Asda to sell off multiple stores to balance books ahead of Budget

Anas Sarwar sets out Budget wish list to Rachel Reeves |

GB News

Supermarket agrees sale-and-leaseback of 24 stores and a distribution centre to raise capital

Don't Miss

Most Read

Latest

Asda has agreed a £568million deal to sell two dozen stores and a distribution centre as part of efforts to reduce its multibillion-pound debt burden.

The supermarket chain will dispose of the properties through sale-and-leaseback arrangements, allowing it to raise capital while retaining control of all sites.

The transactions cover 24 supermarket locations and a distribution depot in Lutterworth, Leicestershire. Asda will continue to operate each site after completing the sales to investment groups.

Based on its most recent annual reports, the decision comes as the retailer faces net debt of £3.8billion. Recently, Asda's boss pleaded Chancellor Rachel Reeves to "stop taxing everything", and focus instead on investing in Britain to drive growth in next week's Budget.

TRENDING

Stories

Videos

Your Say

The disposals form part of a wider plan to strengthen the company’s financial position and generate immediate liquidity. Three separate investment groups will acquire the properties.

American investment firm Blue Owl Capital has agreed to purchase ten stores alongside the Leicestershire depot.

Another ten locations will be sold to a joint venture between Blue Owl and Supermarket Income REIT, a specialist real estate investment trust.

The remaining four stores will be acquired by London-based DTZ Investors.

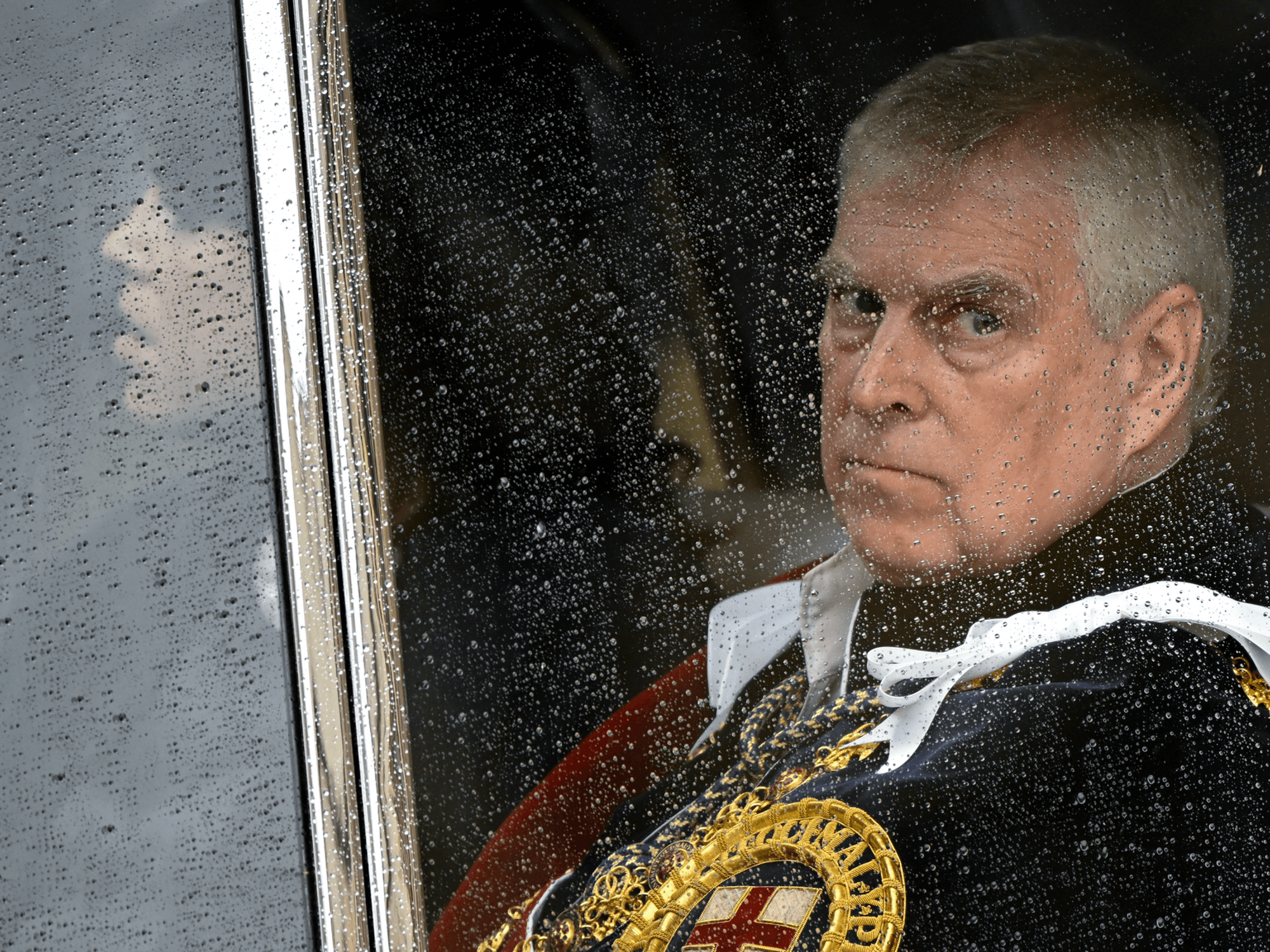

Asda will lease the sites back for 25 years

|PA

Under all agreements, Asda will lease the sites back for 25 years.

Each arrangement includes an option to extend the leases for an additional ten years.

The retailer said there will be no disruption for employees working at the affected locations.

Trading will continue as normal across all 24 stores and at the Lutterworth facility.

Asda sought to reassure staff, suppliers and investors about the operational impact of the transactions.

A spokesman said: "Asda's property strategy is centred on maintaining a strong freehold base while also taking a considered and selective approach to unlocking value from our estate where appropriate."

He added: "These transactions reflect that approach, enabling us to realise value from the sites while retaining full operational control."

LATEST DEVELOPMENTS

The supermarket said job roles remain secure across all locations included in the deal

| GETTYThe supermarket emphasised that job roles remain secure across all locations included in the deal.

The spokesman said no changes to employment terms are expected as a result of the sale-and-leaseback arrangements.

The model allows retailers to convert property assets into cash while continuing to trade from the same premises.

It has become increasingly common among large chains looking to improve liquidity without disrupting store networks.

The disposals align with broader turnaround measures under chief executive Allan Leighton.

Mr Leighton faces the challenge of improving performance while managing the grocer’s debt position.

The £3.8billion net debt figure, disclosed in Asda’s 2024 full-year accounts, highlights the financial pressures facing the business.

The latest property transactions represent one of several steps aimed at easing those constraints.

Asda is due to publish its third-quarter trading update and financial results next week.

More From GB News