Car finance scandal update may see compensation delivered within months as millions wait for £950 payout

Compensation payouts could come in early 2026

Don't Miss

Most Read

Around 30 million drivers could receive compensation as part of the car finance scandal after MPs grilled officials from the national financial regulator.

Members of the Financial Conduct Authority (FCA) were in front of the Treasury Committee earlier today ahead of a proposed consultation which could see millions owed compensation.

The FCA said it would be rolling out a consultation on a potential redress scheme in early October to address compensation requests from millions of drivers.

It warned that millions of agreements may not be valid since the broker may have adjusted the interest rate offered to the customer without properly informing them.

Do you have a story you'd like to share? Get in touch by emailing motoring@gbnews.uk

The FCA is currently looking at around 30 million car finance agreements as part of the car finance scandal compensation scheme

|PA

FCA officials part of the panel included Chief Executive Nikhil Rathi, Chair Ashley Alder, General Counsel and Chief Risk Officer Stephen Braviner Roman, and Executive Director of Authorisations Sheree Howard.

Speaking to the Treasury Committee panel, Nikhil Rathi said: "During the period that we're looking at - from 2007 through to approximately 2020 - there are around 30 million agreements."

He added there were 14.6 million discretionary commission agreements, although not all of them would be eligible for the compensation, as they may have been "zero commission" arrangements or the driver may not have complained.

While the consultation is expected to launch in October, compensation, which is expected to be around £950 per complaint, could be delivered as early as 2026.

READ MORE: Car finance scandal sees drivers 'stitched up' as Britons wait for billions in compensation update

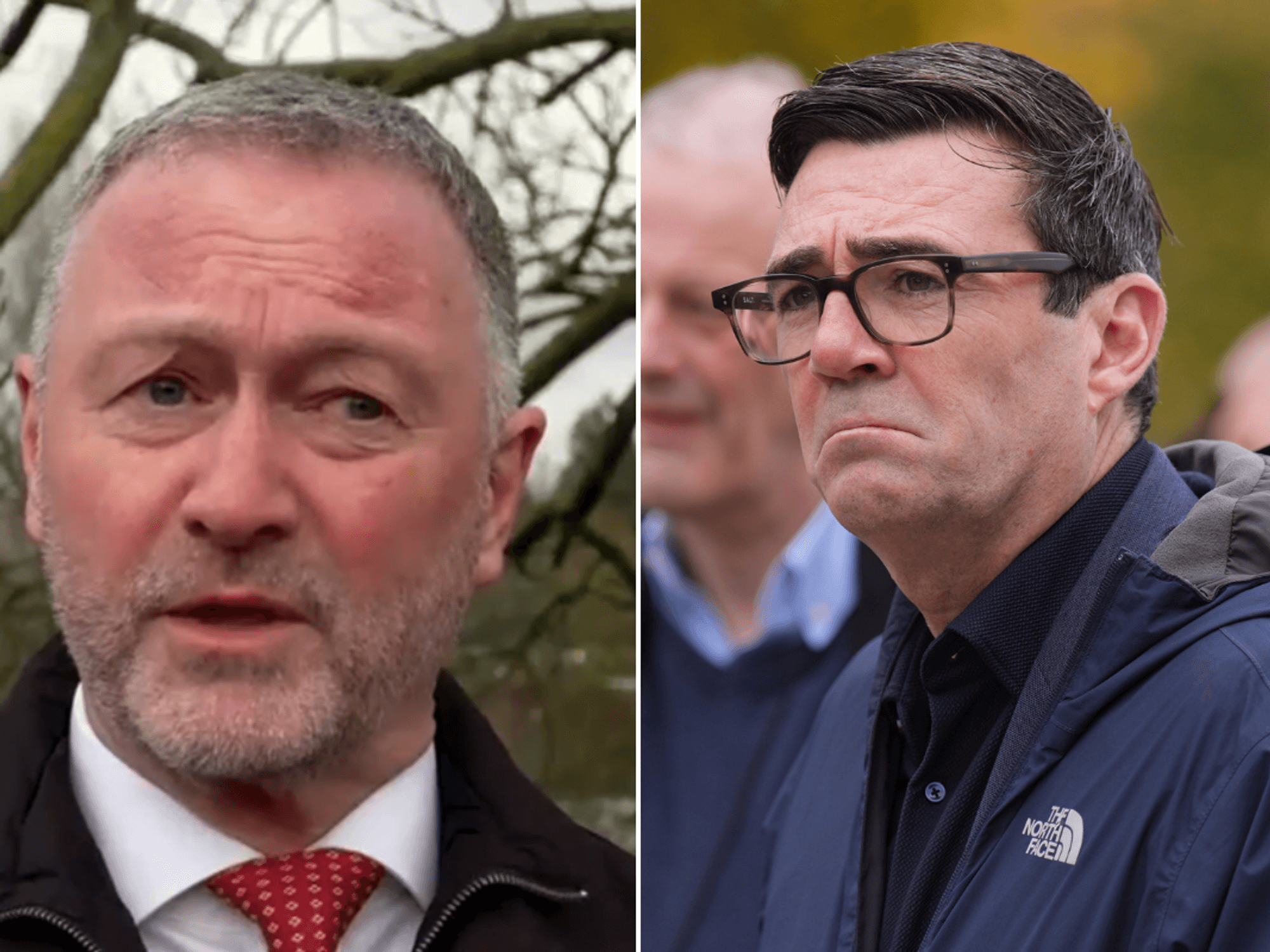

Lib Dem MP Bobby Dean previously told GB News that too many drivers had been unfairly 'ripped off'

|PARLIAMENT TV

Following the Supreme Court judgement in early August, the FCA said it was unlikely for the cost of the scheme to be any lower than £9billion, including administrative costs.

However, there are "plausible scenarios" which could see the compensation amount hiked to £18billion, although the FCA said this is an unlikely event.

Mr Rathi explained that a consultation scheme was needed after evidence was uncovered that appeared to show "unfair relationships between lenders and consumers".

Bobby Dean MP questioned the panel on the confusion around the recent Supreme Court judgement and how two of the three cases brought forward were rejected.

LATEST DEVELOPMENTS:

The Liberal Democrat MP for Carshalton and Wallington called on the panel to provide clarity on the situation regarding the "unfair relationship" between lenders and drivers when car finance agreements were being issued.

Mr Dean, who won his seat in the 2024 General Election with 43 per cent of the vote, has previously spoken to GB News, saying too many people had been "ripped off".

He claimed that the average payouts that have passed through the courts are around £1,800, as witnessed by Mr Dean, despite the FCA reporting an estimated compensation package of around £950, on average.

In response, Mr Rathi said: "We've been engaging very openly all the way through this process, recognising that legal procedures have been underway.

Nikhil Rathi, Chief Executive of the FCA, said the regulator was looking at around 30 million agreements

|PARLIAMENT TV

"Some of the claims management companies (CMCs) and law firms are putting out high-pressured advertising suggesting to consumers that they may get £4,500 and numbers like that.

"We will be firm and assertive across a range of regulated actors where we believe communications to consumers are fair and accurate and we have intervened in around 400 promotions, asking for them to be removed or amended since 2021."

He also highlighted that it had challenged 171 adverts since the Supreme Court decision at the start of August, adding that the FCA doesn't agree with some of the "very large estimates".

"We do think that the average is likely to be hundreds, and not thousands. I said that the weekend after the [Supreme Court] judgement because it's important for us to be transparent," Mr Rathi said.