Bank of England warning: UK economy faces ZERO GDP growth as 'technical' recession fears 'rise'

The central bank has projected there will be no gross domestic product growth in Q2 2025

Don't Miss

Most Read

Britain's economy is forecast to have zero gross domestic product (GDP) growth in the fourth quarter of 2025, the Bank of England has warned following today's base rate announcement.

The central bank's Monetary Policy Committee (MPC) voted to cut interest rates from four per cent to 3.75 per cent in move that is expected to benefit mortgage holders and borrowers.

However, the Bank's policymakers also warned that the UK is on the trajectory of zero per cent economic growth this quarter, which lasts from October to December 2025.

This comes as a blow to Chancellor Rachel Reeves who has economic growth central to the Labour Government's fiscal mission since getting the keys to the Treasury.

The Bank of England has issued a warning over the UK's growth forecasts

|GETTY

GDP growth for October 2025 came in at negative 0.1 per cent, according to the latest figures from the Office for National Statistics (ONS), signalling a slowdown in the economy.

Q1 saw positive 0.7 per cent GDP growth, whereas the second and third and fourth quarters of this year have seen 0.3 per cent and 0.3 per cent growth bursts, respectively.

On its projections for this current quarter, the Bank stated: "GDP growth had eased to 0.1 per cent in 2025 Q3, slightly below the rate expected in the November Report.

"Bank staff analysis had suggested that some of this softening was erratic, with underlying quarterly GDP growth closer to 0.2 per cent.

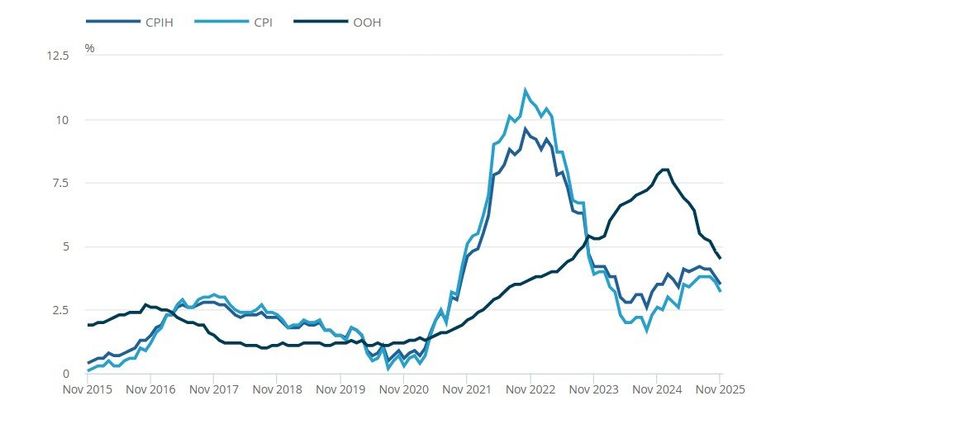

How has the CPI inflation rate changed? | ONS

How has the CPI inflation rate changed? | ONS"Monthly GDP had declined by 0.1 per cent in October, due to a further fall in market sector output. This was weaker than had been expected in the November Report and Bank staff now expected zero growth in headline GDP in Q4."

The recent plateau in GDP growth have resurrected concerns over a potential recession, which occurs when a country experiences two consecutive quarters of negative economic growth.

Britain's economy last experienced this phenomenon in the third and fourth quarters of 2023, which is defined as a "technical recession". The last economic crash occurred as a result of the Covid-19 pandemic in early 2020.

Professor Joe Nellis, an economic adviser at accountancy firm MHA, said: "The risk of the UK posting zero GDP growth in the final quarter of 2025 is increasing as economic momentum fades.

"Despite lower inflation, household spending remains under pressure, business investment is cautious, and tight financial conditions continue to restrain activity. While a technical recession is likely to be avoided, the economy appears to be losing forward speed.

"The consequences would be material. Stagnant output would weaken job creation, slow income growth and limit a much-needed recovery in tax revenues, placing added strain on the public finances.

"Zero growth in Q4 would also intensify calls for policy support, strengthening the case for an early cut in interest rates in 2026 on the back of the rate cut announced by the Bank of England today to prevent prolonged economic inertia."

Earlier this week, the ONS confirmed that the CPI inflation rate eased to 3.2 per cent in the 12 months to October 2025, a greater drop than anticipated from most economists.

LATEST DEVELOPMENTS

Economists on both sides of the Atlantic are sounding the alarm over recession signs

| GETTYJulian Jessop, an economics fellow at the Institute of Economic Affairs said: "The news that inflation is falling more quickly than expected is mostly welcome, but it may also be a warning that the risks of recession are rising.

"The decline in the CPI measure to 3.2 per cent in November, from 3.6 per cent in October, is another step in the right direction and surely enough to seal a rate cut from the Bank of England tomorrow.

"UK inflation is still some way above the MPC's two per cent target and one per cent higher than in the euro area (where the flash estimate for November was 2.2 per cent), but at least these gaps are closing.

"Nonetheless, prices are still rising from already high levels, just at a slightly slower pace. This is especially true of food prices, where the annual inflation rate was still 4.2 per cent."