State pension error fixed as HMRC says 'sorry' to 800,000 Britons at risk of payment shortfall

Individuals received inflated state pension forecasts from HMRC's online tool

Don't Miss

Most Read

A major state pension payment error impacting 800,000 Britons has been fixed with HM Revenue and Customs (HMRC) saying "sorry" to those who received inaccurate forecasts, which analysts claim could have led to a retirement savings shortfall.

Yesterday, the UK tax authority rectified a long-standing flaw in its online state pension forecast tool that had persisted for nine years, following an investigation into the service.

It is understood that as many as 800,000 individuals who had previously "contracted out" of the additional state pension are due to reach pension age after April 2029.

These users may have received overly optimistic forecasts, leading them to believe they would receive the maximum state pension without needing to make further contributions.

HMRC has apologised for a historic state pension error

|GETTY

The fix came after HMRC advised users on Monday to delay checking their forecasts until February 14, following a system update designed to improve accuracy.

Government ministers were first alerted to the problem back in 2017, yet it took another four years before any corrective measures were put in place.

The online forecast tool had been introduced in February 2016, just two months prior to the launch of the new state pension system.

By 2019, approximately 360,000 users had already been given inaccurate estimates during the tool's first three years of operation.

Are you affected by state pension age changes? | GETTY

Are you affected by state pension age changes? | GETTYLATEST DEVELOPMENTS

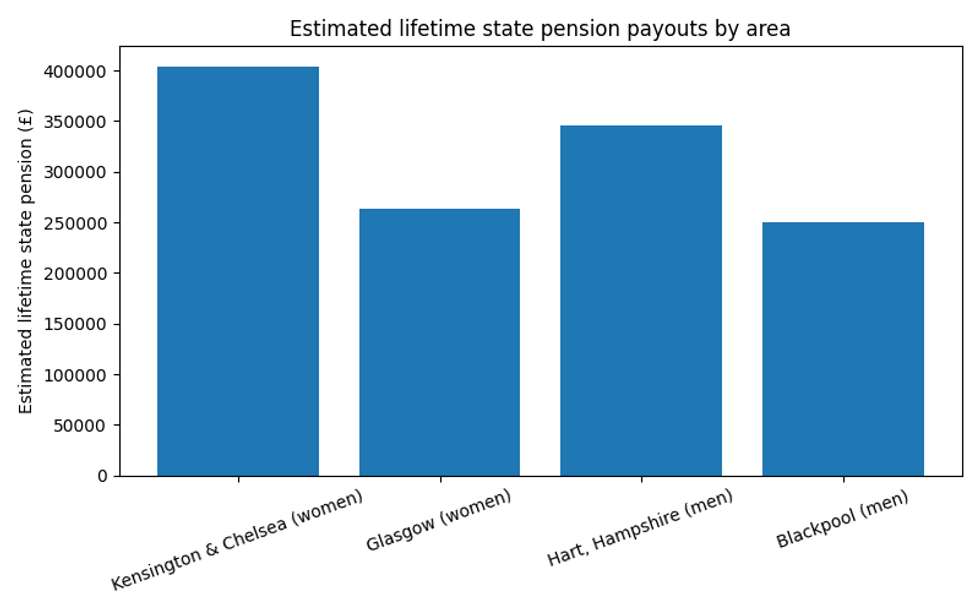

Estimated lifetime state pension payouts by area | ONS/CHATGPT

Estimated lifetime state pension payouts by area | ONS/CHATGPTHMRC acknowledged that those reaching pension age after April 2029 were still being incorrectly informed they qualified for full payments.

The contracting out arrangement, which has since been abolished, permitted millions of workers to redirect their contributions away from the State Earnings-Related Pension Scheme, known as Serps, provided they were paying into a private or workplace pension instead.

Upon retirement, individuals who took this option face a reduction from their final state pension to account for those periods.

The forecast tool failed to reflect these deductions, meaning affected users were wrongly told they had accumulated sufficient National Insurance contributions to qualify for the maximum payment.

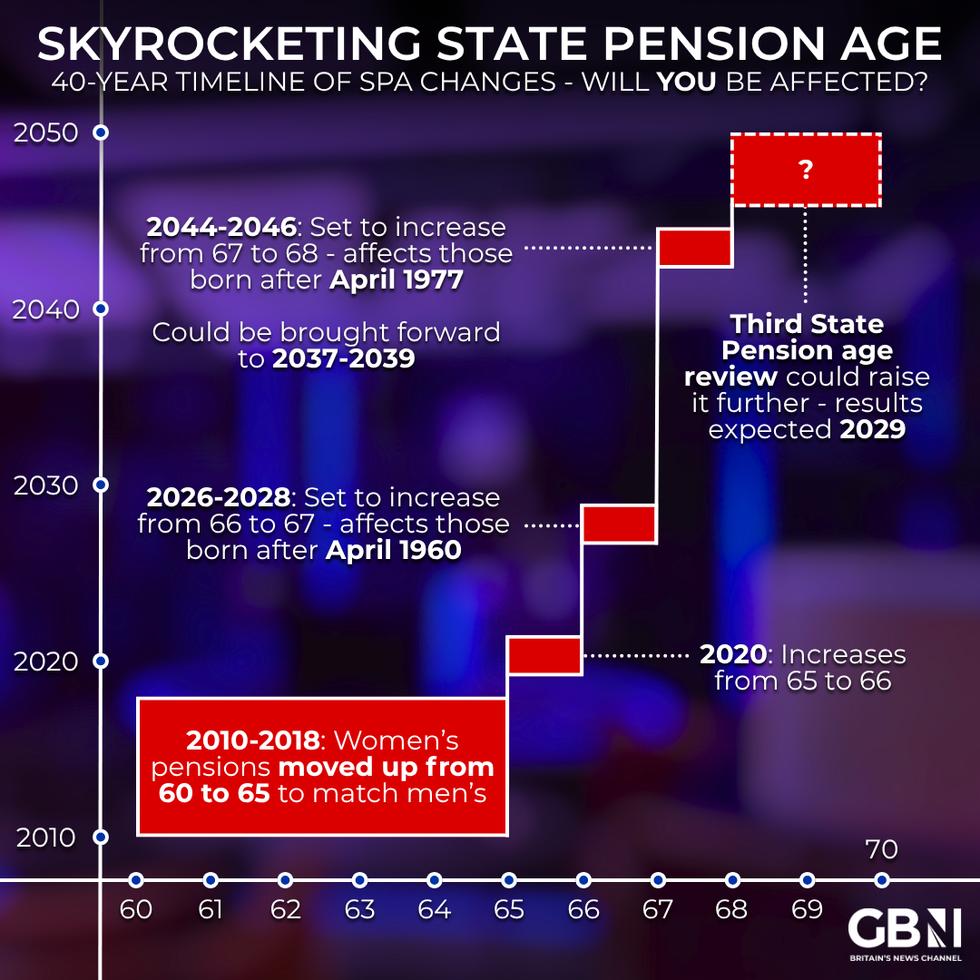

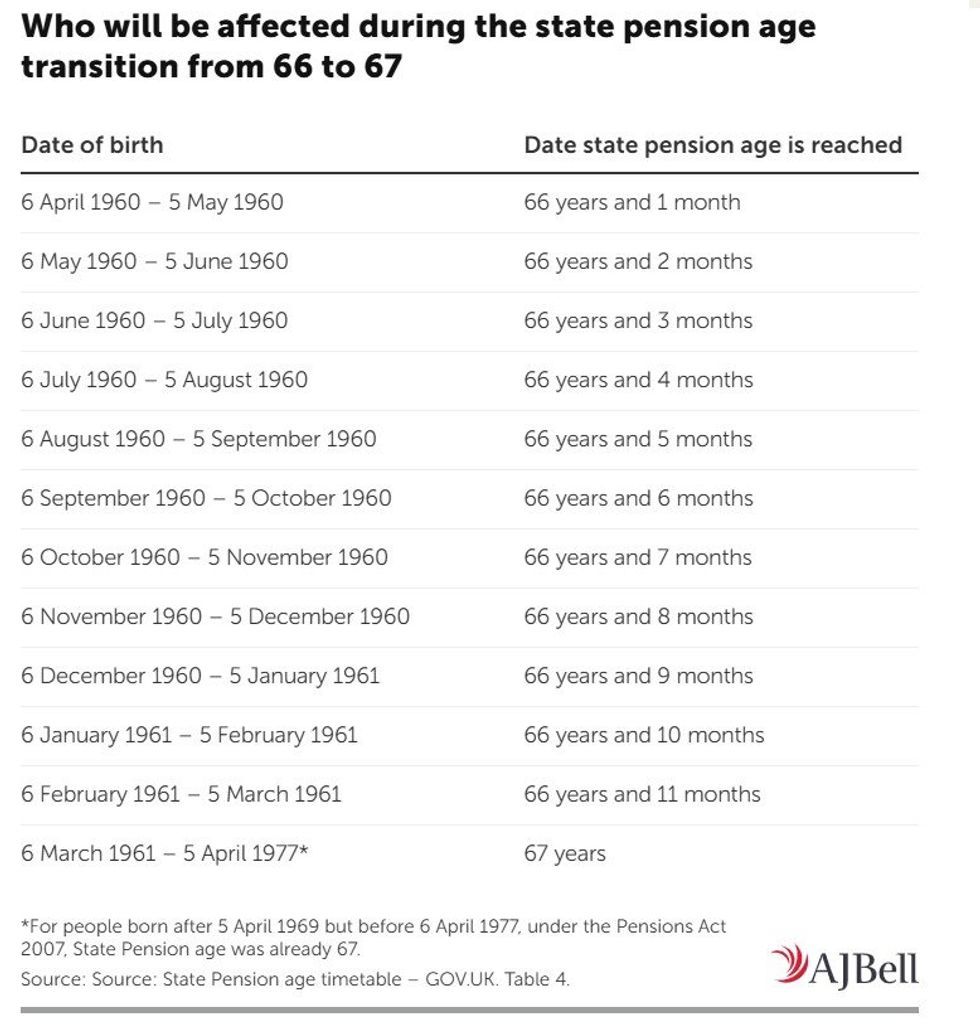

When will yoiu be impacted by the state pension increase? | AJ BELL / GOV.UK

When will yoiu be impacted by the state pension increase? | AJ BELL / GOV.UK This left many people at risk of receiving smaller pensions than anticipated, without the chance to address any shortfall through additional contributions.

Sir Steve Webb, a former pensions minister now working at consultancy LCP, warned that the error had placed people at risk of retirements "built on sand".

He added: "It is good to see that HMRC are making further updates to improve the accuracy of state pension forecasts."

An HMRC spokesman apologised for the difficulties users had experienced, confirming the update would now properly account for contracted-out periods. To qualify for the full new state pension, individuals must accumulate 35 complete years of National Insurance contributions, currently worth £230.25 weekly.

HMRC has stated that affected individuals can make lump sum payments of up to £907 per missing year to top up their records.

More From GB News