Car insurance prices could plummet with 'new strategy' aiming to slash premiums for British drivers

The average car insurance price in the final quarter of 2023 was £157 higher compared with 2022

Don't Miss

Most Read

Experts have announced plans to slash the rising cost of car insurance which could force action from the industry, Government or regulators.

The Association of British Insurers (ABI) said the industry could do more to make the sector more transparent about which vehicles are the most expensive to insure.

It added that changes like these could help motorists make more informed choices about purchasing vehicles and the associated costs they face.

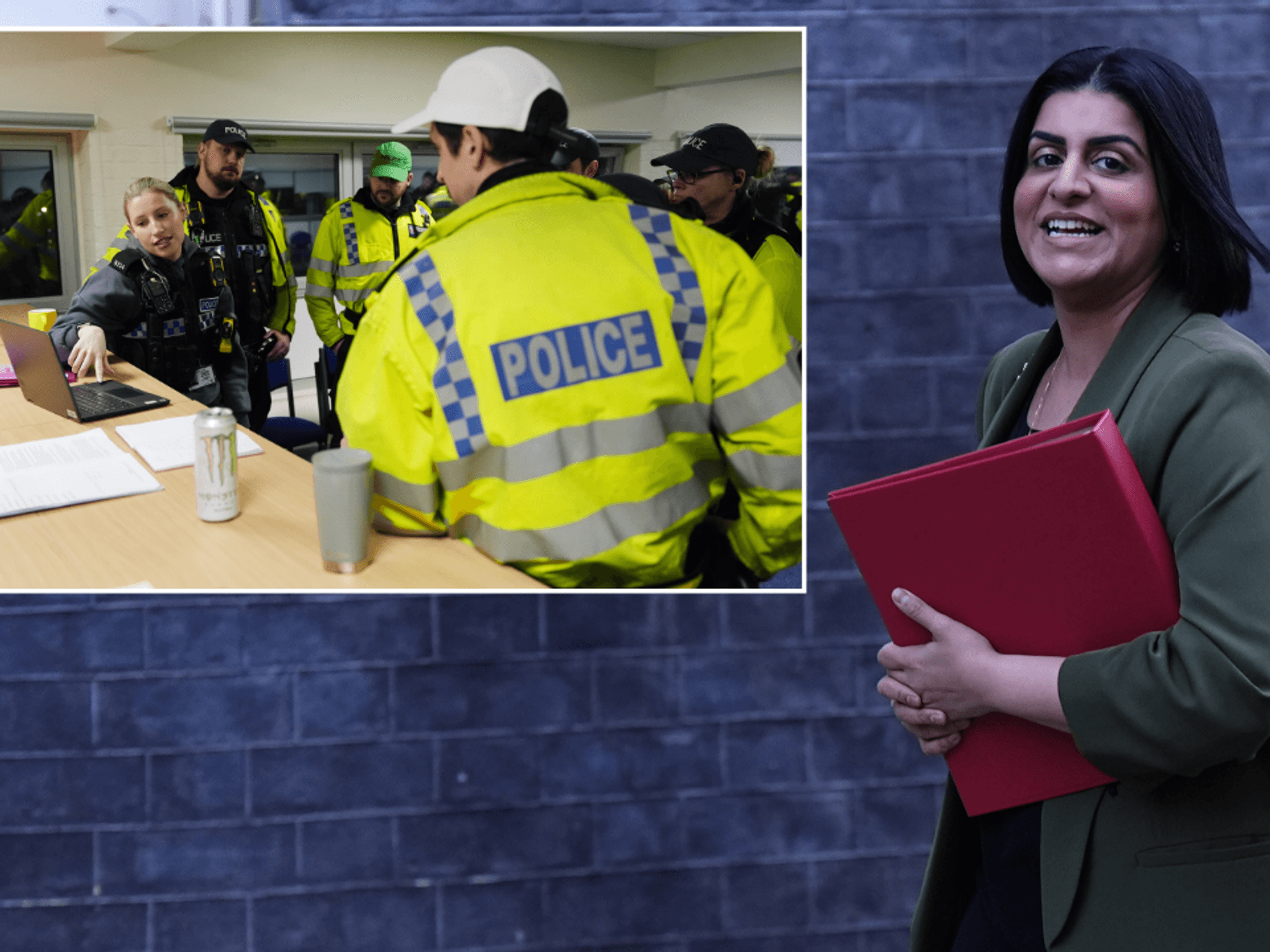

The ABI said it was exploring a partnership with the police to help the recovery of stolen vehicles from ports.

Do you have a story you'd like to share? Get in touch by emailing motoring@gbnews.uk

Young people are facing the largest car insurance quotes - something the ABI is looking to change

|GETTY

Other partnerships touted by the ABI could see the organisation join forces with the Mayor of London’s office and the National Police Chiefs’ Council to find ways of preventing vehicle thefts.

The Association said cracking down on fraud and uninsured driving will help cut costs further for law-abiding drivers.

The average price paid for motor insurance in the final quarter of 2023 was £157 higher compared with the same time a year earlier.

Between October 1 and December 31, 2023, motorists paid an average of £627 for car insurance, a huge jump from £470 during the same period a year prior.

The ABI has targeted Insurance Premium Tax as one of the key factors that could immediately bring costs down for motor insurance customers.

IPT, which is around 12 per cent, currently adds £67 to the average motor premium and is passed on to the driver by the insurance provider.

Speaking previously, Mervyn Skeet, the ABI’s director of general insurance policy, said cutting IPT would provide “immediate relief for stretched consumers”.

According to the ABI, research will be commissioned into the impact of various social policies focused on helping low-income households manage insurance costs.

This will be undertaken with its Consumer Advisory Group, which is made up of Which?, Citizen’s Advice, Fair by Design and others.

Commenting on the ABI’s plans to tackle the rising cost of motor insurance, Mervyn Skeet said the organisation would continue to work to help drivers save money.

He added: “We will continue to do what we can under our new strategy to help consumers access the products that are integral to financial wellbeing and play a key role in the nation’s financial resilience.”

The rising cost of insurance has been blamed on more expensive repair prices for vehicles, replacement vehicles and the rate of inflation.

LATEST DEVELOPMENTS:

Car repairs have become more expensive

|PA

The ABI added that premium finance would be another focus as part of its measures to make car insurance more affordable.

Premium finance allows drivers to pay monthly instead of paying in one go, although this will usually attract a higher rate of interest.