'Mortgage rates will not go back up and Bank of England will be forced to lower interest rates' says Dr Roger Gewolb

Financial commentator Dr Roger Gewolb shares his predictions for the mortgage market in an exclusive op-ed for GB News members

Don't Miss

Most Read

Mortgage rates will not go back up. That is my prediction.

I believe that the large banks and other mortgage lenders have sussed the Bank of England and realise they are wrong in the way they have handled and continue to administer monetary policy (interest rates).

They may not all agree with me that Andrew Bailey and his mostly stubborn Monetary Policy Committee colleagues were terribly wrong to raise interest rates 14 consecutive times in a very short period to combat our mainly non-consumer-driven inflation, which always falls by itself.

But, they probably have observed that raising interest rates actually inflates and prolongs our kind of inflation.

They certainly will have grasped that continuing to now keep interest rates where they are when inflation has fallen so significantly is a huge mistake.

Do you have a money story you’d like to share? Get in touch by emailing money@gbnews.uk.

Dr Roger Gewolb has shared his mortgage rates predictions

|GETTY | GB NEWS

It's a mistake that is damaging their own market, as well as the property market, the rental market, the Bank of Mum and Dad and the ability of young people and other first-time buyers to ever get on the property ladder.

More than half a million businesses are reputed to be ready to go to the wall and mortgage arrears have risen by over 50 per cent.

And it is all so totally unnecessary, to wreck our economy like this, when they should have simply left interest rates alone and allowed this cost-push inflation, as it is called, to run itself out, as previous Bank of England administrations have done.

And, it is nothing short of pathetic that Rishi Sunak and Jeremy Hunt did nothing about this, and are even now crowing about and taking credit for the falling inflation.

In a word, then, I think the mortgage market has had quite enough and has pretty much discounted what the Bank thinks, and has to say.

Especially since the House of Lords Economic Affairs Committee criticised the Bank for its flawed modelling and forecasting, the way it has handled inflation, and its groupthink with no diversity of opinion allowed, I believe the mortgage lenders are going in their own direction.

That direction is to keep their market healthy.

LATEST DEVELOPMENTS:

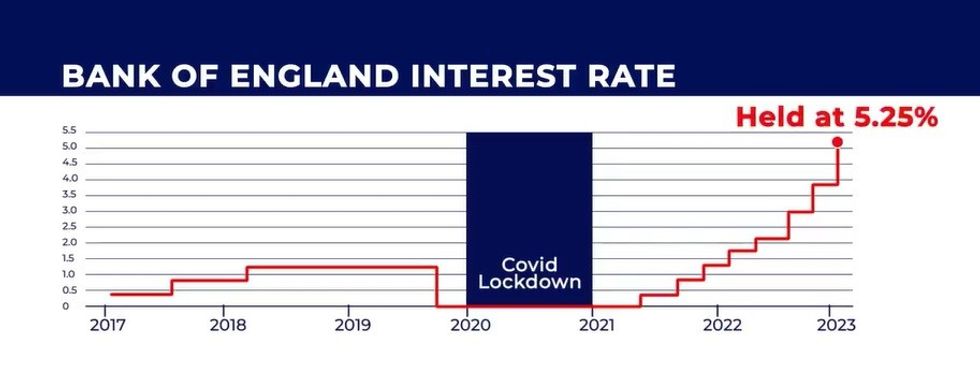

The Bank of England has continued to hold the Base Rate at 5.25 per cent since August 2023

|GB NEWS

They saw the damage done to their business volumes by the interest rate hikes, and, after a period, realised what was happening and started dropping rates on their own.

Now they are even offering 99 per cent mortgages to first-time buyers, to keep that sector buoyant, and so that young people can indeed begin to get on the property ladder.

My prediction is that these patterns will continue, and the Bank will finally be forced to lower interest rates, probably in Spring, and the mortgage lenders will pretty much keep their rates where they are now, maybe even lowering them a bit.