Motorists urged to follow vital loophole to avoid paying Rachel Reeves' £3,840 new car tax

Drivers of hybrid company cars can benefit from tax breaks by using the loophole

Don't Miss

Most Read

Latest

Drivers of popular vehicles have been urged to follow a car tax loophole in response to Rachel Reeves' announcement at last month's Autumn Budget.

Labour introduced new measures to protect around 150,000 company car drivers from sudden tax rises caused by a new European emissions testing system.

The Euro 6e-bis standard records much higher carbon dioxide figures for plug-in hybrids than the previous system, even when the vehicles themselves have not changed.

Higher emissions figures push cars into higher Benefit-in-Kind tax bands, with drivers needing to pay income tax on the percentage of their car's list price.

TRENDING

Stories

Videos

Your Say

Owners of hybrid company cars have been urged to look into a temporary relief scheme, which has opened a narrow opportunity for drivers to reduce how much tax they pay, provided they act quickly.

Experts have suggested that motorists should avoid long lease contracts and instead opt for shorter, more flexible agreements that end before the tax relief expires.

Under the relief scheme, plug-in hybrids registered between January 1, 2025, and April 5, 2028, will have their emissions treated as just 1g/km for tax purposes.

This means the higher emissions figure shown on the vehicle's paperwork will be ignored when calculating tax.

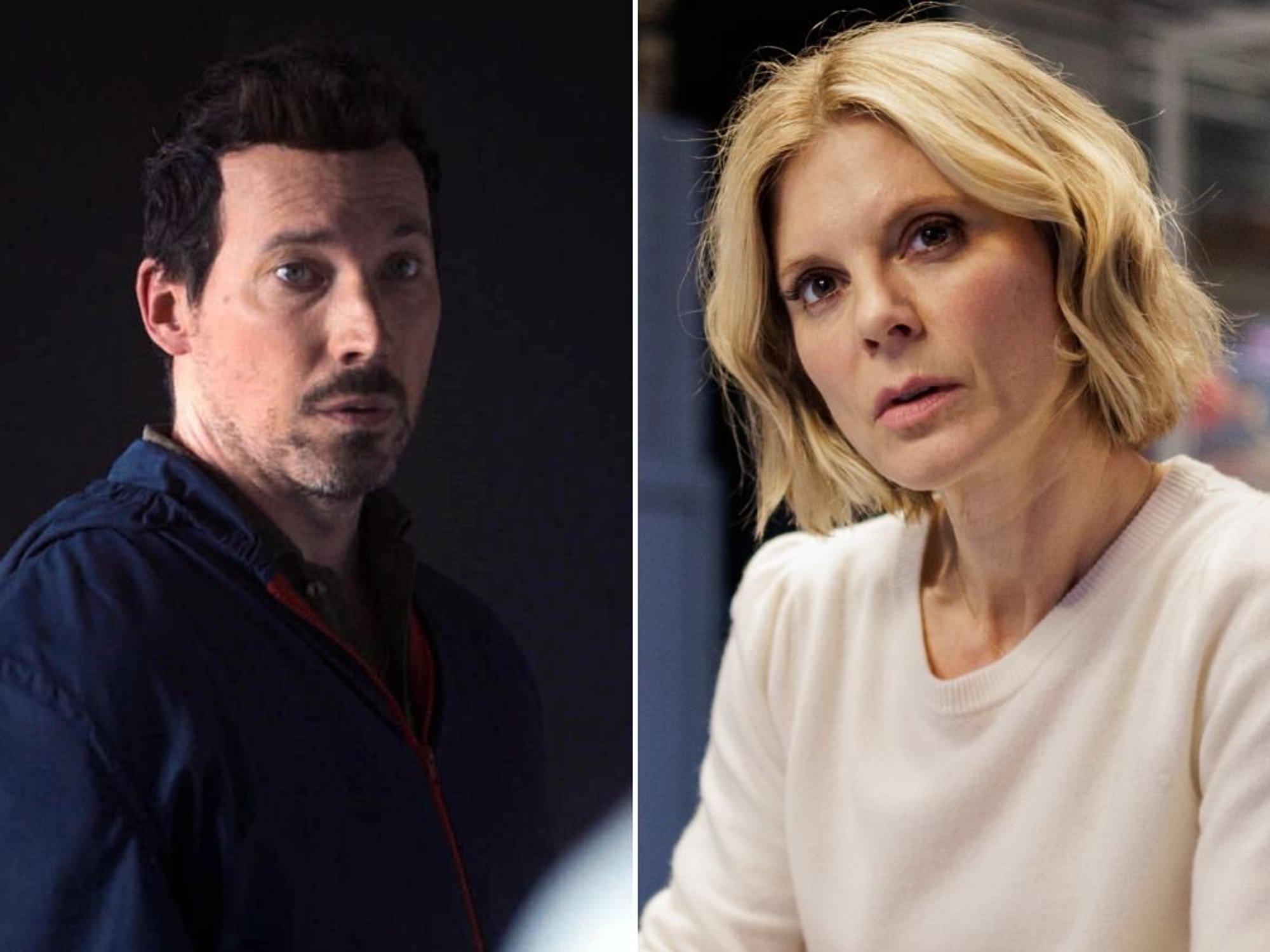

Rachel Reeves revealed new tax rates during the Autumn Budget

| HM TREASURY/GETTY/PASome drivers will continue to benefit until April 2031, as long as they get access to an eligible vehicle before the main relief period ends.

At present, a plug-in hybrid can attract a BiK rate as low as six to nine per cent, depending on its electric range. In comparison, petrol and diesel cars can be taxed at rates of over 30 per cent.

For example, a plug-in hybrid with a list price of £40,000 and a BiK rate of six per cent creates a taxable benefit of £2,400. A basic-rate taxpayer pays 20 per cent of that figure, which works out at £480 a year, while a higher-rate taxpayer pays £960 a year.

Without the loophole, the same vehicle could be pushed into a much higher tax band under the new testing rules. Some plug-in hybrids could see their BiK rate rise to around 24 per cent.

LATEST DEVELOPMENTS

At that level, the taxable benefit on a £40,000 car would increase to £9,600. A basic-rate taxpayer would pay £1,920 a year, while a higher-rate taxpayer would pay £3,840 a year.

From the 2028/29 tax year, company car tax rates are due to rise further across the board, with plug-in hybrids expected to lose much of their tax advantage.

Industry experts warned this could leave drivers paying several thousand pounds more each year unless they plan ahead.

Alan Bastey, a consultant at leasing firm Zenith, said drivers should take a more flexible approach to lease lengths.

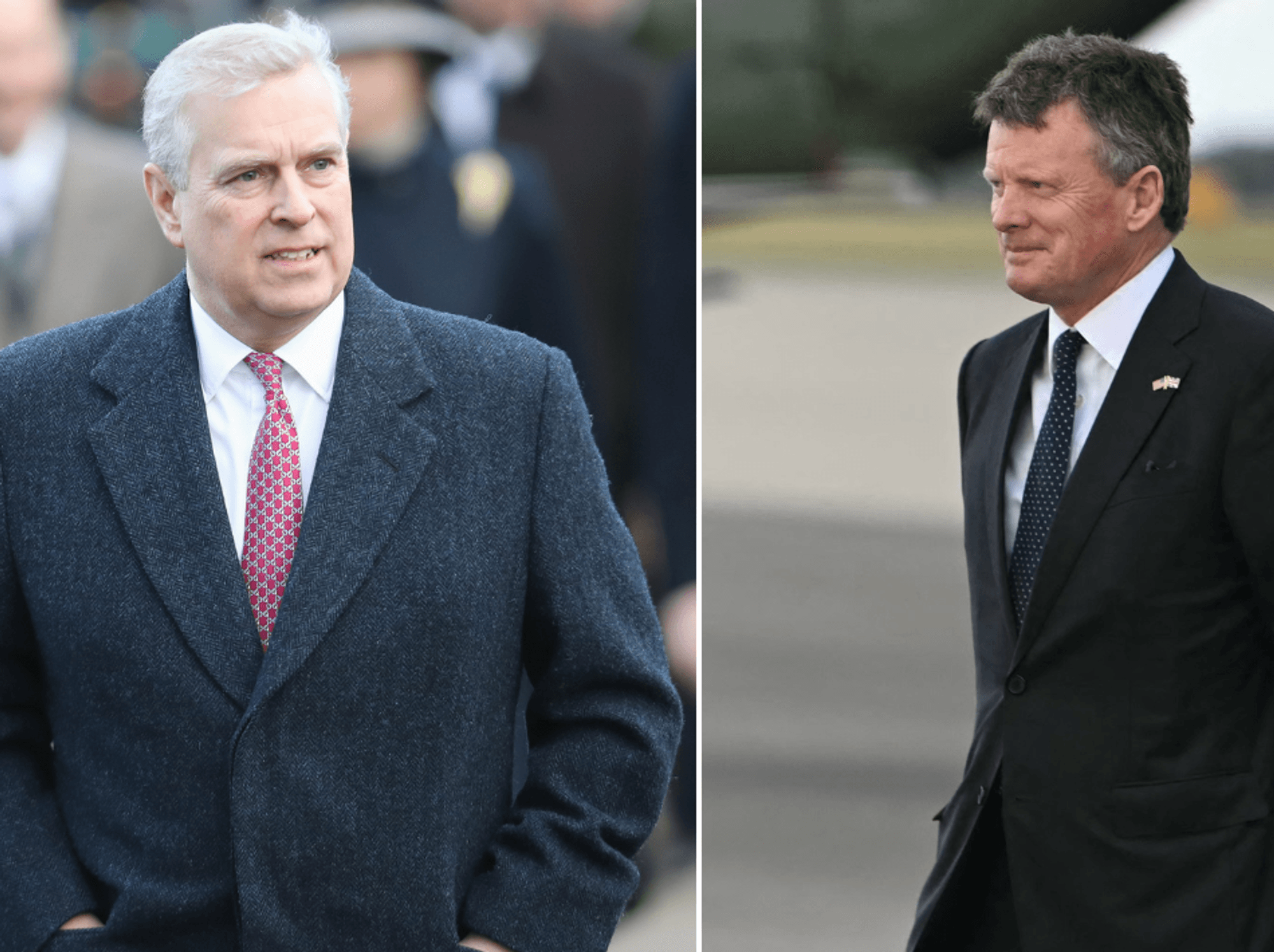

Hybrid cars will be taxed new BiK rates under the new measures announced by the Chancellor

| PA"Flexing your lease cycle is becoming more and more important," he said, adding that the longer a lease runs, the greater the chance drivers will be hit by tax rises later on.

The AA has also warned that the relief scheme only delays the impact. Fleet director Duncan Webb told Fleet News the measure buys drivers time, but that a sharp rise in tax bills is likely once the relief ends.

He said the easement only "buys you two years" before drivers hit what he described as an "absolute cliff edge" when the relief expires.

The Department for Transport has already shown how emissions figures could triple for some plug-in hybrids under the new testing rules, pushing drivers into higher tax bands overnight.