Rachel Reeves' car taxes could 'derail' switch to EVs as Labour faces backlash over anti-petrol and diesel policy

Tax experts have warned that new pay-per-mile road charges will impact electric car adoptions

Don't Miss

Most Read

Latest

Rachel Reeves has come under fire over plans which leave electric car drivers hit by new taxes, with experts warning the move risks putting people off switching to cleaner vehicles.

The Chancellor is pressing ahead with a pay-per-mile tax on electric vehicles, due to come into force in April 2028, which would charge drivers based on how far they travel rather than how much fuel they use.

The proposal, known as the new electric Vehicle Excise Duty (eVED), is designed to replace falling fuel duty revenues as more drivers move away from petrol and diesel cars. Treasury forecasts suggest the scheme will raise £1.4billion a year by 2029–30.

But tax specialists have now warned the policy could backfire, discouraging motorists from buying electric cars at the very moment the Government wants the uptake to increase as part of the Zero Emission Vehicle mandate.

TRENDING

Stories

Videos

Your Say

The warning follows new HMRC figures, which showed fuel duty income is already falling. Between April and October 2025, fuel duty receipts totalled £16.4billion, according to figures, marking £43million less than during the same period last year.

Officials said the continued shift away from petrol and diesel vehicles towards electric and hybrid cars was the main reason for the drop.

The decline forms part of a wider £1billion shortfall in tax receipts, adding to the financial pressure facing Ms Reeves as Chancellor.

At the same time, revenues from the energy profits levy on oil and gas producers have also dropped sharply. Income from the levy fell by around a fifth, from £1.1billion in October 2024 to £888million this year, forcing the Treasury to downgrade its forecasts.

Chancellor Rachel Reeves has been warned about the impact pay-per-mile car taxes could have on EV adoption

| PASheena McGuinness, Co-Head of Energy and Natural Resources at RSM UK, said the move towards electric vehicles was positive for environmental targets, but warned that new taxes could slow progress.

She said: "The transition to electric vehicles represents a positive step in the right direction to meet ambitious net zero targets, but the introduction of the price per mile scheme, which is set to raise £1.4billion by 2029–30, could derail progress."

Electric vehicles were previously exempt from traditional Vehicle Excise Duty until April this year, making them cheaper to run than petrol and diesel cars.

But under the new plans announced at the Autumn Budget, this advantage has disappeared, with EV and plug-in hybrid drivers paying based on mileage instead.

LATEST DEVELOPMENTS

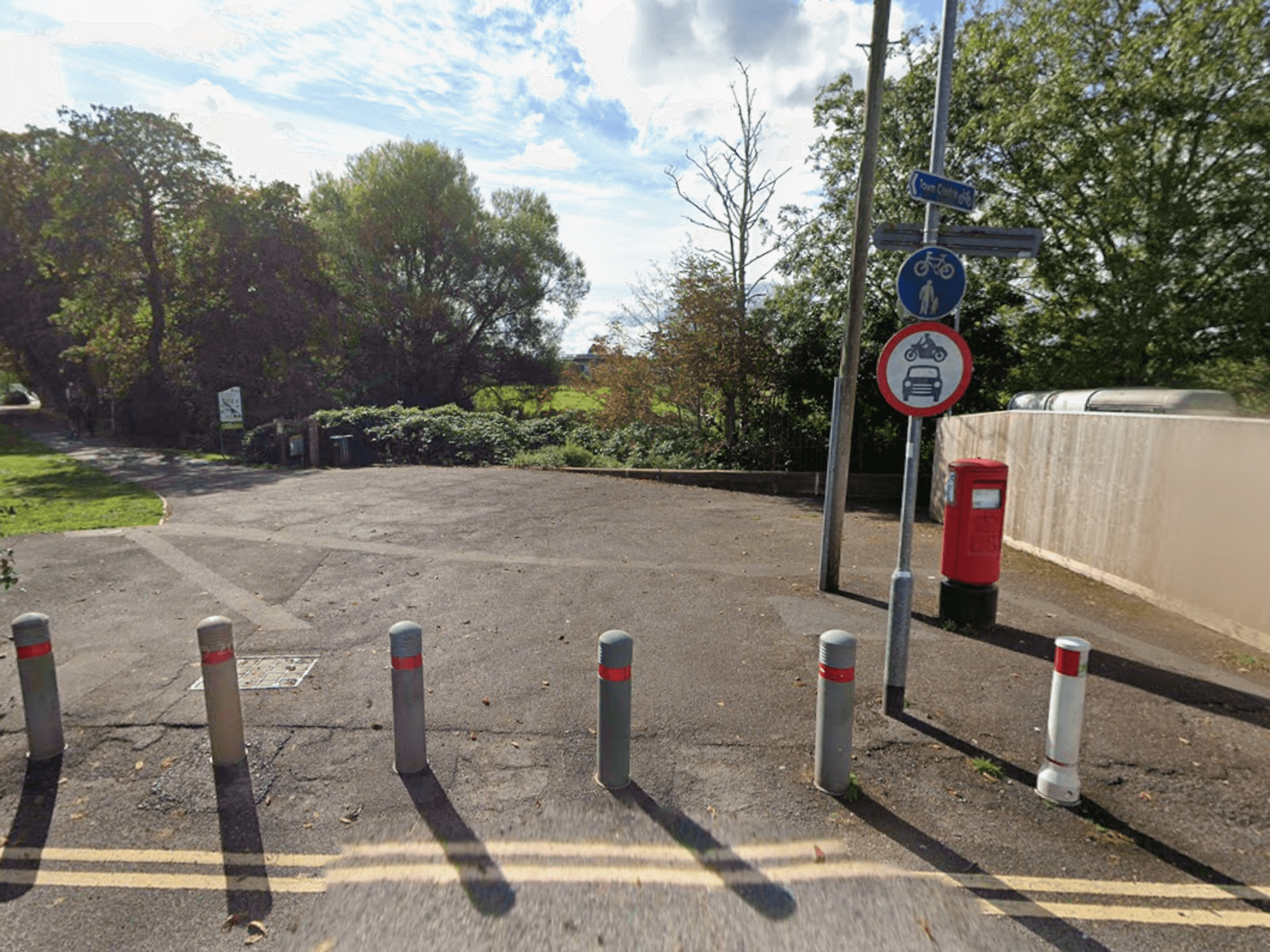

A pay-per-mile scheme will be an alternative to the current system of vehicle taxation for electric cars

| PAWhile the Government stated the cost per mile for electric vehicles would only average 3p, critics fear the change could add hundreds of pounds a year to household motoring bills.

Ms McGuinness also said consumer interest in electric cars appears to have weakened since Ms Reeves' Autumn Budget, when the Government confirmed it would begin taxing EVs more heavily.

She added: "Recent data suggests that intention to buy EVs has slipped since the Budget, so it will be interesting to see if fuel duty revenues start to tick back up."

Any increase in fuel duty income may be temporary. The Government is also planning to reverse the 5p fuel duty cut in September 2026, which would push petrol and diesel prices higher for millions of drivers.

The new tax changes will see EV drivers pay 3p per mile and 1.5p per mile for plug-in hybrids | GETTY

The new tax changes will see EV drivers pay 3p per mile and 1.5p per mile for plug-in hybrids | GETTYBut critics have argued this leaves motorists with few good options – facing higher fuel costs if they stick with petrol or diesel, and new road taxes if they go electric.

The Treasury launched a consultation on the new EV tax in November, with views being sought on how the scheme should work.

Ministers explained that the changes are necessary to create a "fair and sustainable" tax system as fuel duty revenues decline. But experts warned taxing electric cars too aggressively risks slowing the transition to cleaner transport.

With EV demand already showing signs of softening, and drivers struggling with high living costs, Ms Reeves faces a difficult balancing act between raising revenue and keeping the public onside.