'Business is booming!' House sales soar as market returns to post-pandemic levels

Over the past 12 months, Zoopla has recorded a 1.6 per cent jump (£4,330) on the average house price

Don't Miss

Most Read

The UK housing market has sprung back to life after it recorded the highest number of home sales since the pandemic boom of 2021.

Four years on, buyers and sellers have rushed back to the market with renewed vigour following the Easter lull, according to Zoopla's latest House Price Index.

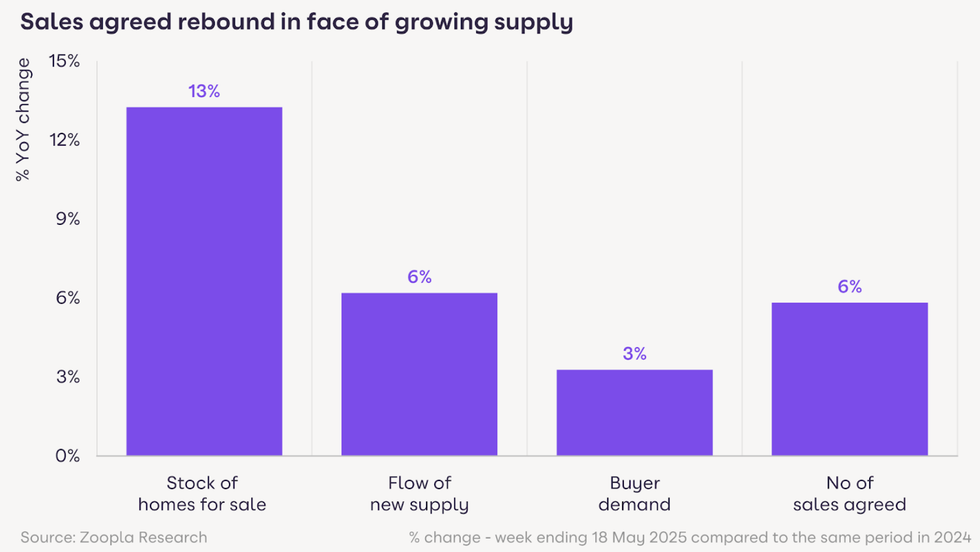

This surge in activity comes as the number of homes for sale has increased by 13 per cent on last year, alongside improvements in mortgage affordability and availability.

Now, the average UK house price stands at £268,250, representing a 1.6 per cent increase (£4,330) over the past 12 months.

The growth in sales had temporarily slowed due to the ending of stamp duty reliefs in April and the Easter holidays but has quickly regained momentum

|GETTY

Owner of Crown Estates and Lettings Agents in Blackburn Martin Bennett said: "Business is booming in Blackburn, with increased demand for properties both at the lower and top end of the market.

"Properties that are priced correctly are going under offer within two weeks of being listed, while it's not uncommon to have 10+ potential buyers on the first day of viewings."

Yet, despite the increased activity, homes are currently selling for an average of £16,000 below asking price.

Sales agreed in May are running six per cent higher than the same period last year, as the market continues to recover from earlier challenges.

This rebound follows a period when mortgage rates hit six per cent in 2022/23, causing a sharp decline in housing sales.

Recent changes to how lenders assess mortgage affordability have participated in this recovery.

Now, buyers can borrow up to 20 per cent more than earlier this year, boosting consumer confidence and supporting the increase in sales.

The growth in sales had temporarily slowed due to the ending of stamp duty reliefs in April and the Easter holidays but the market has appeared to quickly regain momentum.

LATEST DEVELOPMENTS

Many sellers are also buyers themselves, taking advantage of attractive mortgage deals while moving to meet their housing ambitions - although this increased activity hasn't resulted in accelerated price rises.

Meanwhile, the north west has emerged as England's hottest housing market for price rises.

Currently, cities like Blackburn are seeing price increases of 5.8 per cent, while some southern locations such as Brighton and Bournemouth are experiencing small price falls.

Strong employment growth in the north west is boosting demand and house prices throughout the region.

Higher home values in major cities like Manchester and Liverpool, where prices have increased by 2.5 per cent and three per cent respectively, are pushing buyers into adjacent areas.

This ripple effect has benefitted other north west cities including Wigan, where prices are up 4.4 per cent, and Birkenhead at 4.1 per cent. Belfast leads all UK cities with whopping price growth of 6.1 per cent.

The fastest-growing markets are predominantly located outside southern England, with this trend expected to persist as home values rise in more affordable areas.

House price growth has remained below one per cent across all southern regions

|GETTY

Southern England has witnessed quite the opposite; while the south west has 21 per cent more homes for sale compared to last year, London and the south east have seen increases of 17 per cent and 15 per cent respectively.

This abundance of buyers' choice has resulted in house price growth remaining below one per cent across all southern regions, ranging from just 0.5 per cent in the south east to 0.9 per cent in the south west.

By comparison, the northwest has only three per cent more homes for sale than a year ago, with Scotland seeing a five per cent leap on its previous rates.

Zoopla's director Richard Donnell said: "More homes for sale means more buyers looking to move home.

"This, coupled with more attractive mortgage deals and changes to how lenders assess affordability, is supporting an increase in the number of sales being agreed."

"There are more sales and stronger house price increases in northern regions of England and Scotland, where homes are more affordable. In southern regions of England, affordability continues to weigh on price inflation."