Rachel Reeves' new road charges risk quadrupling car taxes as drivers face £150 cost hike - 'Not fair'

The Electric Car Scheme warned that rural drivers will pay four times more taxes under the pay-per-mile plans

Don't Miss

Most Read

Latest

Rachel Reeves' car tax hike could see some drivers paying almost four times as much as others under the new road charging plans, with rural electric vehicle owners hit hardest.

Fresh analysis warned how motorists living in parts of the countryside may face annual bills of more than £150, while drivers in London would pay just £33 under the proposed pay-per-mile system.

The Chancellor unveiled the new 3p-per-mile road tax in her Autumn Budget, arguing it is needed to plug a growing hole in the public finances as fuel duty revenues fall. The levy, due to begin in 2028, is expected to raise around £1.1billion a year for the Treasury.

But according to research by The Electric Car Scheme, drivers in the South West would face the highest average annual charge at £110.25, with the East Midlands close behind at £105.09.

TRENDING

Stories

Videos

Your Say

By contrast, motorists in London would pay just £33.09 a year on average, despite the capital having some of the highest numbers of electric vehicles and the best charging infrastructure in the country.

Drivers in the North East and North West would face mid-range costs of £82.20 and £83.79 respectively.

The biggest tax hike would be for people living in smaller rural towns near cities, who would pay an average of £156.51 per year, compared to just £76.02 for drivers living in cities and larger towns.

Rural drivers typically travel further for work, school and essential services, meaning they would rack up higher bills under a pay-per-mile system.

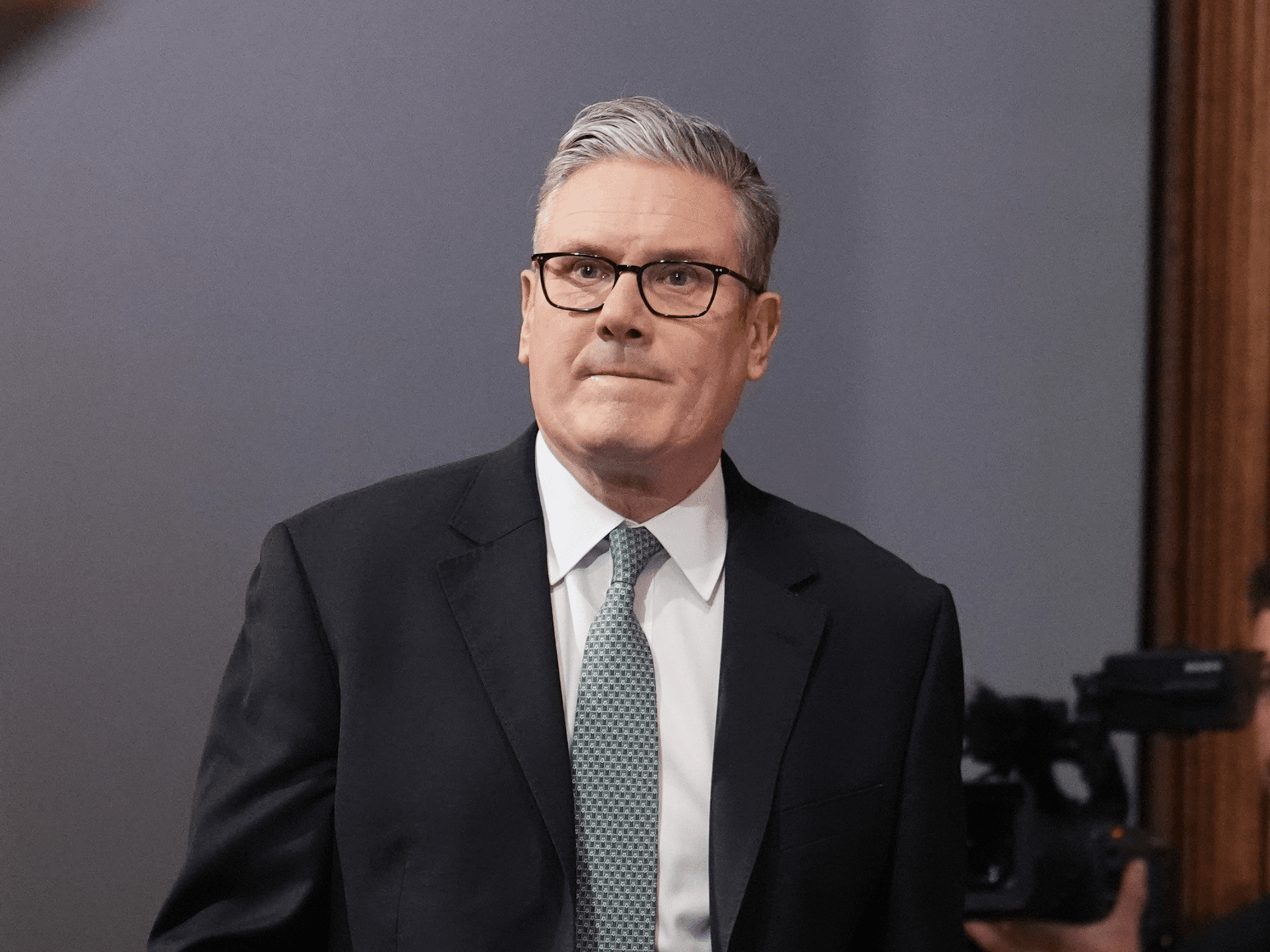

Chancellor Rachel Reeves confirmed the long-awaited pay-per-mile car taxes, which would hit rural drivers the worst

| GETTY/PAThom Groot, chief executive of The Electric Car Scheme, warned the new tax risks would put off would-be buyers at a crucial moment for the electric car market.

He said: "With almost two million electric vehicles on the road now, and more than triple this number expected by 2028, this scheme still has many barriers to overcome, including privacy concerns, regional fairness and public opposition. However, what we have found is that to get more people into EVs, we need financial incentives, such as the very successful salary sacrifice scheme, and not penalties.

"The data clearly shows that rural communities and regions outside London will bear the brunt of these costs due to longer necessary journeys and limited transport alternatives."

He cautioned that the policy could slow the shift from early adopters to mainstream drivers. The Office for Budget Responsibility has estimated the charge could reduce electric vehicle sales by around 440,000 over five years.

The department noted that 320,000 would be offset by the expected increase in sales due to other support measures.

LATEST DEVELOPMENTS

Experts warned that the upcoming pay-per-mile taxes would create another barrier for EV adoption

| PALast year, sales of battery-powered cars hit a record of 473,000, making up 23.4 per cent of the market, although this was still below the Government's 28 per cent target under its Zero Emission Vehicle mandate.

Despite concerns, Mr Groot insisted electric cars would still make financial sense for most drivers. "Even when this tax comes in, the major savings and environmental benefits of going electric remain firmly in place," he said.

A Government spokesperson argued that electric car drivers currently pay no fuel duty, while petrol drivers pay around £480 a year on average.

They added: "Similar to fuel duty, those who drive more will pay more. Right now, electric vehicle drivers pay no fuel duty. That's not fair. Under the new system, electric vehicles will pay half the duty of petrol cars - still the cheaper, greener choice."

The Chancellor introduced new car tax measures for electric vehicles at the Autumn Budget

| GETTYAlongside the new charge, ministers announced a £1.3billion boost to the Electric Car Grant scheme, which includes maximum savings of £3,750 per vehicle.

Under the current plans, plug-in hybrid drivers will pay a lower rate of 1.5p per mile, reflecting the fact that they still pay fuel duty when using petrol.

Fuel duty receipts have already fallen from £27.5billion in 2019-20 to an expected £24billion this financial year as more motorists switch to electric vehicles.

The Treasury has warned that without reform, revenues could slump to around £12billion a year by the 2030s, creating a further spending black hole.