More than 50 private schools closed since Labour's VAT raid as education survival warning issued

'You cannot be happy with this' Camilla grills Bridget Philipson on school closures after private school tax raid |

GB NEWS

Critics have highlighted the drop in pupil numbers as the more significant pressure on the system

Don't Miss

Most Read

Trending on GB News

More than 50 private schools have closed since Labour imposed VAT on private school fees, new data has revealed.

It brings fears from industry experts that the policy risks are adding strain on the public sector as parents pull students from private schools.

The fees, which came into force at the beginning of the year, were part of Labour's general election manifesto as a “revenue-raising” measure.

At least 54 private schools, including top prep schools, sixth-form colleges and specialist provision for children with additional needs, have shut or announced plans to close since January 1.

Expected to generate around £1.6billion a year, Labour says the money will be used to support state education, including paying for 6,500 new teachers.

In January, the number of pupils in independent schools in England fell for the first time since the Covid-19 pandemic, falling by nearly 1.9 per cent, according to the latest Government figures.

Over 11,000 pupils left independent schools in England, with the total dropping from 593,486 in 2023 to 582,477 in January this year, the figures show.

The number of independent schools rose slightly despite the introduction of VAT on school fees from 2,421 in January last year to 2,456 in January this year.

LATEST DEVELOPMENTS:

More than 50 private schools have closed since Labour imposed VAT on private school fees

| PACritics have highlighted the drop in pupil numbers as the more significant pressure on the system.

The Government has repeatedly claimed that the drop in pupil numbers is to be expected.

The majority of pupils who have left the independent sector have been absorbed into state education, with widespread fears of increasing the already strained pressure on the public sector raised by opposition politicians.

Julie Robinson, chief executive of the Independent Schools Council (ISC), said: "Anyone interested in this policy as a revenue raiser should be concerned by the number of pupils who have already left independent education, which is already much higher than the Government predicted.

Starmer has been criticised for the plans | PA

Starmer has been criticised for the plans | PA Rachel Reeves's tax changes have proven to be controversial | PA

Rachel Reeves's tax changes have proven to be controversial | PAShe added: "While there is a combination of factors contributing to school closures, for many, the Government’s decision to tax education has proven a bridge too far. We are likely to see further closures over the coming months and years as the effects of VAT and other tax measures mount up."

Robinson warned that the number of pupils leaving independent education was "already much higher than the Government predicted" and warned that many schools were unlikely to survive the next few years.

A Department for Education spokesman said: "Ending tax breaks for private schools will raise £1.8billion a year by 2029-30 to help fund public services, including supporting the 94 per cent of children in state schools to achieve and thrive."

"The number of children in independent schools has remained steady, while the most recent data shows the rate of families getting a place at their preferred secondary school is at its highest in almost ten years."

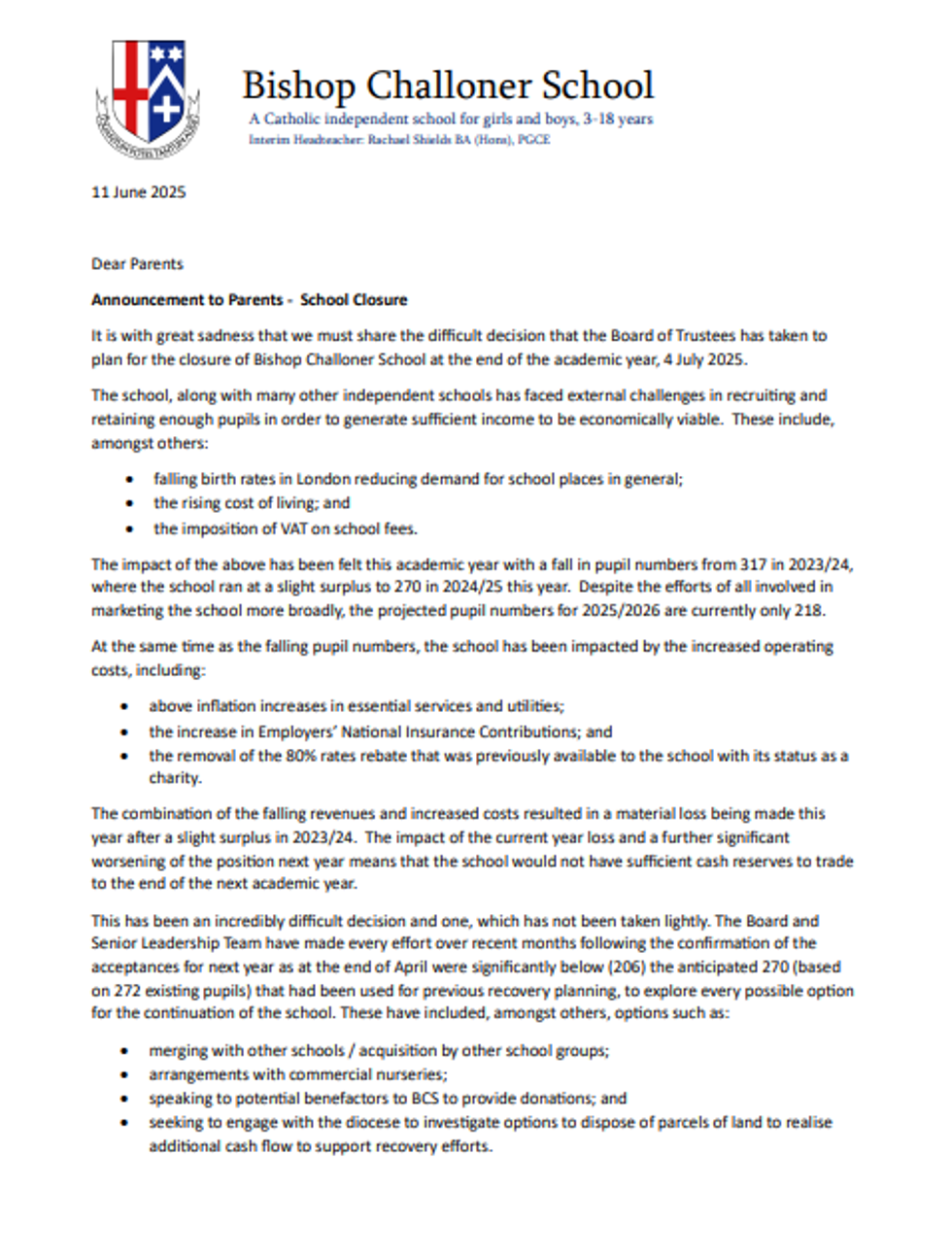

Letter from Bishop Challoner School in Bromley announcing school closure | GB News/supplied

Letter from Bishop Challoner School in Bromley announcing school closure | GB News/suppliedBishop Challoner School in Bromley, Kent, was one of the schools that announced its closure since the introduction of the 20 per cent tax on school fees at the start of the year.

The institution blamed the VAT changes, an increase in Employers’ National Insurance contributions and a decline in pupil numbers for its closure.

The school closed on July 4 to let students finish their exams, help parents find places for 270 students at other schools for the new academic year, and give more than 40 teachers time to seek new employment.

The Independent Schools Council revealed that 12 independent schools had publicly attributed their closures to Labour’s VAT policy and pointed out that 77 independent schools (including specialist ones) had closed since October 2024, with VAT playing a significant factor in those decisions.

More From GB News