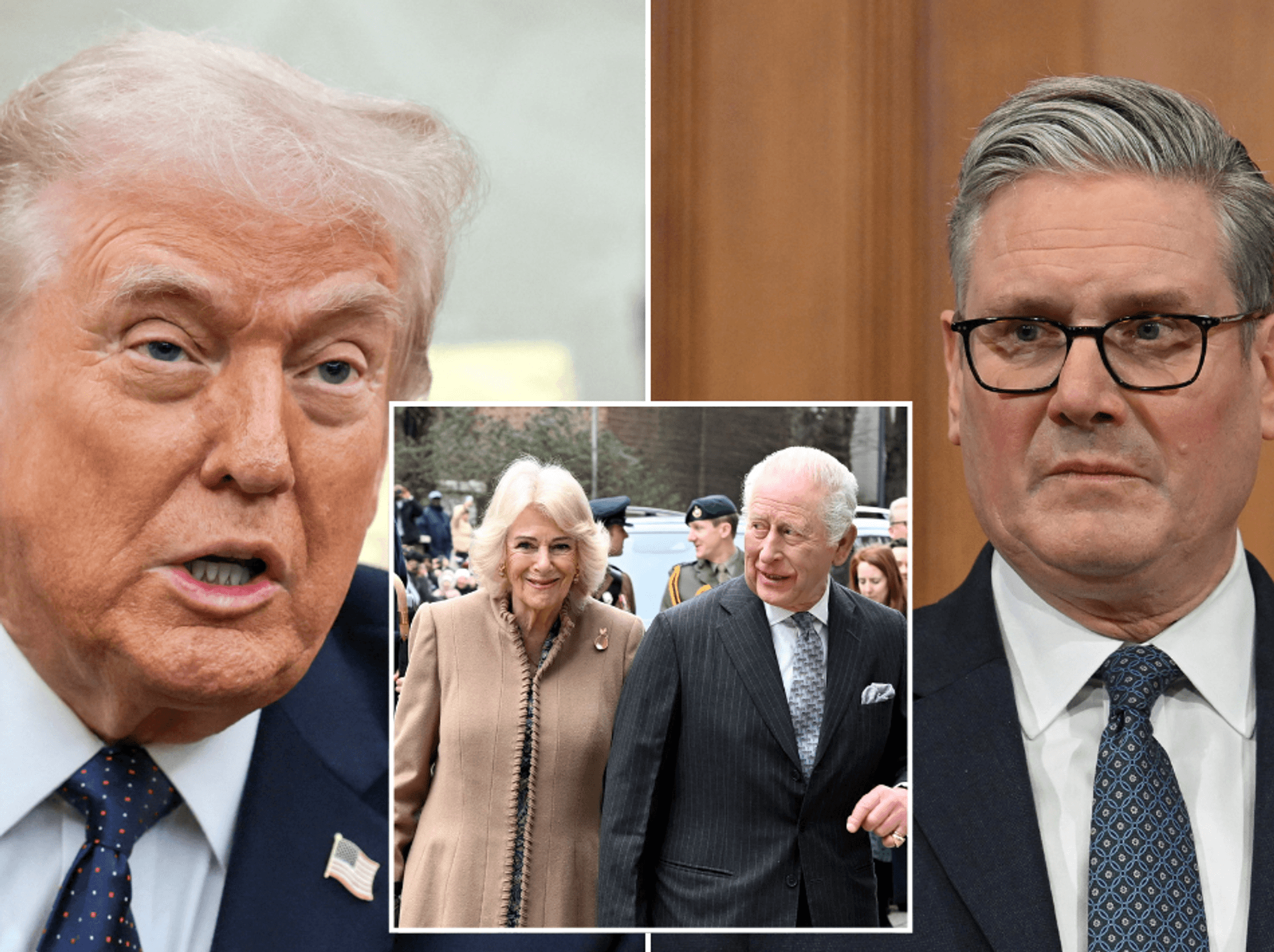

Are you in your 50s or 60s? What I've learnt about Rachel Reeves' pension gamble applies to you - Nigel Nelson

Cheshire pensioners claim the Labour Government 'doesn't care' as pension rates increase |

GB

OPINION: The Chancellor’s scheme will have an impact on everyone who hopes to one day retire

Don't Miss

Most Read

Trending on GB News

If you’re in your 20s you probably won’t read this. In your 30s and 40s you might give it a few paragraphs before giving up.But if you’re in your 50s and 60s you’ll be riveted. And anyone in their 70s and 80s will most likely be across this already.Because this is about what Rachel Reeves plans to do with pensions.

And although you may not give them much thought in your 20s, 30s and 40s, the Chancellor’s scheme will have an impact on everyone who hopes to one day retire with the comfortable nest egg they saved for.

Pension funds are big money. Really big money. They have a staggering £3trillion sloshing about inside them. If that cash was turned into pound coins laid end to end they would stretch 16 million miles to Venus.

The Chancellor’s deal with 17 of the largest workplace pension providers is known as the Mansion House Accord.The idea is that they should invest around five per cent of their money - that’s our life savings - into big British infrastructure projects such as net zero gizmos to boost the economy by around £50billion.

The scheme is voluntary, though there are dark mutterings from the Treasury that it could be made compulsory if investment firms do not comply.

This is reportedly going down badly with Lloyds Bank and its pensions offshoot, Scottish Widows, with 10 million customers, and they have yet to sign the updated accord.

You would need to have been marooned on a remote desert island not to have noticed Scottish Widows founded in 1815, the same year the Duke of Wellington won the Battle of Waterloo.

It has been advertising itself since the 1980s with a stunning young woman dressed in a black hood and cape guaranteed to catch the eye of any age group. Scottish Widows is not against investing in the UK because it already does with 7.6 per cent of its £72billion worth of funds.

Are you in your 50s or 60s? What I've learnt about Rachel Reeves' pension gamble applies to you - Nigel Nelson

|Getty Images

But its CEO, Chirantan Barua, said: “We will continue the investment approach to support our communities where it generates strong returns for pensioners.”

Three cheers for Mr Barua and his widows because this is exactly how we should treat pension funds. Investments should not be based on geography, or even patriotism, but on what is in the best interests of current and future pensioners.

If, and I stress the ‘if’, those interests are best served by investing in Britain, then I’m all for it - along with former pensions minister Baroness Ros Altmann.

She told me: “Countries such as Australia see their pension funds invest far more in their own domestic economies than UK funds do, and I fully support the idea of encouraging more of our pension money to be invested to boost Britain.“Investing in quoted companies, including undervalued investment trusts specialising in alternative energy, could boost growth and deliver good returns.”

I have no doubt that is true. I’m just not so trusting when I’ve seen what governments do with pension funds when they get their hands on them. Take the Mineworkers Pension Scheme.

This scandal dates back to 1994 when British Coal was privatised and ministers agreed the Government would act as guarantor for its pension payouts. Under this arrangement, any future surpluses would be split 50/50 between the Treasury and scheme members.

So far, so good. Not a bad deal for miners to start with because it meant their pensions were safe. But the fund did much better than expected, handing the Treasury a massive source of extra revenue.

And it carried on taking its slice as the decades rolled on, despite MPs imploring it to stop because they’d taken enough. In that time, the Treasury snaffled more than £4billion, money which could have made a huge difference to the lives of retired miners or their widows.

It was this Labour government which put an end to the scam. But it took 30 years to right the wrong..Governments under Tony Blair, Gordon Brown, David Cameron, Theresa May, Boris Johnson and Rishi Sunak did nothing because they wanted the dosh the miners' pension fund was bringing in.

The £50billion Ms Reeves now has in her sights is a tempting target to fill a big financial hole. But we would do well to remember what happened to the miners before offering her our unqualified support.

More From GB News