the best regular savings accounts currently on offer for the week with interest rates attached:

- Principality BS – 7.5 per cent AER / 7.3 per cent Gross

- Zopa – 7.1 per cent AER / 6.9 per cent Gross

- The Co-operative Bank – Seven per cent AER / Gross

- Monmouthshire BS – Six per cent AER / Gross

- Darlington BS – Six per cent AER / Gross

- West Brom BS – Six per cent AER / Gross

- Market Harborough BS – 5.8 per cent AER / Gross

- Progressive BS – 5.5 per cent AER / Gross

- NatWest – 5.5 per cent AER / 5.4 per cent Gross.

Best fixed-rate savings accounts

Here is a list of the best savings accounts offering a one-year fixed interest rate:

- Chetwood Bank – 4.5 per cent AER / Gross

- Atom Bank – 4.4 per cent AER / Gross

- Cynergy Bank – 4.4 per cent AER / Gross

- JN Bank – 4.39 per cent AER / Gross

- Tandem Bank – 4.37 per cent AER / Gross

- Habib Bank Zurich plc – 4.36 per cent AER / Gross

- Habib Bank Zurich plc – 4.36 per cent AER / Gross

- JN Bank – 4.35 per cent AER / Gross

- DF Capital – 4.35 per cent AER / Gross

- Zenith Bank (UK) Ltd – 4.35 per cent AER / Gross.

Do you have a money story you’d like to share? Get in touch by emailing money@gbnews.uk.

How has the base rate changed since 2020? | CHAT GPT

How has the base rate changed since 2020? | CHAT GPT Best cash ISAs

Here is a list of the best cash ISAs with a one year fixed interest rate attached currently on offer:

- Vida Savings – 4.31 per cent AER / Gross

- Shawbrook Bank – 4.31 per cent AER / Gross

- Cynergy Bank – 4.3 per cent AER / Gross

- Tembo Money – 4.27 per cent AER / Gross

- Charter Savings Bank – 4.24 per cent AER / Gross

- Kent Reliance – 4.23 per cent AER / Gross

- Vanquis Bank – 4.21 per cent AER / Gross

- Aldermore – 4.2 per cent AER / Gross

- United Trust Bank – 4.2 per cent AER / Gross

- Close Brothers Savings – 4.2 per cent AER / Gross.

Here is a full list of the best cash ISAs with a variable interest rate attached currently on offer:

- Trading 212 – 4.5 per cent AER / 4.4 per cent Gross

- Principality BS – 4.4 per cent AER / Gross

- Vida Savings – 4.38 per cent AER / Gross

- Plum – 4.35 per cent AER / 4.3 per cent Gross

- The Stafford BS – 4.35 per cent AER / Gross

- Kent Reliance – 4.32 per cent AER / Gross

- Chip – 4.32 per cent AER / 4.2 per cent Gross

- Charter Savings Bank – 4.31 per cent AER / Gross

- Harpenden BS – 4.31 per cent AER / Gross

- Family Building Society – 4.3 per cent AER / Gross.

MEMBERSHIP:

- EXPOSED: Bombshell report blows lid on the staggering number of Channel migrants who pretend to be children

- REVEALED: The five biggest scandals that have rocked Labour since sweeping to power as Angela Rayner on brink

- Reform's Doge unit has uncovered a £1.2bn money pit. Labour must be terrified about May 2026 - Ann Widdecombe

Best easy-access accounts

Here is a full list of the best easy access savings accounts without a bonus attached:

- Cahoot – Five per cent AER / Gross

- Cahoot – 4.4 per cent AER / Gross

- Vida Savings – 4.38 per cent AER / Gross

- Kent Reliance – 4.33 per cent AER / Gross

- Kent Reliance – 4.33 per cent AER / Gross

- Charter Savings Bank – 4.31 per cent AER / Gross

- Harpenden BS – 4.31 per cent AER / Gross

- Snoop – 4.3 per cent AER / 4.2 per cent Gross

- Spring – 4.3 per cent AER / 4.2 per cent Gross

- Close Brothers Savings – 4.3 per cent AER / Gross.

Here is a full list of the best easy access accounts with a bonus attached:

- Chase – 4.75 per cent AER / 4.65 per cent Gross

- Principality BS – 4.45 per cent AER / Gross

- Oxbury Bank – 4.36 per cent AER / 4.28 per cent Gross

- Nottingham BS – 4.35 per cent AER / Gross

- Chip – 4.32 per cent AER / 4.24 per cent Gross

- Skipton BS – 4.12 per cent AER / Gross

- Tesco Bank – 4.1 per cent AER / Gross

- Chip – 4.07 per cent AER / 4 per cent Gross

- Cynergy Bank – Four per cent AER / Gross

- Post Office Money – 3.95 per cent AER / Gross.

LATEST DEVELOPMENTS:

Britons are looking for the switch deals | GETTY

Britons are looking for the switch deals | GETTYAdam French, the head of News at Moneyfactscompare, said: “Many providers made multiple changes to their fixed and variable rate savings products in the last week.

"We’ve seen an increase in rates from TSB, NatWest Group and Charter Savings Bank and rate reductions from Yorkshire Building Society and Barclays Bank, among others. As a result, the Moneyfacts Average Savings Rate dropped from 3.46 per cent last week to 3.44 per cent today.

"The cost of Government borrowing has been grabbing headlines in recent weeks, which has caused a degree of turbulence in the savings and mortgage markets as some banks and building societies look again and how to price their products.

"The good news is that the market remains competitive, and it is still possible to bag a market-leading savings rate that beats current inflation forecasts of four per cent."

More From GB News