HMRC to unveil new costs for petrol, diesel and electric car owners within weeks

The updated rates will be introduced on Sunday, March 1

Don't Miss

Most Read

Latest

Drivers are being warned of new rules from HMRC being introduced in the coming weeks that could see them pay more to run their vehicles.

HM Revenue and Customs publishes new advisory fuel rates (AFRs) every three months for users of company cars, with new rates set to be published within weeks.

The rates are used to reimburse employees for business travel in their company cars, or for employees who need to repay the cost of fuel used for private travel.

New AFRs will be unveiled on Sunday, March 1, followed by June 1, September 1, and December 1.

TRENDING

Stories

Videos

Your Say

HMRC recently unveiled new rates for electric vehicle drivers, depending on whether they predominantly charge at home or use a public charger.

Those who mainly utilise home chargers pay half the rate per mile compared to drivers using public chargers.

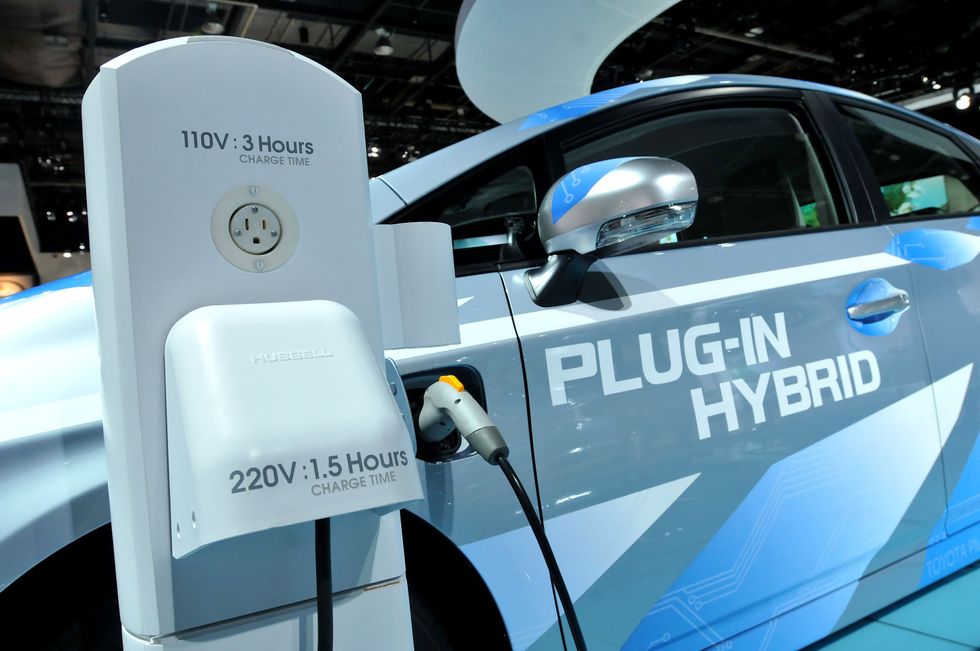

For the sake of the AFRs, hybrid cars are treated either as petrol or diesel cars, depending on their powertrain.

GB News has collated the latest advisory fuel rates for drivers ahead of the new rates being published in March.

HMRC will unveil new advisory fuel rates in the coming weeks

| PA/GETTYAdvisory fuel rates per mile from December 1, 2025

Petrol

Engines up to 1,400cc - Remains at 12p

Between 1,401cc and 2,000cc - Remains at 14p

Over 2,000cc - Remains at 22p

Diesel

Engines up to 1,600cc - Remains at 12p

Between 1,601cc and 2,000cc - Remains at 13p

Over 2,000cc - Remains at 18p

LATEST DEVELOPMENTS

The AFR for electric vehicles was recently split to differentiate charging

| PAElectric

Home charger - Reduced from 8p to 7p

Public charger - Remains at 14p

Liquefied Petroleum Gas (LPG)

Engines up to 1,400cc - Remains at 11p

Between 1,401cc and 2,000cc - Remains at 13p

Over 2,000cc - Remains at 21p

Hybrid vehicles are designated as either petrol or diesel for the sake of AFRs

| GETTYThe rates are calculated by taking the latest petrol and diesel prices from the Department for Energy Security and Net Zero (DESNZ).

Despite being a rare sight on UK roads, Liquid Petroleum Gas (LPG) vehicles are charged based on the UK average price from the AA website.

Electric vehicle rates are calculated via price data from DESNZ, the Office for National Statistics, consumption rates from the Department for Transport, and annual business sales volumes.

Prices are calculated by HMRC on a per-mile basis, while any rates which end in 0.5 are rounded down to the nearest whole penny.