Labour’s Budget 'tax hike is a choice NOT a necessity’, says Katherine Forster

GB NEWS

The Chancellor unveiled a raft of tax hikes that will hit households and businesses over the coming years

Don't Miss

Most Read

Trending on GB News

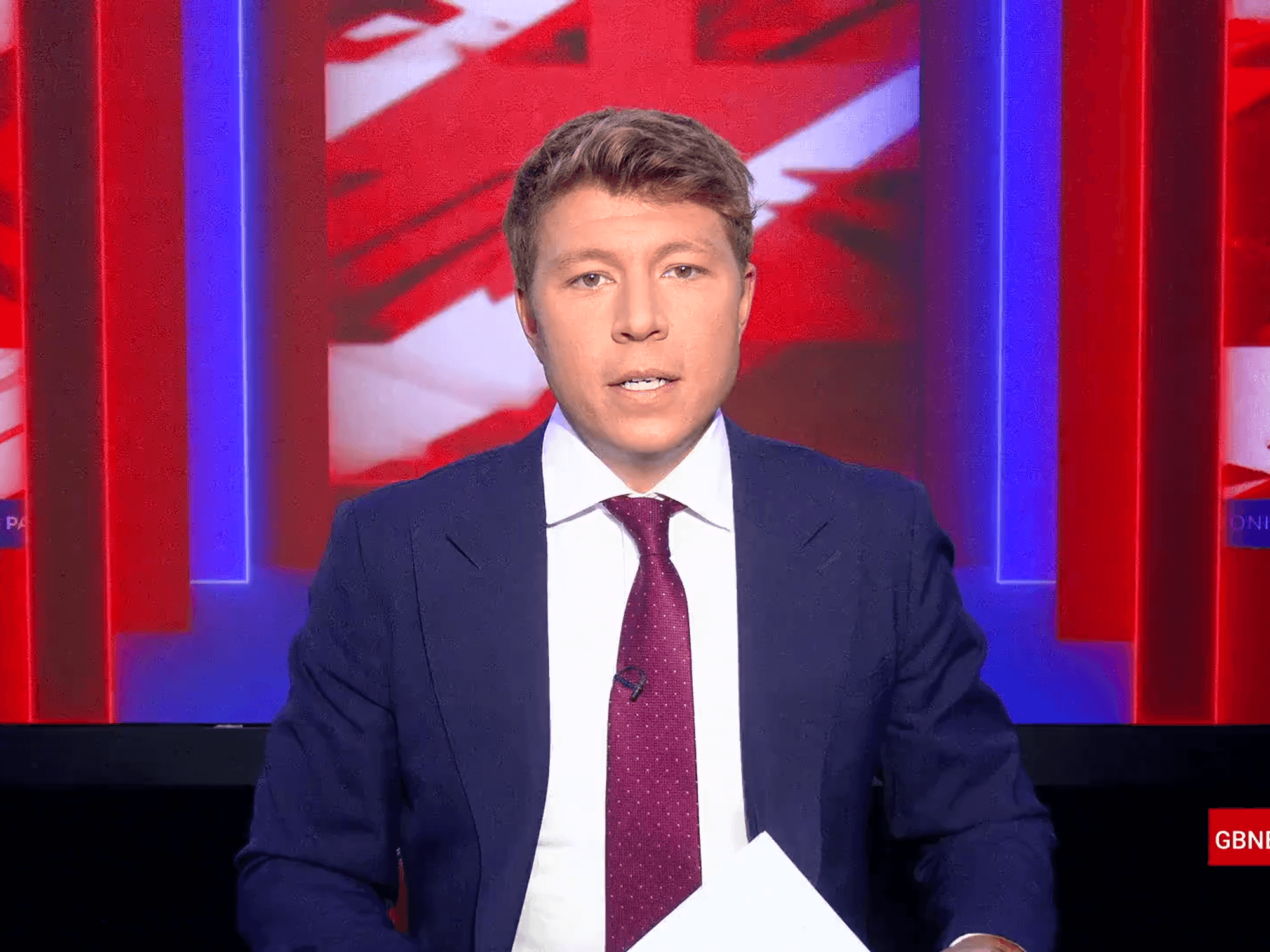

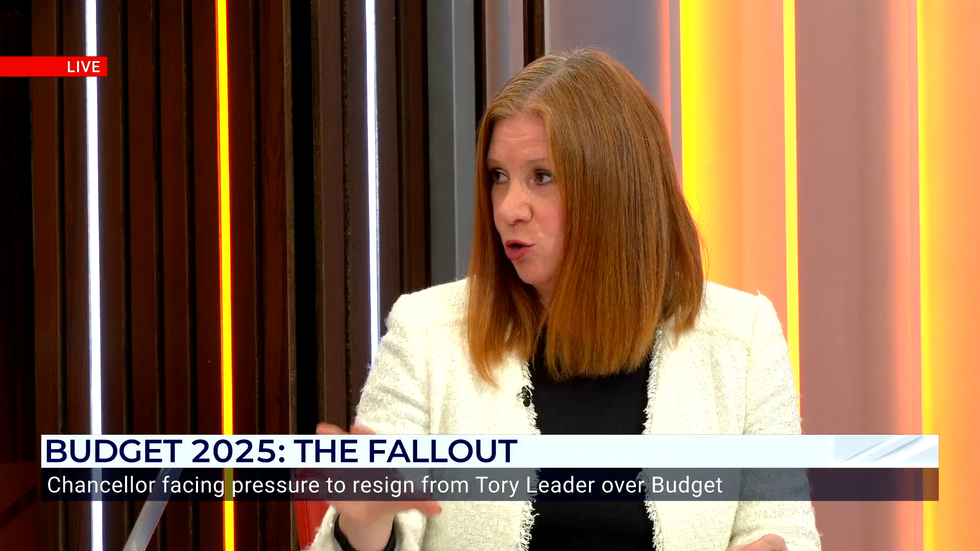

Katherine Forster has delivered a blistering verdict on Labour’s Budget, arguing the Chancellor’s tax hikes were "a choice, not a necessity”.

GB News's political correspondent said Rachel Reeves had been pushed into major U-turns, including scrapping the two-child benefit cap she once called unaffordable, because Labour backbenchers were “so deeply unhappy” with the Government’s direction.

Speaking on The People's Channel, Katherine said: "We know that she's lifted the two child benefit cap in full, something she did not want to do, something she resisted, something that she previously said was unaffordable.

"We know that this Budget has largely been about self-preservation for herself and the Prime Minister, at least through to next May, because Labour MPs were so deeply unhappy.

"Now, I spoke to several yesterday who are feeling much better about the whole thing. But look, this Government promised very limited, I think, about £8.5billion of tax rises before the general election. It was all going to come from growth.

"Then they came in and talked about a Tory black hole, put up taxes said they'd never need to do it again.

"Now £26billion of tax rises. And these are choices because for all the productivity downgrades that she's talking about, in fact, because of inflation and tax receipts, things were better than they had expected.

"The threshold freezes that are going to hit millions of people. And that is a big tax rise. Working people. That's worth about £8billion a year.

Katherine Forster said raising taxes was 'not a necessity'

|GB NEWS

"Now the welfare U-turn of the £5billion they wanted to save. But backbench MPs wouldn't tolerate that's £5billion there. The two child benefits is £3billion.

"Taken together, £8billion. The same as the tax freezes. So you know the Conservatives say this is a budget for Benefit Street. They are taxing workers and that money is going on benefit payments.

" It doesn't stimulate growth. The growth projections are pretty flat. And living standards are barely predicted to move."

In the Budget there was no manifesto-breaking rise in rates of income tax, nor an increase in VAT.

LATEST BUDGET NEWS

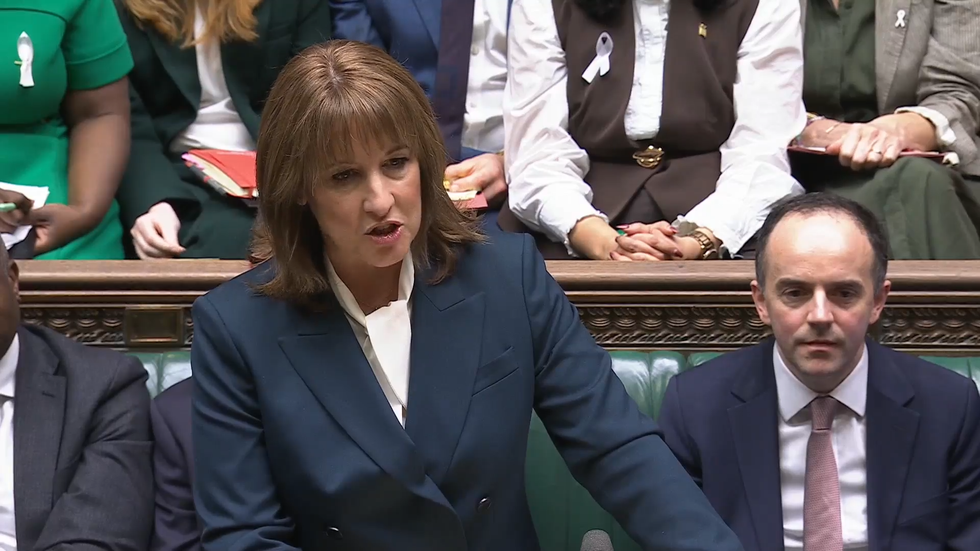

Rachel Reeves unveiled her Budget yesterday

|GB NEWS

However, the Chancellor did unveil a raft of tax hikes that will hit households and businesses over the coming years.

Among the major changes, income tax and National Insurance thresholds will be frozen for another three years, taking the squeeze on earners through to April 2031.

From 2028, owners of high-value homes will face a new annual levy: £2,500 for properties worth over £2million, rising to £7,500 for those above £5 million.

Drivers of electric vehicles will be hit with a new per-mile tax, 3p for EVs and 1.5p for plug-in hybrids, while online betting duty will jump from 15 per cent to 25 per cent.

And a £2,000 cap will be introduced on how much workers can place into pension “salary sacrifice” schemes before triggering National Insurance, ending the current unlimited allowance.

"I know that maintaining these thresholds is a decision that will affect working people, I said that last year and I won't pretend otherwise now," she told MPs.

"I am asking everyone to make a contribution.

"But I can keep that contribution as low as possible because I will make further reforms to our tax system today to make it fairer."