HMRC car tax changes push thousands to 'cash-strapped' driving as urgent policy rethink demanded

The British Vehicle Rental and Leasing Association has warned upcoming car taxes risk impacting the EV transition

Don't Miss

Most Read

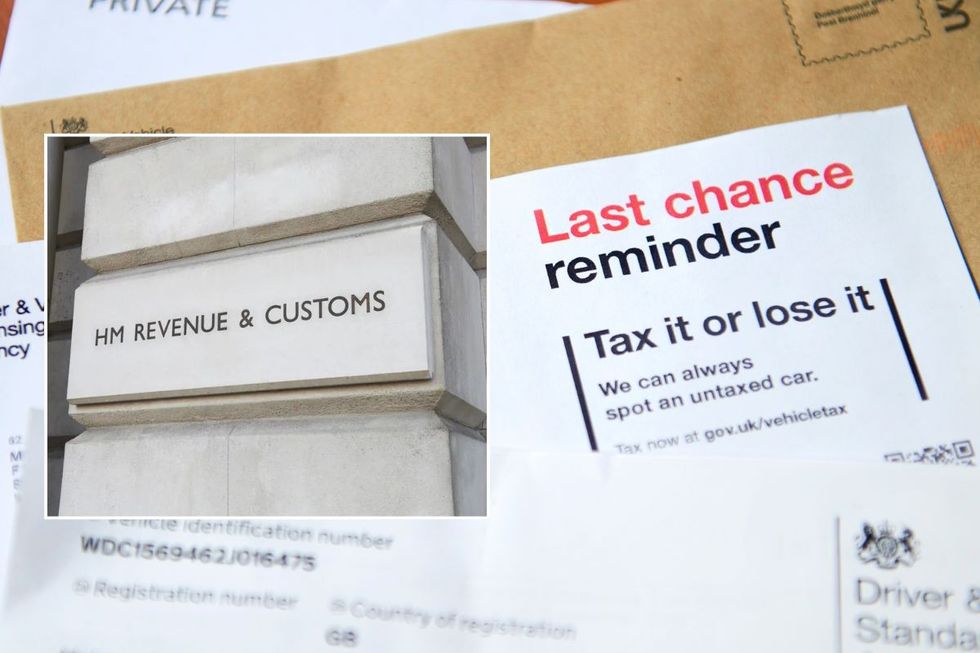

HMRC has come under fire over its changes to car taxes, which will see thousands slapped with higher costs and risks impacting a major car sector.

It follows fresh statistics from the British Vehicle Rental and Leasing Association (BVRLA), which indicated that favourable company car tax incentives remain the primary driver for electric vehicle uptake across the UK.

According to the organisation's most recent Leasing Outlook Report, employees utilising salary sacrifice arrangements were found to be four times as likely to opt for a fully electric model compared to those using personal contract hire.

Consequently, three out of every four vehicles within the BVRLA's leased fleet now possess zero emission capabilities, a figure bolstered by the inclusion of plug-in hybrids and standard hybrids alongside pure electrics.

TRENDING

Stories

Videos

Your Say

Industry experts argue these findings underscore just how critical the current Benefit-in-Kind (BiK) tax structure is in encouraging motorists to switch away from combustion engines.

Last year, ministers confirmed that planned reforms to Employee Car Ownership Schemes were set to take effect from October 6, 2026. However, following backlash from the industry, Chancellor Rachel Reeves amended the start date to April 2030.

The primary objective of the legislation was to eliminate loopholes that currently allow such schemes to bypass standard Company Car Tax liabilities.

Officials argued that tightening these rules will ensure fairness across the tax system and reinforce the emissions-based regime that incentivises zero emission vehicle adoption.

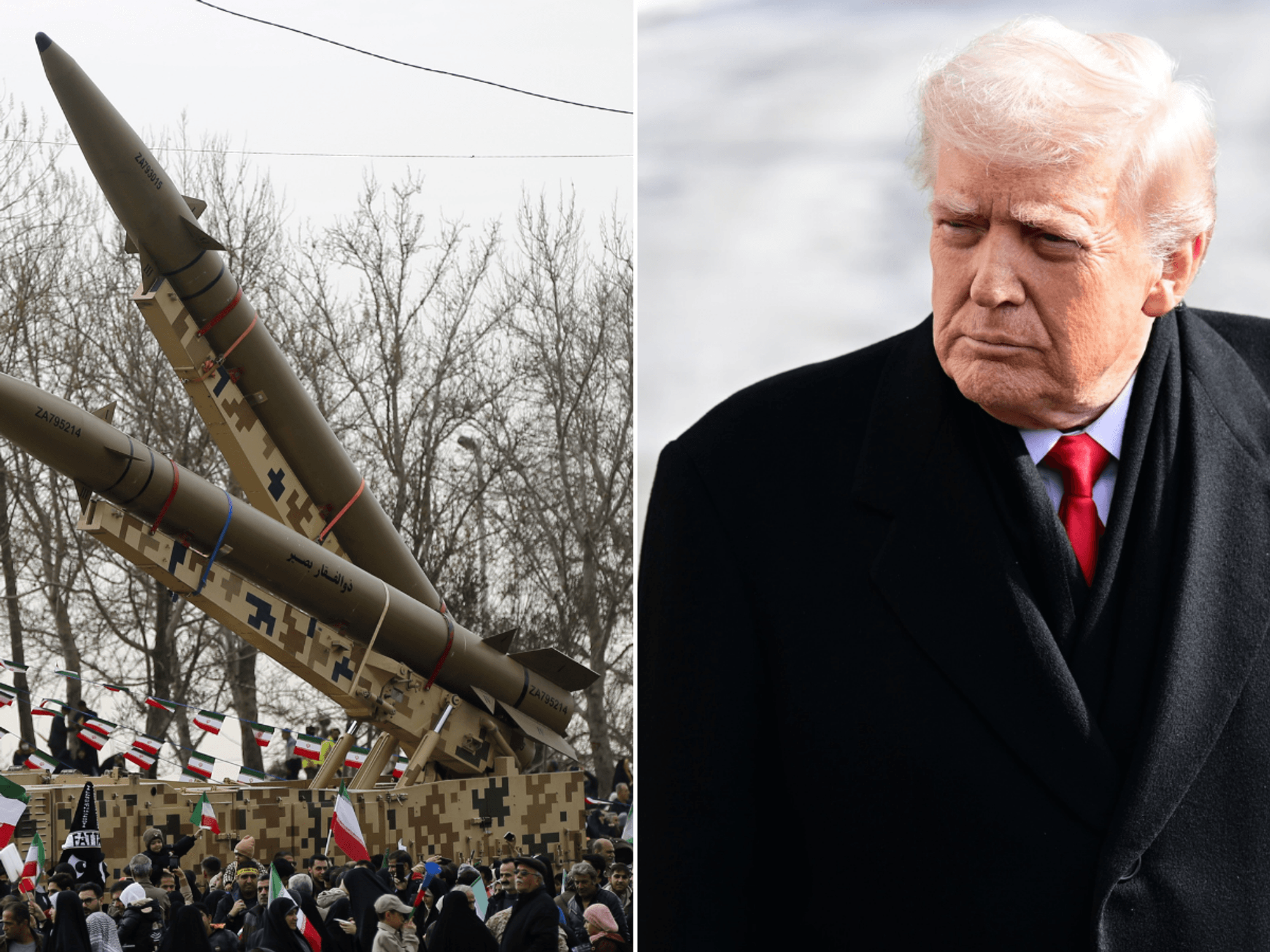

Motoring organisations have warned HMRC's car tax changes will impact thousands of drivers

| PA/GETTYUnder the revised proposals, vehicles provided through these specific arrangements will be deemed taxable Benefits-in-Kind if they are offered on restricted terms.

Approximately 80,000 motorists currently utilising these ownership structures face future income tax liabilities once the new rules take effect.

The deadline extension aims to provide employees with a window to negotiate alternative vehicle provisions with their companies before the 2030 implementation date.

Options for affected drivers may include transitioning to standard company car plans, selecting lower emission models to minimise tax, or opting out of employer-provided transport entirely.

LATEST DEVELOPMENTS

A broader analysis of the leasing market revealed a significant shift away from traditional funding methods toward salary sacrifice arrangements.

Battery-powered models have established themselves as the leading powertrain overall; however, their distribution varies significantly depending on the funding method used, according to the BVRLA report.

Meanwhile, 83 per cent of the salary sacrifice fleet consists of electric vehicles, but this proportion drops to 47 per cent for business contract hire agreements.

Without the financial incentives provided by the BiK tax system, traditional internal combustion engines remain the clear preference for private drivers. Nearly two-thirds (63 per cent) of PCH motorists continue to drive petrol or diesel cars.

The Chancellor introduced new car tax measures at the Autumn Budget, impacting EV owners

| PAA similar reliance on fossil fuels was found to be evident in the light commercial sector, where diesel engines still power 87 per cent of the fleet, leaving electric vans with a market share of barely 10 per cent.

Although the leased vehicle market expanded by eight per cent year-on-year to nearly two million units, the sector cautioned that this volume increase is damaging profit margins.

Toby Poston, the association's chief executive, noted that the industry's role in decarbonisation is being undermined by rising compliance expenses and the falling value of electric vehicles.

He said: "But any satisfaction from these achievements is tempered by the relentless pressure of compliance costs, cash-strapped customers, and rampant EV depreciation.

"The faltering used EV market and the badly designed and poorly timed eVED regime proposals are two prime examples where we need an urgent policy rethink."