As Nigel Farage reveals his 'next Brexit' issue, here are six signs it's already hammering British business

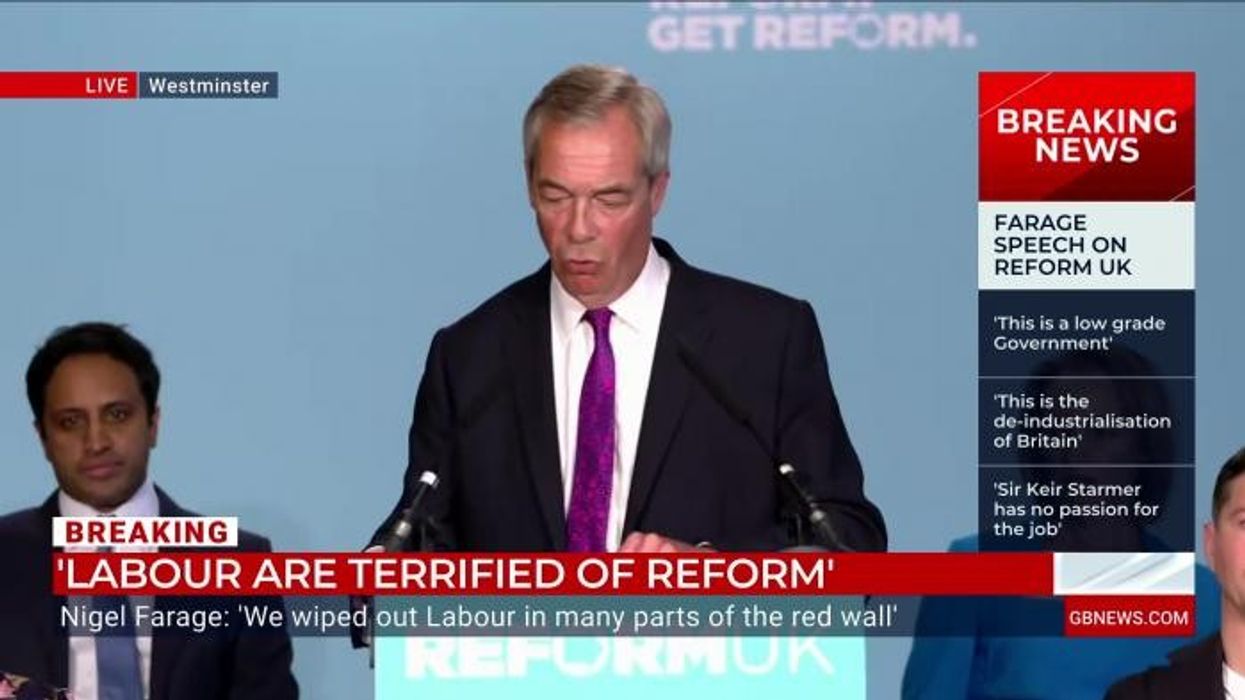

Nigel Farage: We will make big savings by scrapping net zero |

GB News

The Reform UK leader said voters are 'waking up' to net zero - but should they? GB News investigates

Don't Miss

Most Read

Trending on GB News

Speaking to Scottish voters on Monday, Nigel Farage declared net zero "the next Brexit", claiming that Reform speaks for the "majority" of voters who are "waking up" to the reality of what going green really means.

While the scientific consensus holds that anthropogenic climate change poses a significant threat to life, there is considerable debate on how to address the issue, with several individuals opposing Ed Miliband's net zero policy, including former Prime Minister Sir Tony Blair.

Blair has urged a rethink of the UK's commitments, warning that the current green targets are "doomed to fail".

Likewise, Conservative leader Kemi Badenoch has called the push for net zero by 2050 "impossible" and that it's already harming British business.

The public, for its part, does not appear to be sold on net zero. In March, YouGov asked 5,824 British adults: 'To what extent do you support or oppose the government's commitment to cutting carbon emissions to net zero by 2050?

A majority of respondents said they somewhat agreed (33 per cent), while 12 per cent said they strongly opposed, and 15 per cent said they don't know.

Exclusive polling for GB News the following month proved more emphatic, with a whopping 99 per cent of the respondents believing that the Government's net zero plans will make Britain poorer.

With public sentiment souring on the green transition, here's a look at the five ways net zero is already cooling the business climate in Britain.

Nigel Farage has dubbed net zero as the 'next Brexit'

|GETTY

Spiralling operational costs

The transition to net zero requires substantial investments in sustainable technologies and practices, thereby driving up operational costs.

A report, published by Price Waterhouse Coopers (PwC), concludes the net zero could push FTSE 350 companies to spend over 1000 per cent more by 2030, potentially reaching £438million annually.

According to a report published by Price Waterhouse Coopers (PwC), FTSE 350 companies publicly reported purchases of voluntary carbon offsets totalling £38million in 2022, the last year for which data is available.

Looking ahead, the firm projects that by 2030, the cost for FTSE 350 companies to purchase the same volume of voluntary carbon offsets as in 2022 could rise to over £135 million, marking a 256 per cent increase.

LATEST DEVELOPMENTS

Regulatory uncertainty is bad business

There is growing uncertainty with the policy and regulations of net zero, with Miliband having to flip-flop on his plans consistently in the face of economic pressures. As a result policy has seem muddled.

For example, the Public Accounts Committee criticised the government for lacking a clear plan to fund the net zero transition, leading to uncertainty among businesses regarding future regulations and investments.

Furthermore, the British Chambers of Commerce has found that 40 per cent of businesses are unaware of the details of the UK's net zero targets, highlighting a communication gap between policymakers and the business community.

This uncertainty undermines investor confidence at a time when clear direction is crucial.

There is a clear appetite for clarity. A recent survey by independent climate change think tank E3G found 82 per cent of UK-based institutional investors are worried about the impact of climate-related risk on their portfolios, with 40 per cent having sold or reduced holdings due to exposure to climate-related risks.

Investors want to see policy action to mobilise investment, with 88 per cent more likely to invest in a sector if it were covered by a government sectoral investment plan.

Miliband's net zero has been deemed 'doomed to fail' by Blair

| PAJob losses in traditional energy sectors

The Secretary of State for Energy and Climate Change has been urged to slash the windfall tax and reopen the North Sea or risk job losses, which could threaten net zero.

A report from the North Sea Transition Task Force highlighted that there would be a major loss of valuable skills and knowledge needed for the transition to renewable energy if Miliband allows the UK's oil and gas to fade away.

A report by Robert Gordon University warns that without urgent action, the UK's offshore energy workforce could shrink by nearly 20 per cent by 2030, dropping from approximately 154,000 workers in 2024 to around 125,000. The decline in oil and gas jobs is not being offset quickly enough by growth in offshore wind employment.

Furthermore, a survey by the Aberdeen & Grampian Chamber of Commerce reveals a concerning exodus of skilled energy workers from Scotland due to the decline in the domestic oil and gas industry and stagnating renewable projects.

Only 22 per cent of companies expect UK workforce growth, while 65 per cent predict staff increases abroad by 2030, indicating a trend of "skills offshoring".

Killing competition

It's feared that carbon prices could hurt businesses with the planned implementation of the EU Carbon Border Adjustment Mechanism (CBAM) in 2026.

The EU’s CBAM is designed to tax imported goods based on their carbon emissions, levelling the playing field with EU producers who face strict climate regulations.

However, for the UK — which is no longer part of the EU — CBAM poses several risks to competitiveness, especially in energy-intensive industries.

For example, without alignment between the UK's Emissions Trading Scheme (ETS) and the EU's, UK exporters may face significant costs under CBAM.

A Reuters report indicates that Britain could incur up to £800million annually in CBAM-related charges if it fails to link its ETS with the EU's by the end of 2025. This financial burden could make UK goods less competitive in the EU market.

Reports warn that domestic industries may lose market share to international competitors not subject to similar carbon costs.

Putting strain on the little guy

A related challenge is that net zero policies in the UK present significant challenges for small and medium-sized enterprises (SMEs), thereby benefiting incumbents.

SMEs often struggle to secure the necessary financing to invest in sustainable technologies and practices. The British Business Bank's 2025 report indicates that while some SMEs are interested in external financing for net zero initiatives, many find the available financial products unsuitable or inaccessible.

This financial gap hinders their ability to transition effectively toward sustainability goals.

This problem looks like it's here to stay. Echoing what we explored earlier about a lack of clarity over policy, many SMEs report a lack of clear, accessible information on how to implement net zero strategies effectively.

The UK Net Zero Business Census 2024 found that 46 per cent of SMEs cited a lack of trusted information sources as a barrier to action.

This information deficit hampers their ability to make informed decisions and adopt best practices in sustainability.

Is this the winning ticket for Nigel Farage?

When speaking in Scotland, Farage explained that the opinion is changing on net zero.

The Reform UK leader said: "You have Westminster, you have Edinburgh, you have Cardiff, all wedded to one particular point of view. Us, as the minority voice inside those institutions, but increasingly the majority voice out in the rest of the country.

"Believe me, the scales are falling from the eyes of the public when it comes to net zero. They realise we are putting upon ourselves a massive cost, let alone the opportunity cost of what we're missing.

"When we closed down refineries... and steelworks... all we're doing is exporting the emissions of CO2 with the goods then being shipped back to us. The public are waking up to this."

More From GB News