Nationwide, Yorkshire Building Society and NS&I to cut savings rates despite Bank of England decision

Savers are being urged to take advantage of high interest rates while they still can

Don't Miss

Most Read

Savers face a difficult day as three major financial institutions implement interest rate reductions across dozens of accounts despite the Bank of England's decision to keep the base rate at 3.75 per cent.

Yorkshire Building Society, Nationwide, and National Savings and Investments (NS&I) are all lowering returns from today, with the changes affecting a combined total of 43 savings products.

The cuts follow December's base rate decision and represent unwelcome news for those hoping to maximise returns on their deposits. Finder analysts have been monitoring the shifting landscape closely, tracking precisely which providers are reducing rates and when these changes take effect.

For many customers, the reductions will mean noticeably smaller returns on their hard-earned savings throughout the coming year.

Three major savings providers are cutting savings rates

|GETTY / NS&I / NATIONWIDE

Yorkshire Building Society is reducing rates on four products, including its Easy Access Saver, falling from 3.9 per cent to 3.65 per cent, and its easy access ISA declining from 3.7 per cent to 3.6 per cent.

Nationwide's changes are the most extensive, spanning 37 different accounts. Some of these will see rates tumble to as little as 1.2 per cent AER.

The Government-backed NS&I is also trimming returns on two offerings. Its Direct Saver drops from 3.3 per cent AER to 3.05 per cent AER, whilst Income Bonds fall from 3.26 per cent AER to 3.01 per cent AER.

With the Monetary Policy Committee's (MPC) move to halt cuts to the base rate, savers would have been hoping for some respite from further reductions in account interest rates.

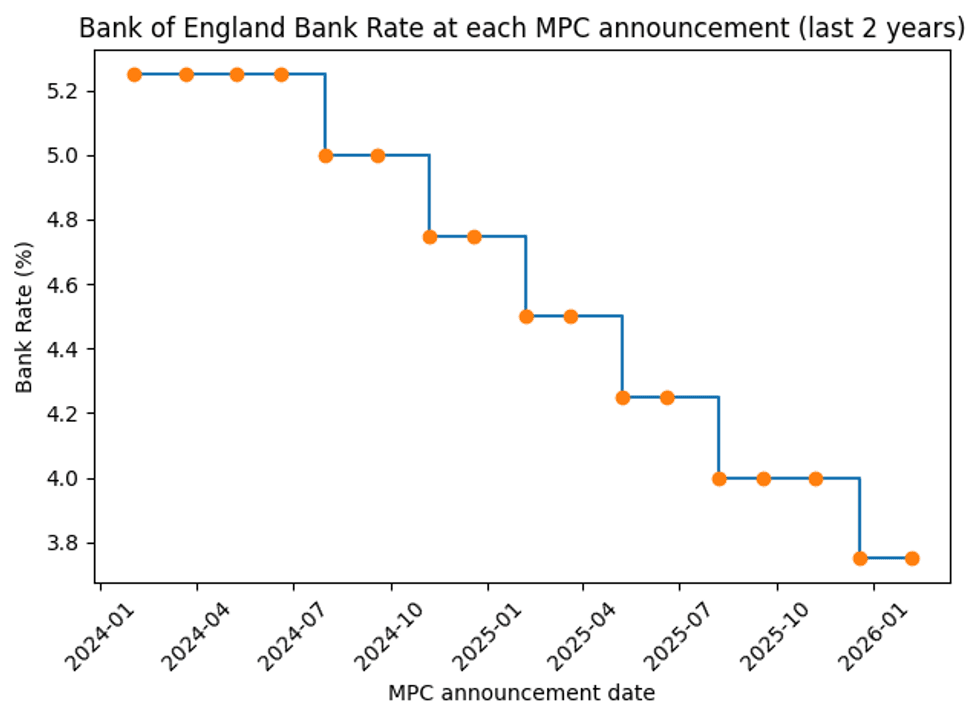

How has the base rate changed in recent years? | CHAT GPT

How has the base rate changed in recent years? | CHAT GPT Kate Steere, personal finance expert at Finder, highlighted the stark contrast between settling for poor rates versus shopping around.

"Savers shouldn't settle for a worse deal out of a sense of loyalty to their current provider," she said.

"With the average UK savings (£19,214), if you kept your savings pot with one of the new, lower rates, such as an account earning 1.25 per cent, you'd end up with just £240 after a year.

"Meanwhile, a market-leading rate of 4.5 per cent from Chase would mean £864 in interest, a significant difference of over £600."

Britons are looking for the best savings deals | GETTY

Britons are looking for the best savings deals | GETTYFor those with remaining ISA allowance before April, competitive options exist, including eToro by Moneyfarm's Cash ISA at 4.49 per cent AER for the first year.

In a further blow to bank customers, analysts warn that pain for savers will not end with today's announcements.

Five additional banks have confirmed rate reductions scheduled for the first fortnight of March, including NatWest, RBS, The Co-operative Bank, Barclays, and HSBC.

Ms Steere urged customers to act swiftly rather than wait for further erosion of their returns.

"On top of the 3 providers cutting rates this month, 5 banks have announced further rate cuts in March, so now is the time to take action," she advised.

"Get in early with a savings spring clean, and your finances will thank you."

Despite today's decision from the Bank of Engand. savers are reminded that high-interest savings products are still on offer at major banks and building societies.

The central bank's next MPC meeting is next scheduled to take place on March 19, 2026.