Blow to Sunak as 'cautious' Bank of England unlikely to cut interest rates before next General Election

Wages continue to be high which may complicate the Bank of England's decision making over interest rates

|GETTY

Figures from the Office for National Statistics (ONS) revealed regular earnings growth continued to be unchanged in the three months to April 2024

Don't Miss

Most Read

The likelihood of a cut to interest rates by the Bank of England before the General Election has fallen n a blow to Prime Minister Rishi Sunak. The central bank will likely be "cautious" in slashing rates after new Government figures have reveled no progress in wage growth being brought down.

New statistics from the Office for National Statistics (ONS) have revealed basic pay increased at an annual rate of six per cent in the three months to April, which remains unchanged from the last quarter, in a blow to homeowners.

Homeowners and other borrowers have been saddled with sky high mortgage and debt repayments in recent years thanks to the central bank's decision to raise the base rate.

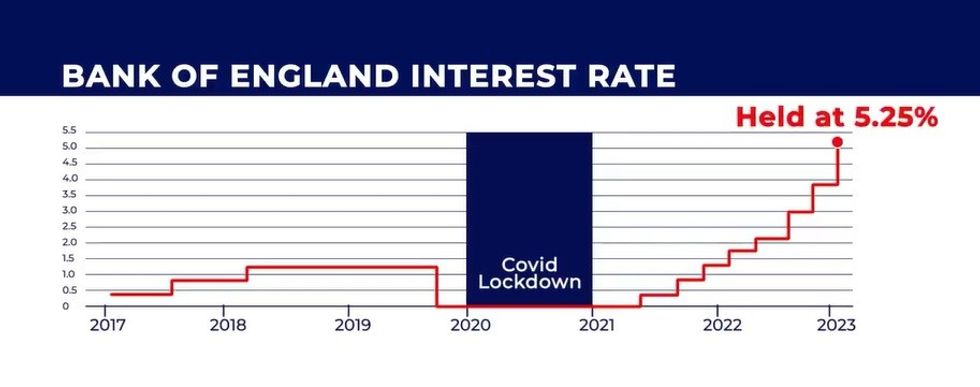

Interest rates have been increased and held at 5.25 per cent in an attempt to ease the consumer price index (CPI) rate of inflation, which has recently fallen to 2.3 per cent.

However, the most recent ONS figures suggest wage regular earnings wage growth figures are more than double the inflation rate.

This is partially contributable to upwards pressure came from the most recent 9.8 per cent payment rate hike in the National Living Wage back in April.

Do you have a money story you’d like to share? Get in touch by emailing money@gbnews.uk.

The UK economy is continuing to struggle amid the cost of living crisis

| GETTYTaking into account the effects of inflation, the wage rate was found to be at its highest level since July 2021 at 2.9 perc cent.

The ONS's figures highlighted that the pay measure that includes bonuses increased to 5.9 per cent from 5.7 per cent.

Despite wage growth remaining relatively high, this will likely prevent the Bank of England from cutting interest rates in the immediate future. The Bank is expected to meet within the next two weeks.

Monica George Michail, an associate economist at the National Institute of Economic and Social Research (NIESR), broke down why this is likely to be the case.

She explained: "Wage growth continues to be strong at 5.9 per cent (6 per cent excluding bonuses) in the three months to April, amidst the 9.8 percent hike in minimum wage.

"With inflation falling, real income gains for employees recorded 2.2 per cent in the three months to April, its highest level since October 2021.

"However, the persistence of wage growth also raises concerns about stickier inflation, prompting the Bank of England to remain cautious about interest rate cuts.

"We expect wage pressures to ease gradually in the coming months as the labour market cools, with unemployment rising relative to vacancies.”

As well as this, the UK's unemployment rate has unexpectedly increased in a blow to Prime Minister Rishi Sunak's record on the economy ahead of the upcoming General Election.

Figures from the ONS found the rate jumped to 4.4 per cent in the three months to April, an increase from 4.3 per cent over the previous quarter.

LATEST DEVELOPMENTS:

The Bank of England base rate has held interest rates at a 16-year high since it was hiked to 5.25 per cent last August | GB NEWS

The Bank of England base rate has held interest rates at a 16-year high since it was hiked to 5.25 per cent last August | GB NEWSAccording to the most recent figures, the number of people claiming out-of-work benefit payments from the Department for Work and Pensions (DWP) rose by 50,400 in May,

The latest hike bested expectations for the jobless rate to remain unchanged and sees it reach the highest level since July to September 2021.

Furthermore, vacancies plunged to 904,000 in the three months to May.

The Bank of England's Monetary Policy Committee (MPC) will next make an announcement regarding interest rates on June 20, 2024.