Car tax changes omitted from Jeremy Hunt's Budget will leave British drivers in limbo ahead of April deadline

Car taxes are expected to rise in line with inflation from April

Don't Miss

Most Read

Drivers in the UK have been left frustrated after Chancellor Jeremy Hunt failed to mention new details on car tax changes, which are set to be introduced within weeks.

With Jeremy Hunt outlining the Government's financial plans for the coming year, British motorists may feel aggrieved after the Chancellor ignored outlining changes to car tax rates which will be introduced in April.

Car tax changes normally take place in April to coincide with the new financial year as drivers prepare to pay a higher rate for their vehicles.

In the Autumn Statement last year, the Government announced that it would uprate the rate of Vehicle Excise Duty (VED) rates for cars, vans and motorcycles in line with RPI from April 1, 2024.

Do you have a story you'd like to share? Get in touch by emailing motoring@gbnews.uk

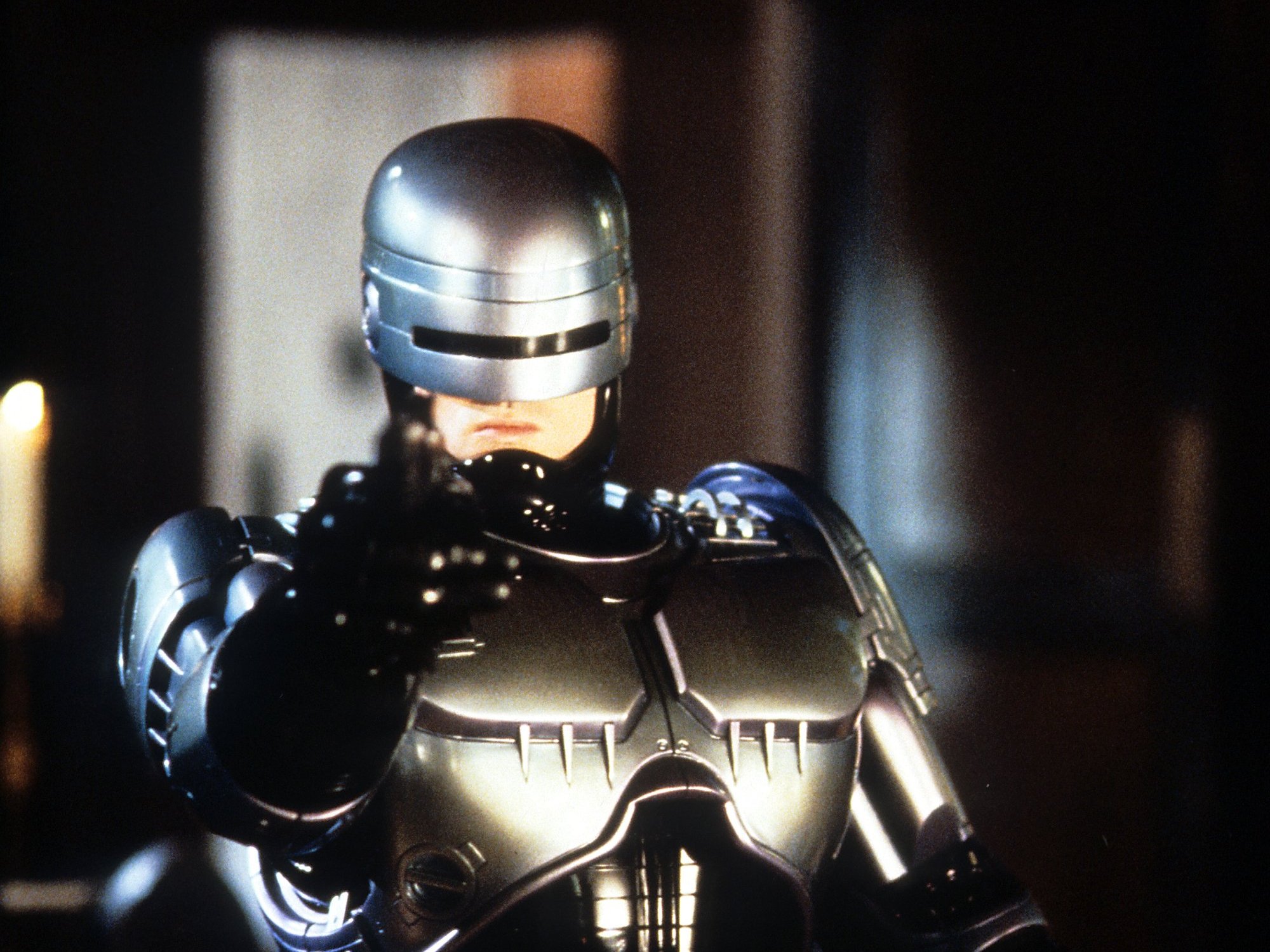

New car tax changes are set to be introduced in April

|GETTY

While the new rules will be introduced within weeks, the Government has failed to give clarity to drivers who are looking to plan their finances in the future.

Businesses will also be looking for guidance on how they can navigate around Benefit-in-Kind taxes, which are also expected to rise in April.

According to new research, 30 per cent of drivers said the hike in Vehicle Excise Duty (VED) was one of their main concerns for the coming 12 months.

Lisa Watson, Director of Sales at Close Brothers Motor Finance, said the extension of the fuel duty freeze was "some relief" for drivers who were concerned about petrol and diesel prices.

She added: "We’ve seen continuous hikes at the pumps over the last few months and this has added further pressure to drivers who already feel they’re faced with increased costs from all lanes, making car ownership difficult to afford for 62 per cent of drivers.

"What is essential now is that this cut reaches drivers' fuel tanks and wallets.”

Despite the lack of detail from the Chancellor or the Treasury on upcoming car tax changes, some drivers will see some relief from April.

As announced in the Autumn Statement last November, the haulage sector will see VED for heavy goods vehicles frozen.

The HGV Levy will also remain at the same 2023-24 rates in the 2024-25 tax year.

This follows concerns around car tax changes which were confirmed and scrapped within the space of a week in February after backlash from drivers forced HMRC to scrap the idea.

The original plans would have seen owners of double cab pick-up trucks charged as company cars, meaning anyone purchasing a double cab pick-up truck after July 1, 2024, hit with a near-fivefold increase in their personal tax bills.

These vehicles include any pick-up truck with a payload of more than 1,000kg, with notable models including the popular Ford Ranger Wildtrak.

LATEST DEVELOPMENTS:

- Major car brands could be forced to ditch touchscreen dashboards and bring back physical buttons

- Drivers warned of further car insurance price hikes as Hunt avoids scrapping premium 'stealth tax'

- Electric car switch in danger as drivers attack Hunt for ignoring 'bizarre tax' - 'enormously disappointing'

VED for HGVs will remain frozen next year

|GETTY

HMRC said it had “listened carefully” to the motoring industry when deciding to U-turn and confirmed that the existing guidance would be withdrawn, allowing double cab pick-up trucks to be treated as goods vehicles rather than cars.

However, Paul Hollick, chair of the Association of Fleet Professionals (AFP) warned that drivers may still be hit with the expensive costs, even if it doesn't happen immediately.

He said: "The Government with the HMRC do want to try and change things... that will happen at some point in the next couple of years.”