Bank of England pressed to 'cut interest rates and go for growth' amid weak economy figures

Trade union leaders urge faster rate reductions as weak growth data raises economic concerns

Don't Miss

Most Read

Latest

The Trades Union Congress (TUC) is urging the Bank of England to cut borrowing costs more aggressively, arguing Britain’s economic recovery requires faster monetary policy action.

This month’s Monetary Policy Committee (MPC) decision resulted in a narrow five to four split in favour of holding the base rate at 3.75 per cent following six rate cuts since mid 2024.

Union leaders argue weak economic growth should take priority over inflation concerns that continue to influence some committee members.

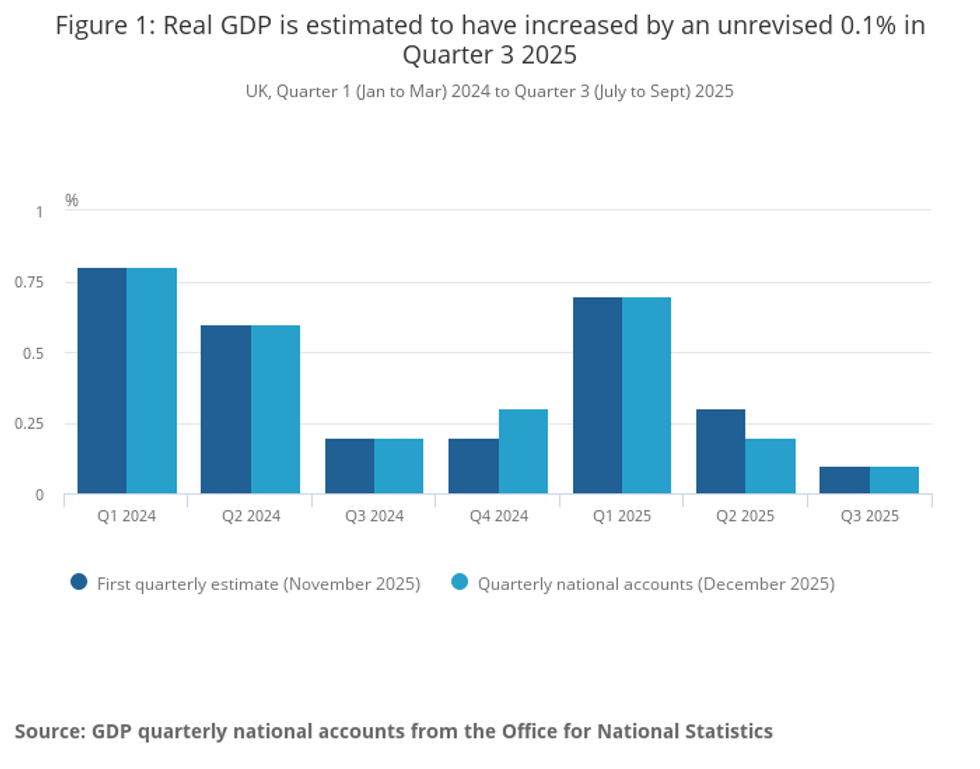

Official data showed the economy expanded by just 0.1 per cent during the final three months of last year, below the 0.2 per cent growth economists had forecast.

TRENDING

Stories

Videos

Your Say

The union body said elevated borrowing costs are restricting household spending power and slowing the pace of economic recovery.

Paul Nowak, TUC general secretary, said: "The Bank of England has a crucial role to play here. Last year they were overly cautious and too slow to act. They should go for growth with a sequence of quick fire cuts this year.

"Lower interest rates would help households and help the high street putting money in people's pockets to spend in shops and restaurants, and boosting confidence for consumers and for businesses."

TUC analysis shows UK consumer spending has grown more slowly over the past three years than in 32 of the 37 member states of the Organisation for Economic Co-operation and Development.

The bank has been urged to cut rates more aggressively

|PA/ONS

The analysis found many comparable economies have managed to maintain low inflation while still achieving stronger consumer spending growth.

Household spending has historically driven around two thirds of UK economic output since the 2008 financial crisis.

However, the TUC said consumer spending contributed nothing to economic growth over the past two years.

Some policymakers at the Bank of England have expressed caution about cutting borrowing costs further.

Huw Pill, Bank of England chief economist, said borrowing costs may already be "a little bit too low" given current economic conditions.

LATEST DEVELOPMENTS

How has GDP changed over the past year? | ONS

How has GDP changed over the past year? | ONSMr Pill said "underlying" inflation could be closer to 2.5 per cent once the impact of the Chancellor’s price reduction policies are removed from official figures.

This contrasts with Monetary Policy Committee forecasts showing inflation returning to the two per cent target by spring, down from 3.4 per cent recorded in December.

Some committee members remain concerned strong wage growth could create renewed inflationary pressure.

Fresh employment and inflation figures are scheduled for release later this week and could influence the direction of future interest rate decisions.

Rachel Reeves has attempted to support conditions for future rate cuts through measures announced in her November Budget, including policies designed to reduce energy bills from April.

Financial markets widely expect the Monetary Policy Committee to cut interest rates at its March meeting following the close vote this month.

However, market pricing suggests investors do not expect borrowing costs to fall as quickly as they did during last year’s easing cycle.

Some business groups have warned that increases to employer National Insurance contributions and the minimum wage have increased costs for firms.

Business representatives said some companies have responded by raising prices, which could complicate efforts to bring inflation down further.

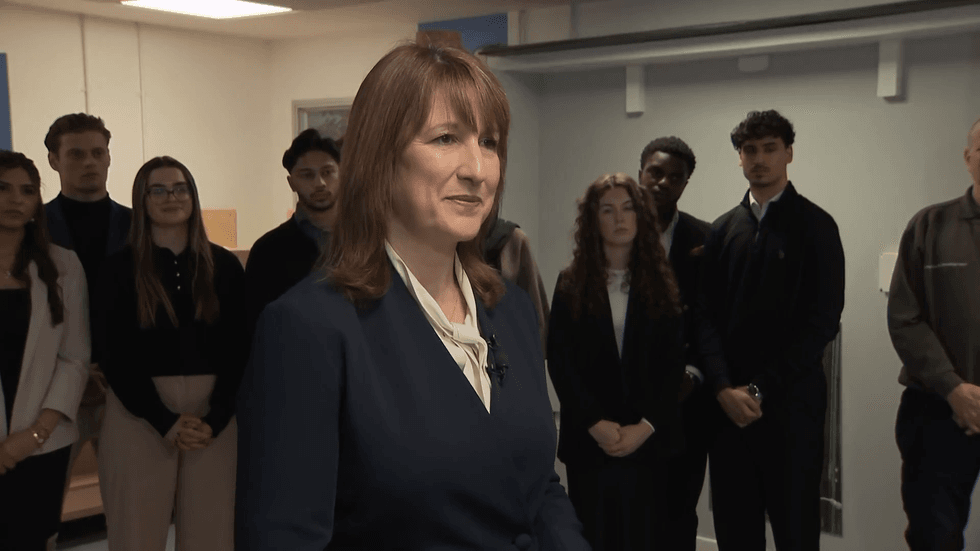

Rachel Reeves trumpeted economic growth during a chat with journalists | GB NEWS

Rachel Reeves trumpeted economic growth during a chat with journalists | GB NEWSMs Reeves has continued to emphasise her focus on economic growth through infrastructure investment and planning reform.

"I'm confident that the decisions that we have made to return stability to the economy, to bring investment to our economy, and the changes we're making around planning and regulation will help deliver stronger growth this year."

Economists said upcoming data releases will be closely watched by policymakers, financial markets and businesses seeking clarity on the outlook for interest rates and economic growth.

Monetary policy decisions in the coming months are expected to play a key role in shaping borrowing costs for households and businesses across the UK.

More From GB News