Rachel Reeves could put 5,000 jobs at risk as Labour moves to scrap key car tax benefit for first time

The Chancellor plans to axe Employee Car Ownership Schemes next year under new proposals

Don't Miss

Most Read

Rachel Reeves has come under fire over plans to axe vital car tax schemes, which could risk eliminating significant benefits to drivers and inflict severe economic damage in the UK.

The move announced last year at the Autumn Budget and reaffirmed in July saw the Treasury move to fundamentally alter how Employee Car Ownership Schemes (ECOS) operate from October 2026.

The move would bring the scheme in line with company car Benefit-in-Kind tax rules that currently offer workers more favourable treatment.

Industry calculations have suggested that the changes could result in losses exceeding £1billion in sector revenue while threatening approximately 5,000 manufacturing positions, prompting urgent calls for policy reconsideration.

TRENDING

Stories

Videos

Your Say

The Society of Motor Manufacturers and Traders warned that abolishing these schemes would undermine recent Government support for automotive growth and push towards electric vehicles.

It revealed that the overall battery electric car market was up 28.9 per cent this year, with 386,244 units recorded, with 36,830 registrations recorded in October.

According to the trade body, around 100,000 vehicles are supplied annually through ECOS arrangements, representing roughly five per cent of the UK’s new car market, with the schemes playing a crucial role in attracting skilled workers to automotive businesses.

The proposed regulations specify that ECOS arrangements will fall under Benefit-in-Kind taxation when they meet certain conditions, radically changing how these schemes function.

The SMMT warned that removing the ECOS scheme could put 5,000 jobs at risk

| PA/GETTYFrom October 6, 2026, vehicles will be subject to company car tax rules if the arrangement includes limitations on personal vehicle use, designates someone other than the employee as the registered keeper, or incorporates predetermined buyback provisions.

Most existing schemes incorporate all three elements, making widespread impact inevitable according to tax specialists at KPMG.

The draft Finance Bill 2025-26 legislation looked to effectively close what Treasury officials view as a tax advantage, where employees currently pay Benefit-in-Kind charges based on outstanding loan values rather than the vehicle's full worth.

This represents substantially lower taxation than standard company car arrangements, particularly for petrol and diesel vehicles, with the differential creating what the Government considers an unfair disparity in the current system.

LATEST DEVELOPMENTS

Experts have warned that removing ECOS benefits could derail electric car progress

| PAExperts have now warned that the financial impact would exceed double the amount allocated to the Electric Car Grant programme, effectively negating growth initiatives the Government recently introduced to support vehicle electrification.

The knock-on effects would ripple through the new and used vehicle markets, as ECOS currently provides a vital supply channel for these sectors.

Industry analysis has also indicated that the total economic damage would far outweigh any additional tax revenue the Treasury might gain from bringing these schemes under standard company car taxation.

KPMG noted that fundamental operational changes would be required to avoid the new rules, as eliminating buyback provisions would necessitate complete scheme restructuring.

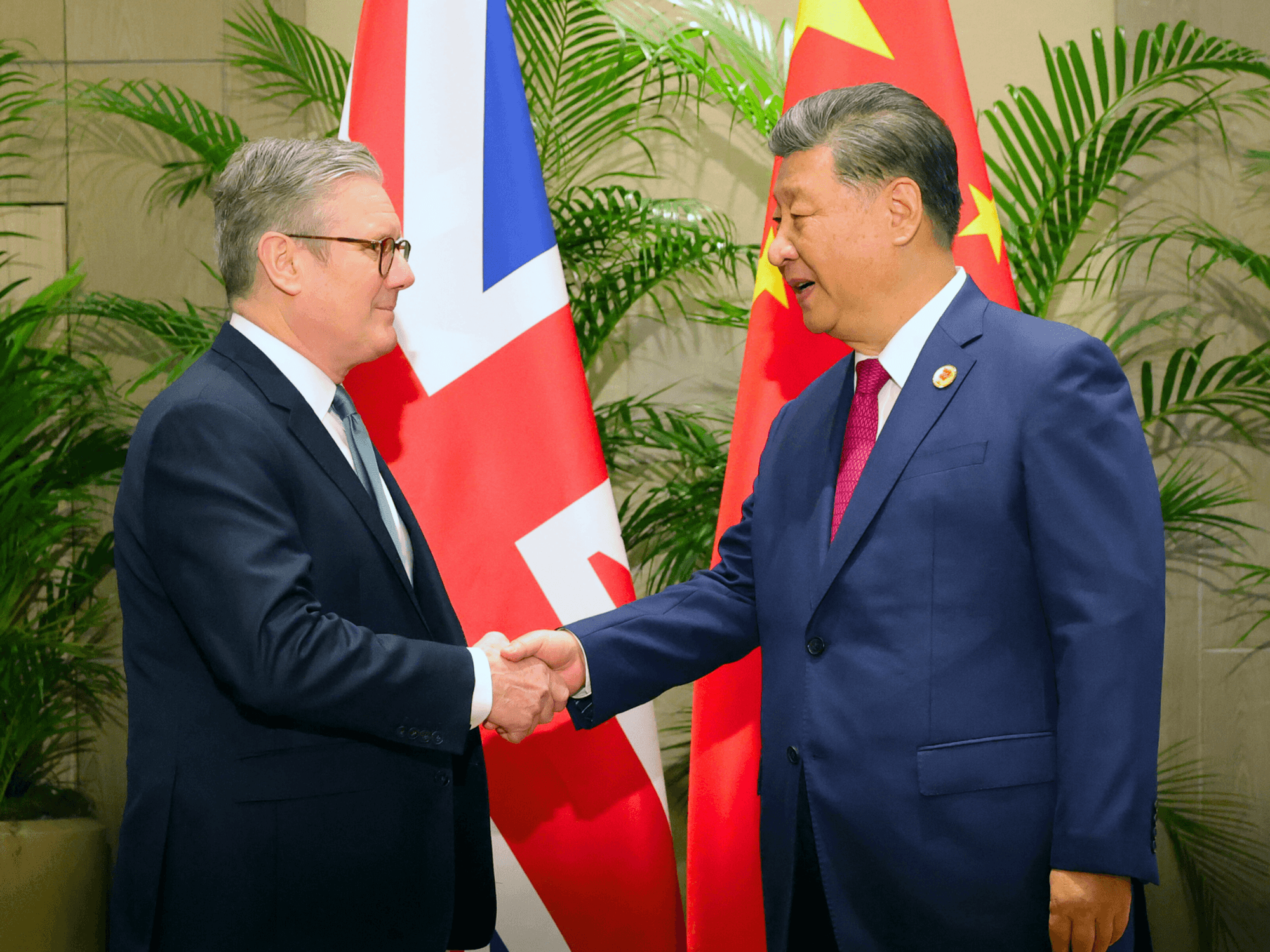

The Chancellor revealed that the Treasury would be scrapping the Employee Car Ownership Schemes

| GETTYMike Hawes, SMMT Chief Executive, condemned the proposals, stating: "The Government has backed the UK automotive sector with EV incentives and global trade deals, helping drive growth and encourage decarbonisation."

He warned that scrapping ECOS would "undermine that progress, penalising workers, reducing Exchequer income and putting green investment at risk".

"At a time when the Budget should fuel growth, the measure will do the exact opposite. It is time for a rethink," he urged.

The Autumn Budget will take place on Wednesday, November 26, with the Chancellor expected to announce several new tax measures, some of which risk adding more costs to drivers.