What buyers, sellers and renters can expect in early 2026, according to a property expert

A New Year is underway, and early trends suggest 2026 could be a pivotal year for house sales, rents and interest rates

Don't Miss

Most Read

Latest

To buy or not to buy? Is it worth putting my house on the market before the Spring? Will 2026 finally be the year the Government gets housebuilding moving?

These are some of the questions that have dropped into my inbox during the first few days of 2026. No property expert possesses a crystal ball. And those who tell you they know what the future holds for the housing market aren’t being honest.

But there are already signs that point towards a few factors which I believe will define the early shape of the market in 2026.

To start with, I predict the first few months of the year are likely to see a spike in house sales due to a surprising uptick in the level of buyers and sellers who will enter the property market.

TRENDING

Stories

Videos

Your Say

Mortgage affordability could improve in 2026

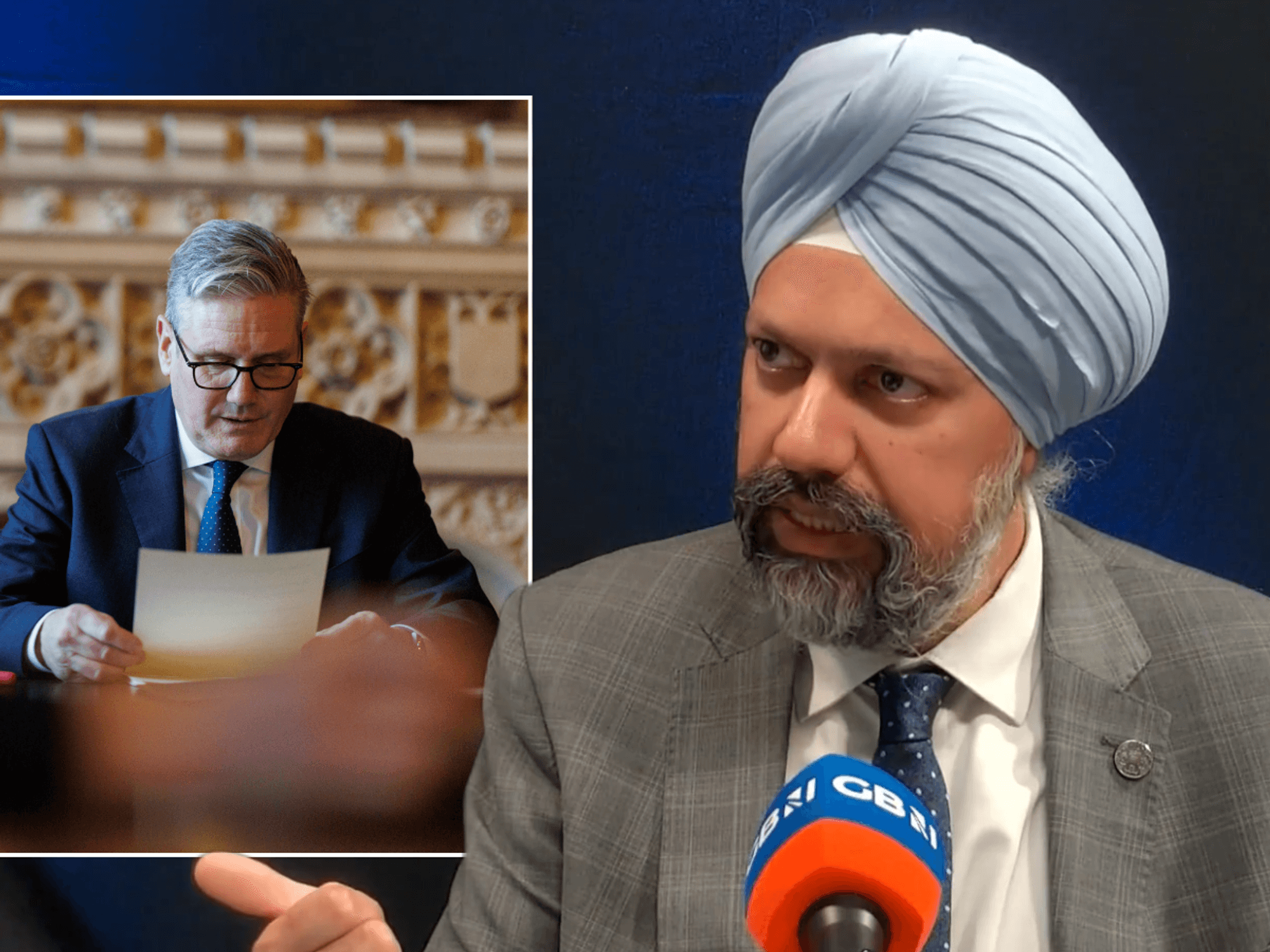

|GETTY

This will be down to the relief of pent-up demand caused by fear and speculation surrounding the last Budget, which saw people postpone their plans until all the details were known.

In the rental market, the upward pressure on rents should ease due to employment softening, bringing a risk of an increase in arrears due to early signs of redundancies and reduced hiring, especially in retail and hospitality.

That will dent confidence, especially among property investors, as yields become less attractive if rents stop rising and costs keep increasing.

Cooling household incomes and rents can also cool inflation, which could see it drift back towards the Bank of England’s target of 2 per cent.

That would be a key psychological and financial turning point and make interest rate cuts more likely.

If inflation behaves as expected, markets are pricing in at least one, and possibly two rate cuts, taking the base rate down to around 3.25 per cent by the autumn.

Mortgage affordability could improve, but it will be patchy: lower rates would be welcome for mortgage holders and new buyers, but lenders will still be cautious where job security looks shaky.

One area to watch is cash being held by households - over £2 trillion according to BoE figures.

LATEST DEVELOPMENTS

If rate cuts reduce the appeal of saving and nudge people into spending, that could boost transactions and housing-related activity massively and is therefore a key indicator to watch as the year progresses.

Headwinds for businesses remain, however. Policies such as higher business costs, in terms of business rates, wage changes and employment rules, risk hammering business confidence, which can feed through into weaker housing demand.

'The first few months of the year are likely to see a spike in house sales'

| GETTYNet migration trends could shift demand. Visa tightening and higher emigration may reduce population-driven housing pressure in some areas, with knock-on effects for rents and entry-level demand.

With such an imbalance in supply versus demand, the impact will likely be negligible.

So, expect hesitation and reasonable volumes early on, with the potential for the post-Budget New Year release of pent-up demand, turbo-charged if we see interest rates fall as expected.

Our Standards: The GB News Editorial Charter