Brexit rules could decimate car market unless UK joins European Union trade group - 'World-class capability'

'Despite the most difficult environment in decades, UK Automotive remains a powerhouse of global trade'

Don't Miss

Most Read

Latest

Britain's automotive sector has issued an urgent plea for Government intervention as new European Union trading regulations threaten to devastate the electric vehicle market.

Industry representatives warn that tariffs ranging from 10 to 22 per cent could be imposed on EVs crossing the Channel from January 2027.

The potential duties endanger approximately £24billion worth of electric vehicle commerce between Britain and the EU, which has expanded dramatically, surging 424 per cent from £4.6billion in 2019.

Automotive leaders are pressing ministers to begin immediate discussions with Brussels regarding battery component specifications and to explore rejoining the Pan-Euro Mediterranean Convention.

Do you have a story you'd like to share? Get in touch by emailing motoring@gbnews.uk

Experts are calling on Labour to urgently intervene as EU rules could jeopardise the electric vehicle market

|PA

The sector fears these levies would render electric vehicles uncompetitive against traditional combustion models, which face zero tariffs, the Society of Motor Manufacturers and Traders (SMMT) stated.

The regulations stem from stricter origin requirements within the UK-EU Trade and Cooperation Agreement concerning batteries and their components.

Manufacturing facilities must achieve challenging localisation thresholds for battery production within Britain or Europe to avoid the penalties.

Current ambiguity surrounds the classification of cathode active materials, crucial elements in battery manufacturing. Without substantial increases in domestic battery production capacity over the next 16 months, most electric cars, buses and commercial vehicles will fail to meet the required standards.

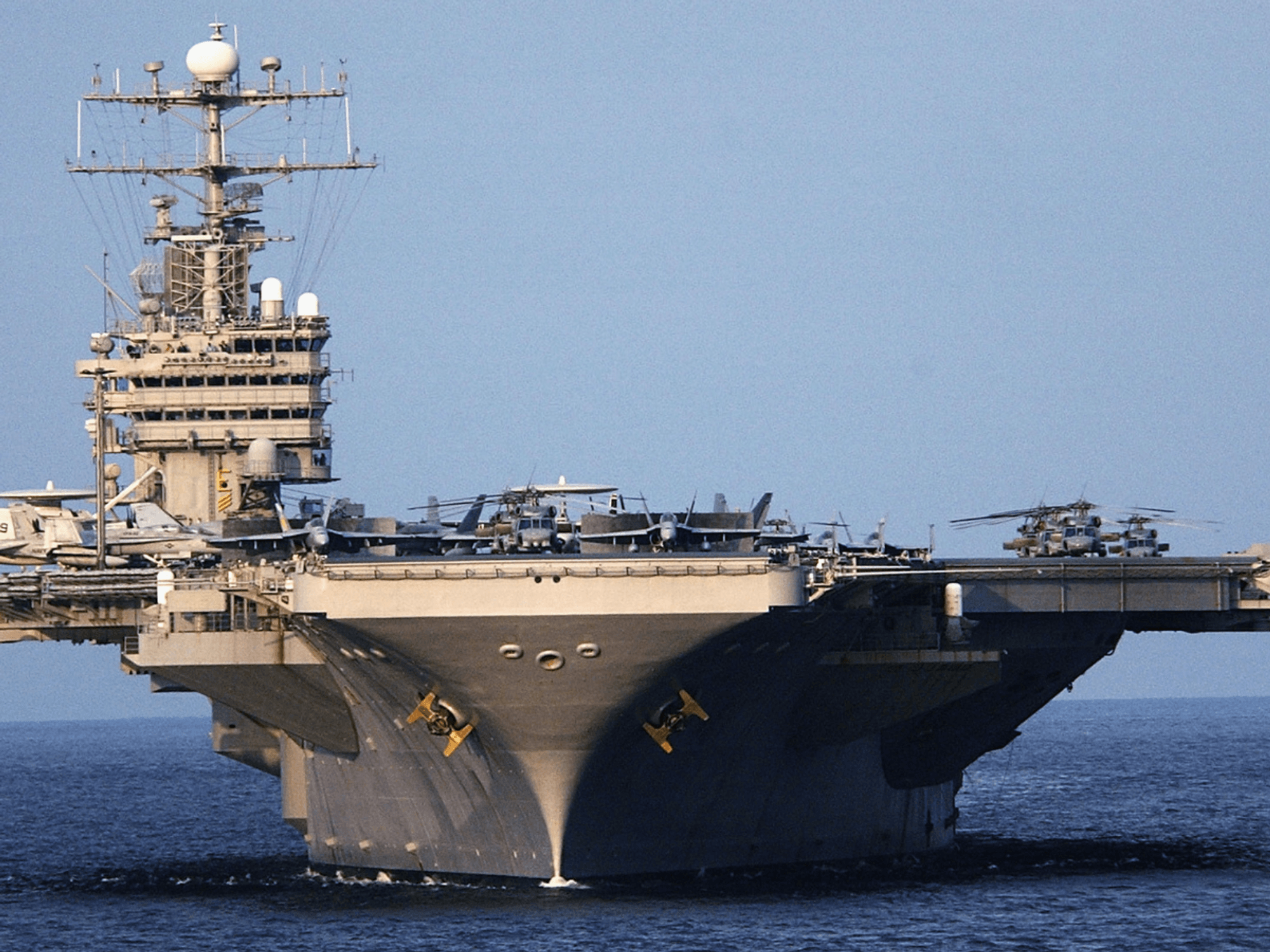

The automotive sector is on course to generate more than £110billion in trade for the third year running

| GETTYThe automotive sector considers the timeline unrealistic given the extensive investment periods and construction schedules needed for battery facilities.

Despite significant commitments to battery manufacturing in Somerset and Sunderland, alongside various European sites, production capacity remains insufficient to meet anticipated demand.

The automotive industry generated £115billion through imports and exports during the previous year, maintaining trade volumes exceeding £110billion for three consecutive years.

Cross-Channel automotive commerce reached £68.4billion annually, constituting nearly 60 per cent of Britain's total automotive trade value.

LATEST DEVELOPMENTS:

- M23 chaos: Drivers stuck in standstill traffic near Gatwick Airport as police respond to 'safety incident'

- Car finance scandal update may see compensation delivered within months as millions wait for £950 payout

- Volkswagen announces huge €1billion investment in revolutionary tech - but it's not for electric cars

Electric vehicle shipments have become the dominant component of bilateral automotive commerce. British EV exports to Europe now exceed traditional combustion engine shipments by 100 per cent in value.

European manufacturers delivered electric vehicles worth £17.6billion to Britain in the year ending June 2025. Pure EV imports from the EU surpassed those from China by more than double and overtook combustion engine import values for the first time.

The specific technical challenge centres on how cathode active materials are classified within the trade agreement's framework. These essential battery components lack clear definitions, creating uncertainty for manufacturers attempting to comply with the new requirements.

The agreement mandates that battery production must occur locally within Britain or the EU to qualify for tariff-free status. Industry experts highlight that achieving these thresholds within the remaining timeframe presents formidable obstacles.

The market share of electric vehicles continues to grow

| GETTYMike Hawes, SMMT Chief Executive, said: "Despite the most difficult environment in decades, UK Automotive remains a powerhouse of global trade.

"With its unmatched diversity and world-class capability, the sector already trades across the world. But the global trading environment is getting tougher; more competition, more protectionism and more geopolitical tension."

The automotive sector is urging ministers to track anticipated compliance levels with the 2027 electric vehicle origin regulations and commence urgent dialogue with European counterparts about establishing practical cathode active material specifications.

Representatives advocate for swift consultation with businesses and accelerated negotiations to rejoin the Pan-Euro Mediterranean Convention on origin rules.