Rachel Reeves could impose MORE tax hikes as No10 refuses to rule out crippling Britons further

WATCH IN FULL: Rachel Reeves speaks to GB News after snubbing People's Channel on Budget day |

GB NEWS

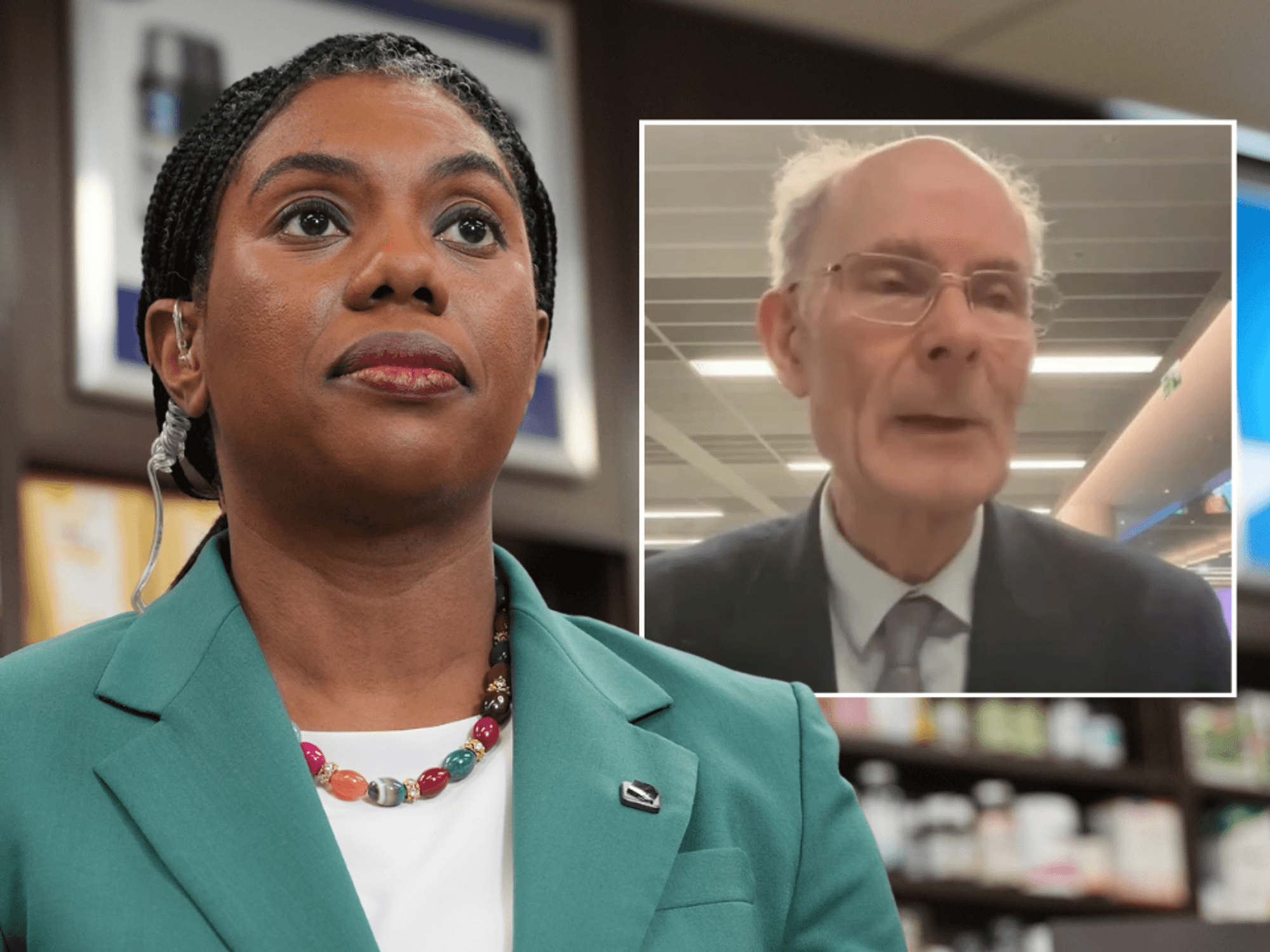

The Chancellor is under scrutiny over her latest Budget reforms

Don't Miss

Most Read

Latest

Chancellor Rachel Reeves could impose further tax rises despite announcing a £26billion raid on workers and businesses in yesterday's Budget.

Speaking to journalists earlier today, the Prime Minister's official spokesperson asserted that Ms Reeves is "not going to write the future Budget ahead of time".

During this year's fiscal event, Ms Reeves revealed the cash ISA tax-free allowance will be cut, a "mansion tax" on homes worth more than £2million and an extension on the current freeze to tax thresholds.

Combined, economists and the Office for Budget Responsibility (OBR) estimate the Treasury will generate £26billion in additional tax revenue from the announced measures.

Rachel Reeves REFUSES to rule out more tax rises after £26bn Budget blow

|GETTY

Defending her "mansion tax" proposal, the Prime Minister's spokesperson claimed that most households will not be affected by the levy which will be charged at homes valued above £2million.

They noted the new council surcharge is being implemented to “keeps things simple while ensuring those with the most valuable houses pay a fairer share".

On whether farmers could be hit by the new tax, the Prime Minister's spokesperson noted that a consultation is due to be carried out by the Valuation Office Agency.

Defending the Treasury's handling of the economy, Number 10 cited how last year's Budget made an effort to entice capital investment into the UK.

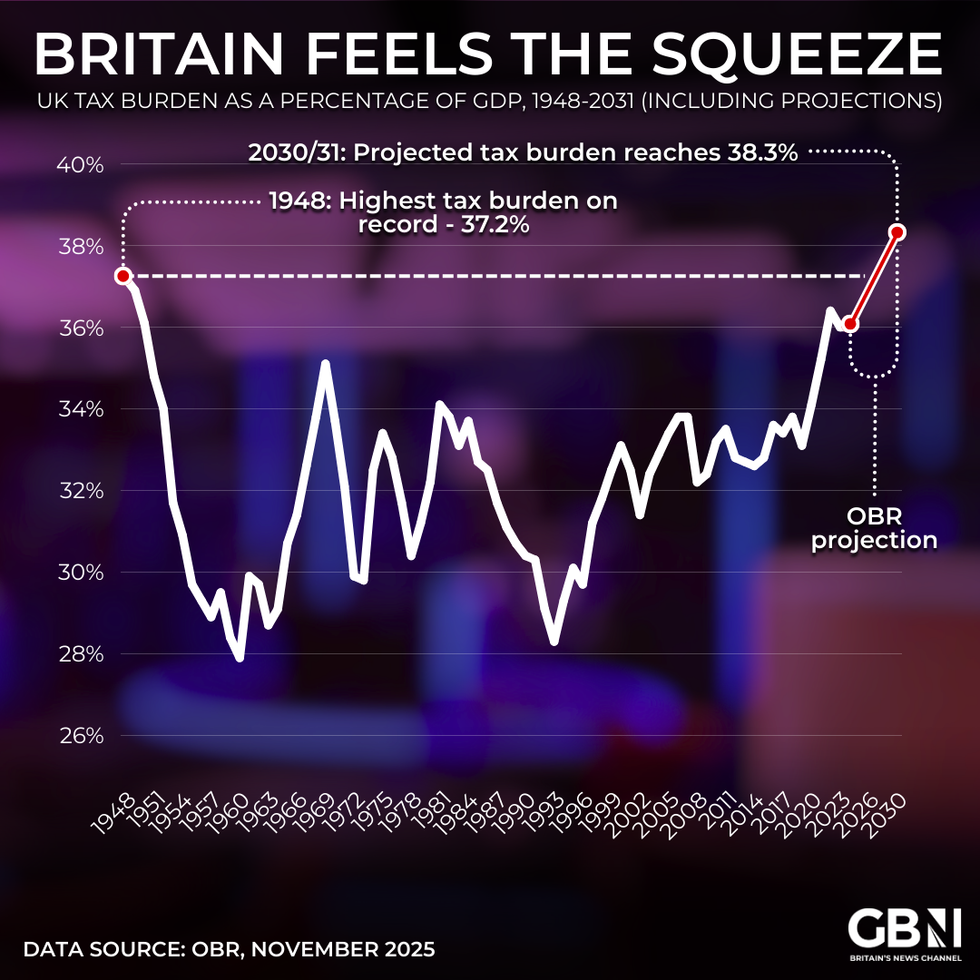

GRAPHED: The UK's tax burden as a percentage of GDP, 1948-2031 | GB NEWS

GRAPHED: The UK's tax burden as a percentage of GDP, 1948-2031 | GB NEWSSpecifically, the Labour Government hailed giving the green light to a third runway at Heathrow airport, investment in Marlow film studios and JP Morgan announcing 8,000 new jobs in the UK.

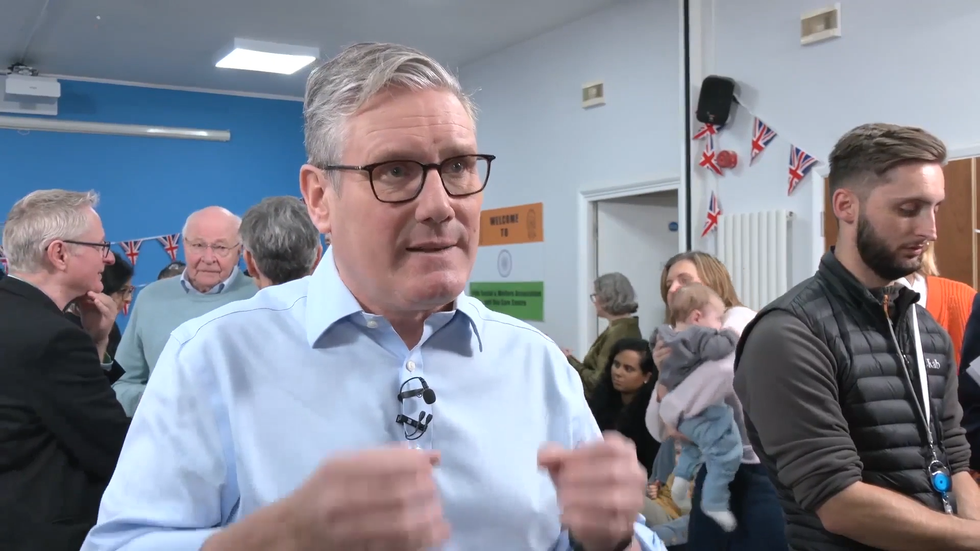

In reaction to the Budget, Prime Minister Keir Starmer said the Budget has "asked everybody to make a contribution" in order to safeguard public services and ease the cost of living.

Mr Starmer added he was "not going to apologise for lifting half a million children out of poverty", as he hit back at claims the measure was announced to appease restive Labour MPs.

One of the most controversial policies announced by the Chancellor was the decision to freeze personal tax thresholds for longer, which critics claim is a stealth tax caused by fiscal drag.

LATEST DEVELOPMENTS

Keir Starmer has defended the Budget

|GB NEWS

The freeze in thresholds will result in 780,000 more basic-rate, 920,000 more higher-rate, and 4,000 more additional-rate income tax payers in 2029/30 as earnings rise over time.

It should be noted that Scotland has a separate income tax system. Britons are pulled into paying 20 per cent income tax if their earnings rise above £12,570, with the 40 per cent rate from £50,271 and the 45 per cent band from £125,140.

Concerningly, the Office for Budget Responsibility downgraded gross domestic product (GDP) growth in 2026 from 1.9 per cent to 1.4 per cent.

The fiscal watchdog estimates that GDP growth in 2027 will fall from 1.8 per cent to 1.5 per cent, in 2028 from 1.7 per cent to 1.5 per cent and in 2029 from 1.8 per cent to 1.5 per cent.

More From GB News