'Highest on record!' Great news for sellers as house prices rocket, including one standout region

The average home is now worth £1,647 more than a month ago

Don't Miss

Most Read

UK house prices have hit a new record high, suggesting lucrative deals for British home sellers.

The latest figures from the Halifax House Price Index show property values climbed by 0.6 per cent last month, marking the fourth increase in the past five months.

As a result, the average property price was recorded at £299,862 in October, the "highest on record", noted the bank's head of mortgages, Amanda Bryden.

It's a significant turnaround from September's 0.3 per cent dip, with the typical home now worth £1,647 more than just a month ago.

TRENDING

Stories

Videos

Your Say

Annual growth has picked up pace too, reaching 1.9 per cent compared to 1.3 per cent in September.

Inspiring confidence, it indicates the housing market remains robust despite ongoing economic pressures.

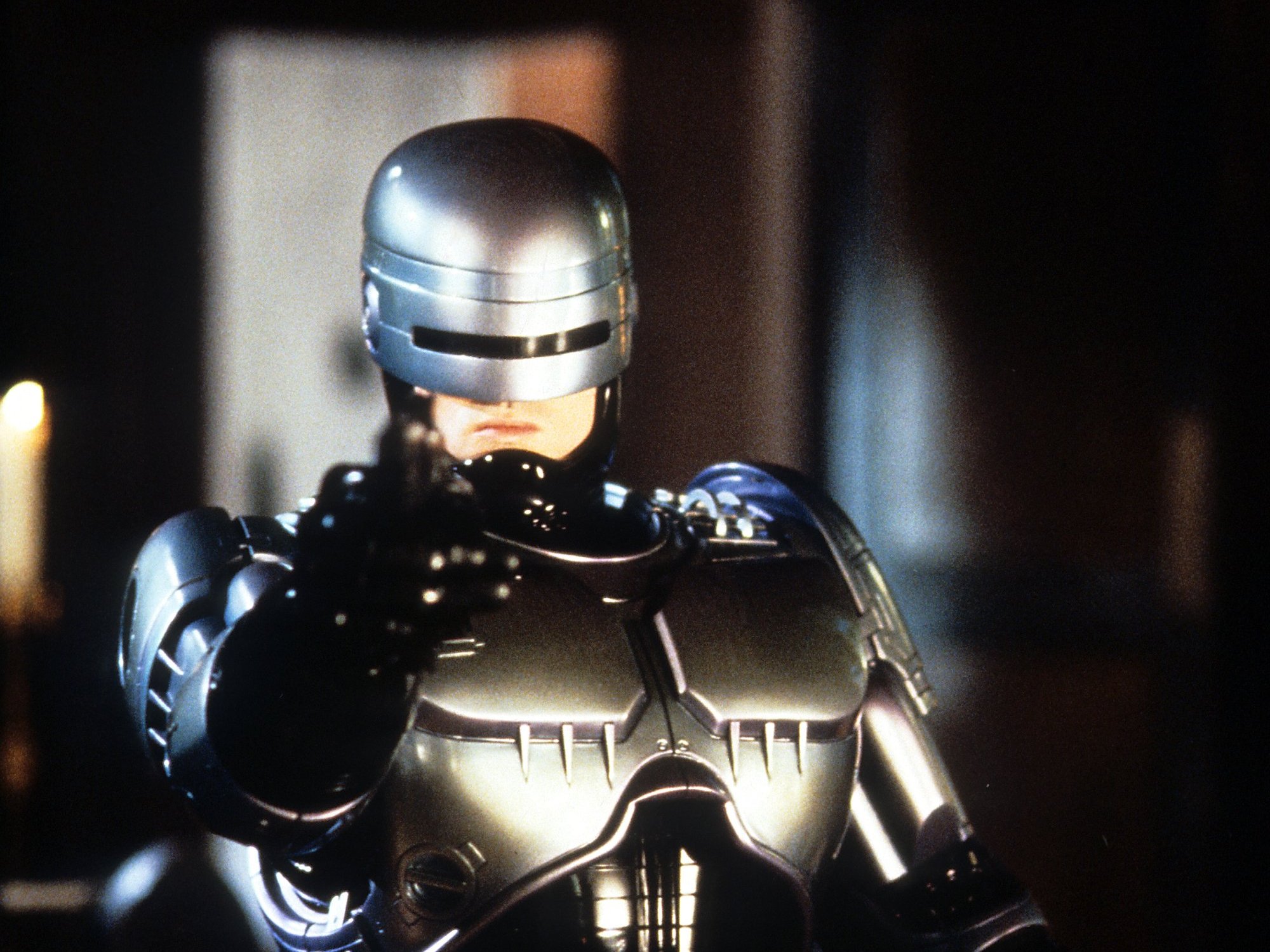

Northern Ireland continues to record the strongest rate of annual property price inflation

|GETTY

So, what can you expect if your house is on the market?

Homes in Northern Ireland have seen the biggest boost, with prices jumping a whopping eight per cent over the past year to reach £219,646. It's a notable increase from the previous month's 6.4 per cent growth rate.

Scotland isn't far behind, with property values climbing 4.4 per cent annually to an average of £216,051.

LATEST PROPERTY TIPS AND TRICKS

London saw house prices fall last month, but the capital remains the most expensive part of the UK

| PAWelsh homes have risen more modestly at two per cent year-on-year, bringing the typical price to £229,558.

In England, the North East leads the way with 4.1 per cent annual growth, pushing average prices to £180,924.

London and the South East have actually seen slight falls of 0.3 per cent and 0.1 per cent respectively, though the capital remains the priciest spot in the UK at £542,273.

The overall picture points to growth, exciting news for those looking to sell and potentially downsize. However, Ms Bryden acknowledged the plight of buyers as house prices jump.

The market's strength is reflected in mortgage approvals hitting their highest level this year, showing buyers aren't being put off despite the challenges they face.

Nevertheless, "there is no doubt that affordability remains a challenge for many", the expert stated.

"Average fixed mortgage rates are currently around four per cent and likely to ease down further, but with property prices at record levels, moving home can feel like a stretch," she said.

The expert also pointed to everyday costs "squeezing" household budgets, noting that these "affect how much people are willing or able to spend on a new property".

Despite these pressures, she remains optimistic about the market's direction. "Even so, while there has been some volatility, the market has proven resilient over recent months, as many buyers opt for smaller deposits and longer terms to help make the numbers work."

She added: "With house prices rising more slowly than incomes for almost three years now, we expect the trend of gradually improving affordability to continue."

Our Standards: The GB News Editorial Charter