Can the bank's rate cut save Britain's beleaguered property market?

Property expert Jonathan Rolande explains why the UK property market is tougher than ever |

GB NEWS

As the Bank of England cuts the base rate from 4.25 per cent to 4 per cent, property expert Jonathan Rolande assesses its potential impact

Don't Miss

Most Read

The interest rate cut to four per cent provides some welcome relief for homeowners and buyers, but questions remain about whether it's enough to revive Britain's struggling property market.

While rates are now at their lowest point in two years, the reality is that borrowing costs remain seriously challenging for many buyers and are still sufficiently high to make investors run to better returns elsewhere.

The property market finds itself caught between two possibilities – either it's adjusting to a more sustainable, affordable level, or we're witnessing the early stages of a more prolonged decline.

**ARE YOU READING THIS ON OUR APP? DOWNLOAD NOW FOR THE BEST GB NEWS EXPERIENCE**

The concern is that market downturns can gather momentum quickly once they take hold.

After all, who wants to buy now, if prices could be lower in six months?

Current challenges extend beyond interest rates alone. Stamp duty levels continue to impact transaction volumes, particularly for those buying additional properties.

Meanwhile, landlords face mounting pressures from mortgage interest rates, tax, and increased regulatory requirements – factors that are contributing to many exiting the market. And they are not being replaced.

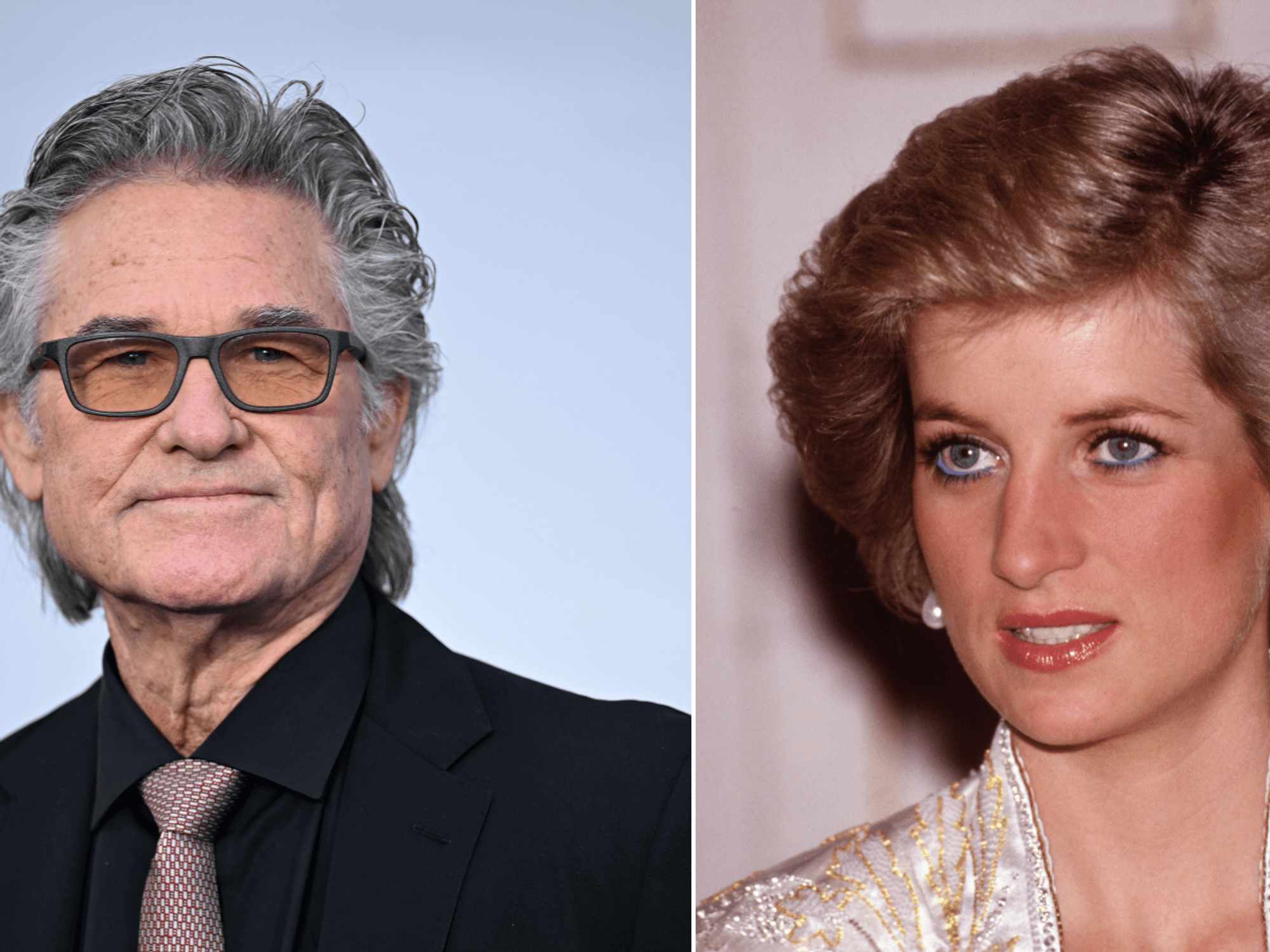

The interest rate cut to four per cent provides some welcome relief for homeowners and buyers

|GETTY IMAGES

LATEST DEVELOPMENTS:

Jonathan Rolande shares his expertise

| Jonathan RolandeDonald Trump has consistently advocated for "very low interest rates", understanding their importance for economic growth and investment.

His approach highlights how accessible credit can stimulate market activity and entrepreneurship.

It can also fuel inflation; the Bank of England must walk that tightrope.

Transaction volumes remain subdued, mortgage approvals are disappointing, and even traditionally strong markets (London, the West Country and South East) are showing signs of strain.

The rate cut is a step in the right direction, but the property market's recovery will likely depend on a broader package of measures addressing both borrowing costs, development, and the tax environment.

Without additional rate cuts and stamp duty reform, the risk remains that we do not see a healthy market correction, but rather the start of a more concerning trend that could impact homeownership prospects for years to come.

The market is clearly falling. The question now is, where will it land?

Jonathan Rolande is a property expert from the National Association of Property Buyers and the founder of House Buy Fast.