Bank of England 'must eliminate the groupthink and cut interest rates immediately'

Former Bank of England adviser Dr Roger Gewolb explains why he argued against the interest rate rises and is calling for an immediate cut to the base rate in an exclusive op-ed for GB News members

Don't Miss

Most Read

We are living in an upside-down world. An emperor’s new clothes world, where fundamental economic and money realities are not only ignored, but are turned upside-down for political purposes.

A world where regulators and politicians on all sides are stupidly or purposely ignoring - it’s hard to tell which - the fact that inflation in the UK is not being driven down, but up, by the cost of money.

Andrew Bailey and his groupthink colleagues at the Bank of England have set the scene for this, and they have been aided and abetted in driving this mythology to its current heights by Rishi Sunak and Jeremy Hunt.

And even the Labour opposition and other parties are going along with it.

They are all congratulating themselves that they are finally curbing inflation and will soon reach the two per cent target.

But, it is nothing to do with them, and nothing to do with the 14 interest rate rises foisted on us by the Bank.

And, in deciding to continue to hold interest rates at their current level last Thursday, even though inflation continues to fall, the Baileyoceros and his thick-skinned colleagues who will listen to no one, not even the House of Lords, have further wrecked our economy unnecessarily.

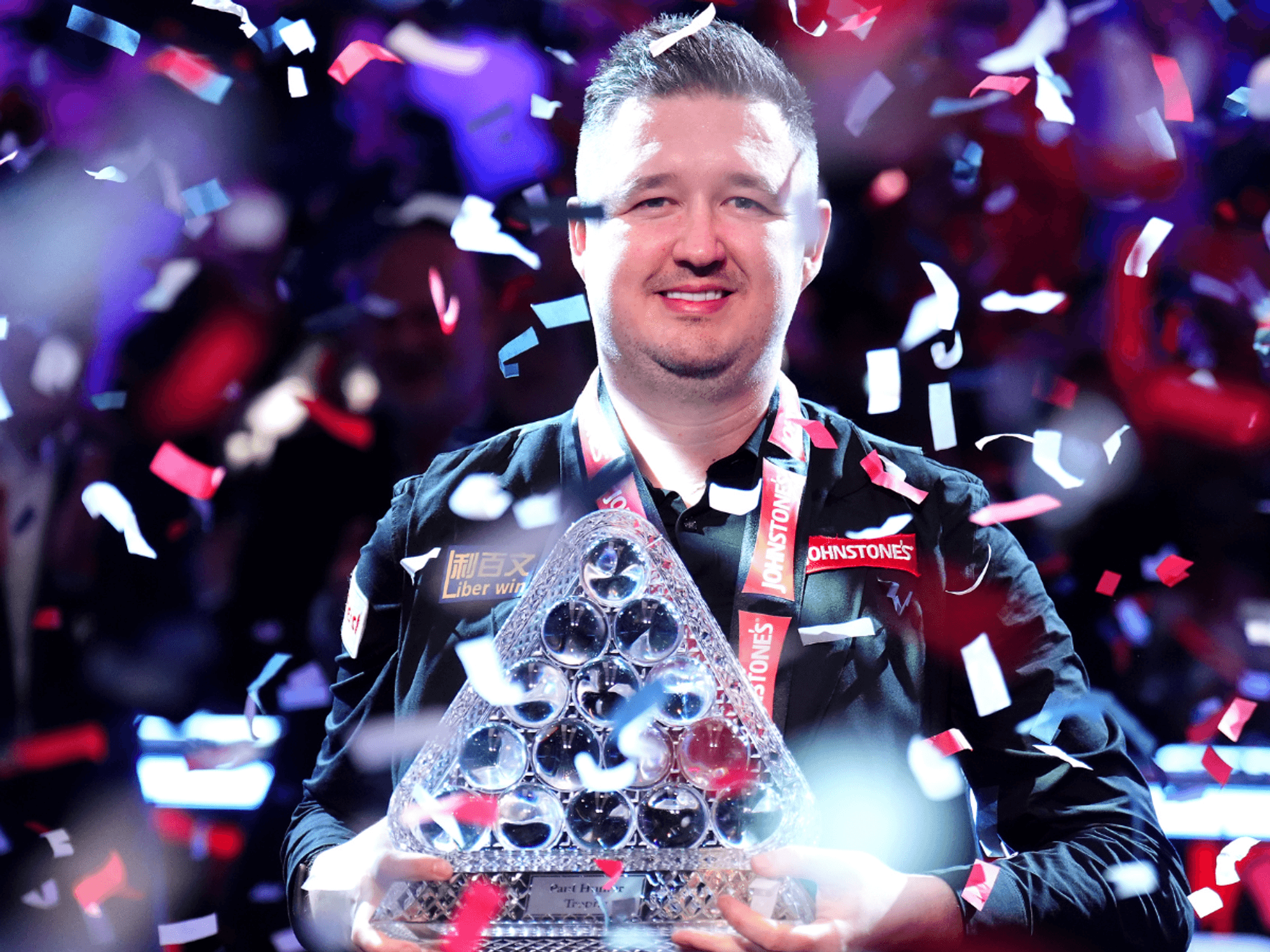

Dr Roger Gewolb (right) is calling for "immediate" interest rate cuts

|PA | GB NEWS

This is because we have inflation that is driven mainly by food and energy, materials and services prices.

It’s called cost–push inflation and it is simply not consumer-driven.

Raising the cost of money for consumers and crushing British businesses and households as this government (and the ever-silent Opposition) and the Bank have done (plus adding the highest taxation in recent history to the burden) does nothing whatsoever to curb inflation.

In fact, it has paradoxically inflated the inflation and prolonged the time before the cost-push prices of all these materials and services over which consumers have no control fall by themselves, as they always do.

I’ve been predicting for over a year and a half, since the very first interest rate hike, that raising the cost of money was the wrong thing to do, and I’ve not been alone.

I also predicted that the trio of Bailey, Hunt, and Sunak would, of course claim credit for the fall when inflation did finally start to drop, which they have, constantly.

Forcing interest rates to their current level (5.25 per cent today is equivalent to roughly a 20 per cent interest rate in the 1980s) and adding to that the massive amount of Quantitative Easing (printing money) that these unqualified people dumped into the system was like emptying an aeroplane tanker full of oil onto a raging Californian forest fire.

Bailey’s interest rates won’t stop the Houthis.

What is the reason for this? It is partly that Bailey and his colleagues feel that they must slavishly follow the United States, where their central bank, the Federal Reserve, controls monetary policy (interest rates) and where they agreed the day before to hold them steady.

However, the US is a totally different situation than ours.

Firstly, they have their own energy supply. They are not hostage to a system like ours where we must buy so much from the international markets, often manipulated by Putin.

Secondly, they have a giant cash mountain of almost $2trillion, saved during the pandemic and now being spent by consumers with alacrity.

We, on the other hand, still have many tens of millions of people having to decide between heating and eating. And it gets worse here every day, amidst some green shoots, of course, but in no way the result of interest rate hikes, taxation or most of the actions of this government of ours.

The second cause is the influence of the left-leaning Treasury officials on the Bank, Bailey and his sycophantic group, the Bank’s Monetary Policy Committee, saw eight out of nine members vote not to begin to lower rates last week.

Except for Ms Dingra, they all appear to be cut from the same cloth, and there has even been a recent appointment of another Bailey groupthink type.

There used to be diversity, and I mean of opinion and views, not gender or race, as it appears to be interpreted on the MPC, but that is long gone, and there is no one to challenge Bailey who himself has a long-standing reputation for being slow to act.

It frankly makes me despair, and rather livid, that a tiny group of misguided people can destroy an entire country’s economy unnecessarily and wreck so many lives and livelihoods, and then, because it is so robust and finally starts to move back in the right directions, claim credit for that but not the original foul deed.

But, I imagine that is not such a rare thing, especially in government and regulatory circles; in commerce, I believe such actions would suffer a harsher fate no doubt.

The Bank of England must now start to reduce interest rates immediately, and they must eliminate the groupthink, and be a truly independent organisation, controlling how monetary policy is formulated by all views being considered with equal weight.

Even the House of Lords Economic Affairs Committee criticised the Bank’s financial modelling and forecasting, and handling of inflation, but there has been no real movement towards amelioration.

They still haven’t even brought in Andy Haldane, the retired 30-year Chief Economist of the Bank, to check on their models, probably because he is against the interest rate rises.

Instead, they brought in a Bailey clone from America, who is due to report soon.

What a surprise that will undoubtedly be.

LATEST DEVELOPMENTS:

Economists believe that Andrew Bailey and Jeremy Hunt (who has never worked a day in his life in any financial organisation but runs this nation’s finances) must either start to reduce interest rates and taxation and take their foot off the throats of consumers and businesses immediately, and appoint members to the MPC who think wildly differently than they do, or resign.

I should finish by pointing out that my regular flow of conspiracy theory messages has increased dramatically.

By this, I am referring to the messages I get saying, “Dr Roger, wake up and smell the coffee. Absolutely no one can be this stupid.“

And the quality of writers has risen from conspiracy nutters to CEOs and professional people such as lawyers and accountants.

And they all point to the World Economic Forum in Davos, or the Illuminati, or Lord knows who, that has some plot and is in the process of destroying us and our livelihoods in order to take absolute control of our futures and have us in rented accommodation with a digital central bank currency, completely beholden to and controlled by them.

I’m not buying that, but it does show that our government and regulators are scaring the wits out of many ordinary folk whilst allowing them to continue to suffer.

My prediction has always been that this is not about taking us over and controlling us like 1984, but to build up a huge war chest to save their skins with giant tax cuts just before the next general election.

On the other hand, that is simply so obvious that perhaps people actually can be that stupid.