Inflation tipped to fall to lowest level in nearly a year as Bank of England mulls interest rate cuts

Most economists are forecasting inflation to fall back sharply to three per cent

Don't Miss

Most Read

Cooling inflation could soon give households and mortgage borrowers something to cheer about.

Fresh figures this week are set to show whether the long squeeze on living costs is finally starting to loosen.

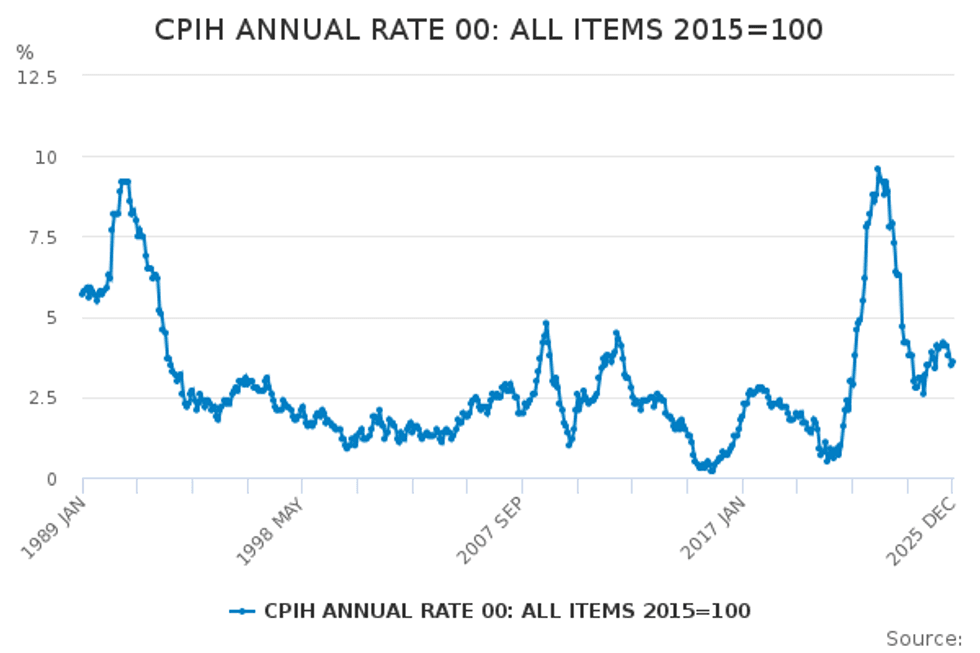

Most economists think the Office for National Statistics will say Consumer Prices Index inflation fell to three per cent last month, down from 3.4 per cent in December, according to analysis by Pantheon Macroeconomics.

If confirmed, that would be the softest pace of price growth in almost a year and the lowest level recorded since March 2025.

The expected drop comes after a stretch in which costs across several major parts of the economy have begun to settle, easing some of the pressure that has weighed on households and policymakers alike.

Several factors are expected to have contributed to January's softer inflation reading.

Airfares are forecast to have plummeted by approximately 25 per cent during the month, reversing sharp increases seen in December when heightened holiday travel demand pushed ticket prices higher.

Food price inflation is also projected to have eased, with Investec Economics economist Ellie Henderson suggesting growth likely fell to 4.2 per cent, though she cautioned that rising grocery costs remain a "key concern".

Energy costs provided additional downward pressure, with the price cap rising by just 0.2 per cent in January compared to a 1.2 per cent increase during the same month last year.

Inflation is currently 3.6%

|ONS

The anticipated inflation figures are likely to strengthen the case for another reduction in borrowing costs, potentially as early as next month.

Markets are increasingly pricing in a March rate cut that would bring the Bank Rate down to 3.5 per cent from its current 3.75 per cent level.

Weak economic performance has bolstered expectations of monetary easing, with ONS data revealing the economy managed just 0.1 per cent growth during the final three months of 2025.

Annual GDP expansion came in at a disappointing 1.3 per cent, falling short of expectations.

Markets are increasingly pricing in a March rate cut that would bring the Bank Rate down to 3.5 per cent from its current 3.75 per cent level

| PAThe Bank of England anticipates inflation will return to its two per cent target by mid-year, supported by measures from the Chancellor's autumn budget including energy bill support from April.

Despite the growing momentum behind rate cut expectations, not all policymakers share this enthusiasm for looser monetary policy.

Bank of England chief economist Huw Pill expressed reservations at a Santander event on Friday, stating that he believed rates were already "a little bit too low".

Mr Pill was among the five members who voted to maintain rates at 3.75 per cent earlier this month

| PAHis comments suggest he is unlikely to support a reduction when the Monetary Policy Committee next convenes.

Mr Pill was among the five members who voted to maintain rates at 3.75 per cent earlier this month, with the committee splitting 5-4 in favour of holding steady.

His stance highlights divisions within the Bank over the appropriate pace of monetary easing.