Keir Starmer's fatal error was to take a scalpel to the benefits bill instead of a sledgehammer - Miriam Cates

Patrick Christys reacts to reports of a 'huge rebellion' from Labour MPs over welfare reforms, which he says marks the 'beginning of the end for Keir Starmer' |

GB

OPINION: The Prime Minister should have made a more compelling case for total reform

Don't Miss

Most Read

Trending on GB News

Sir Keir Starmer’s backbenchers are revolting. More than 130 Labour MPs have signed an amendment to the Universal Credit and Personal Independence Payments Bill in an attempt to force the Prime Minister to drop his planned cuts to disability benefits.

The crunch vote comes next week and, despite Labour’s huge Parliamentary majority, the rebels have sufficient numbers to defeat the government.

Labour bosses are so anxious about the prospect of defeat that they are starting to talk up the issue as a ‘confidence vote’.

This would mean that any MP who failed to vote for the benefits cuts could lose the Labour whip, forfeiting the chance to stand again at the next election. If the Government can’t persuade enough dissenters to back down, the benefit cuts may have to be watered down, or the vote delayed.

The Labour Party has a historic association with the welfare state. The state pension was introduced in 1908, just eight years after the Party won its first seat in Parliament.

In 1923, Labour formed its first government under Prime Minister Ramsay Macdonald. This minority administration was short-lived—lasting just 11 months—but nevertheless counted as one of its major achievements the expansion of unemployment benefits entitlements to include those who had not made contributions.

During the Second World War, plans for the modern welfare state were drawn up by Liberal MP William Beveridge, but it was Clement Attlee’s Labour Government that brought it into being in 1945.

The Labour governments of the 1960s and 70s continued to refine the welfare state, and under the Blair government (1997 – 2010), state intervention ballooned, with the introduction of the national minimum wage, working tax credits, and even non-means-tested cash payments of £190 to all pregnant women.

Keir Starmer's fatal error was to take a scalpel to the benefits bill instead of a sledgehammer - Miriam Cates

|Getty Images

The Labour Party and the welfare state are joined at the hip. It is therefore unsurprising that Labour MPs – many of whom came of age under the Conservative ‘austerity’ governments – are viscerally opposed to voting for benefit reductions.

Such fierce opposition to relatively small-scale cuts – just £5billion a year out of a total welfare bill of £313billion - raises the question as to whether Labour MPs think that the cost of the welfare state can continue to grow indefinitely.

That is certainly where we’re headed. Spending on health and disability benefits is forecast to rise from £75billion to £100bn in just the next five years.

Expenditure on pensioner benefits will increase from 15 per cent of national income today to 21 per cent in 2050.

Perhaps the Labour rebels agree in principle that the size of the welfare state must be reduced, but believe that disability benefits should be protected from cuts.

Yet these are the same MPs who forced a U-turn on Rachel Reeves’ decision to means-test the winter fuel allowance for state pensioners, a decision that would have saved just £1.5 billion a year.

It’s not unreasonable to assume that Labour backbenchers would refuse to vote for cuts to Universal Credit, the State Pension or the NHS.

We can therefore conclude that Labour MPs believe welfare should continue to expand for eternity, like the known universe in the wake of the Big Bang. This position is, in a word, insane.

Even if our economy were more productive, even if the pandemic and the Ukraine war never happened, our economic outlook would still be dire.

The ratio of working people to non-working people in Britain has been shrinking since the 1970s.This is mostly due to an ageing population - there are now just three workers supporting each pensioner compared to 4.5 in 1970 - but in recent years the shift has been exacerbated by the growing numbers of people claiming disability benefits with no requirement to work.

The current trajectory of the welfare state is unaffordable. Without drastic reforms, welfare spending will bankrupt the UK in the next few decades.

But perhaps the Prime Minister’s mistake was to be insufficiently radical; the cuts the government is proposing are just a ‘salami slicing’ of the benefits bill, inflicting considerable political pain for negligible savings overall.

Had Starmer made a more compelling case for total reform and demonstrated the significant savings this would generate, perhaps more Labour MPs would have bought into the vision. Or maybe pigs might fly.

Back in the real world, many members of the Labour party think that ‘progressive’ tax increases can fund our ballooning welfare bill. But they’re wrong; Britain’s wealth creators have already been squeezed dry by record levels of taxation.

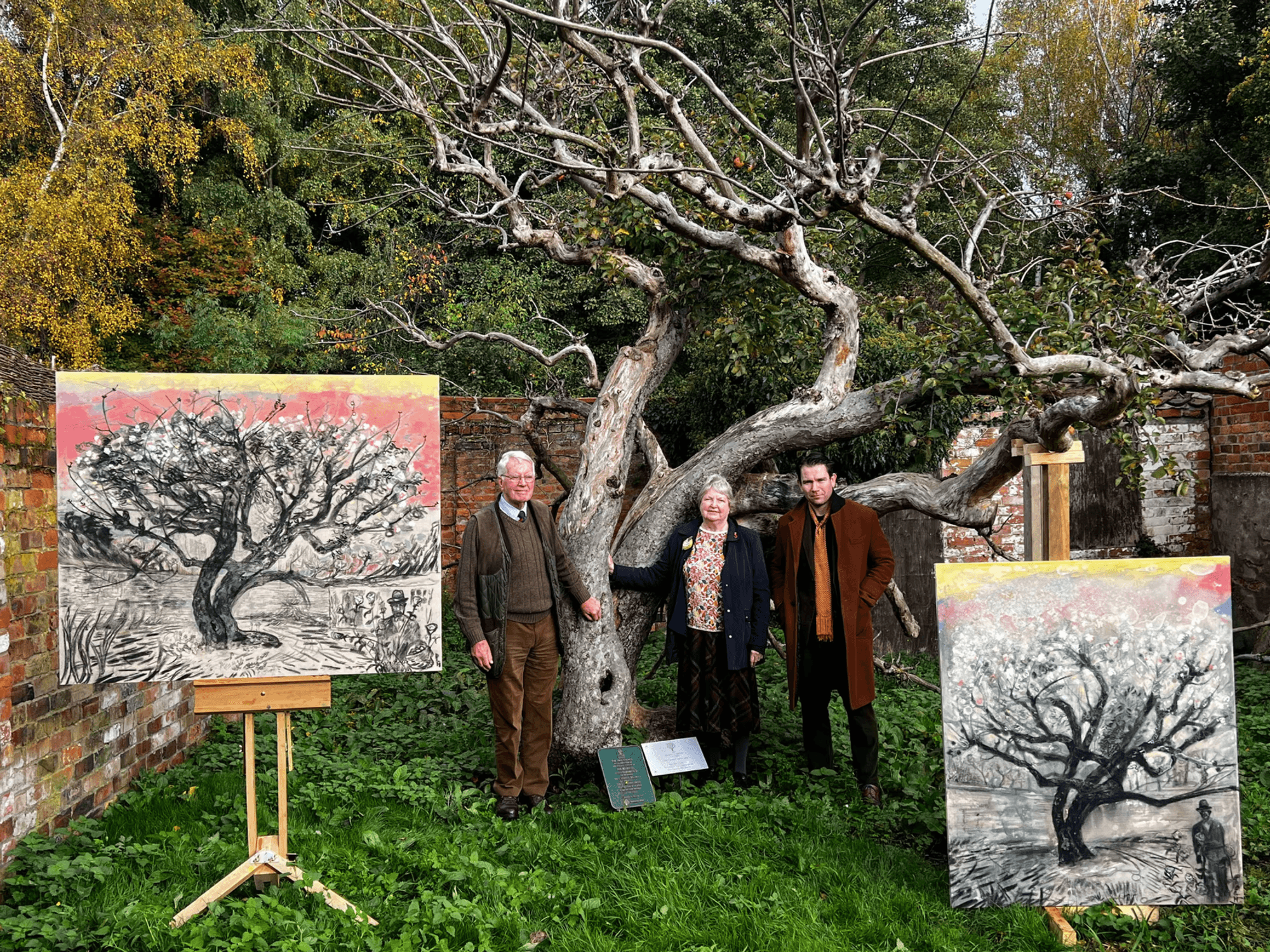

Had Starmer made a more compelling case for total reform, perhaps more Labour MPs would have bought into the vision, writes Miriam Cates

| Keir Starmer faces mega-rebellion as 100 Labour MPs plot to kill PM's welfare billIt is thought that as many as 16,500 millionaires will leave Britain this year, and with so many individuals now caught in the higher rate of tax, even people in ordinary jobs are disincentivised to work harder.

The socialists ran out of other people’s money a long time ago, and we are now living on debt – nearly £3trillion of it - robbing future generations to pay for our welfare habit.

It is hard to imagine a future without the welfare state as we know it. There is no longer anyone alive who can remember a time before the state pension, and you’d have to be over 100 years old to have lived any of your adult life without the NHS. Free healthcare and a welfare safety net have become inseparable from our national identity.

But there was a time when the state had a much smaller role in our lives. Before the 1940s, the main roles of government were to uphold law and order, provide for national security and ensure sufficient infrastructure for the needs of citizens and businesses.

The responsibility for caring for the old, the young, the vulnerable, and the jobless lay with families, communities and the church.

Yet now those responsibilities have been fully socialised and transferred to the state. The impact on public spending has been profound. In 1900, state spending accounted for just 10 per cent of GDP. Today, that figure has more than quadrupled to 45 per cent.

Many on the left cling to the post-war welfare model like an addiction, believing that we’ll be okay if we can just keep getting our hands on more of it. But what if a bloated welfare system is the cause of our economic problems, rather than the solution?

In theory, using general taxation to pay an income for those who can’t support themselves sounds like a good and generous idea. But in practice, the provision of welfare has greatly reduced the incentive to care for or be cared for by our own families and communities.

People no longer have to support their elderly parents, because their elderly parents’ pensions, health and care costs are paid for by the state. But those who want to care for their relatives can’t afford to do so, because so much money is taken from them in taxation to pay for elderly people they’ve never met.

LATEST MEMBERSHIP DEVELOPMENTS

- Get FIVE free entries into The Great British Giveaway when you become a GBN member in June

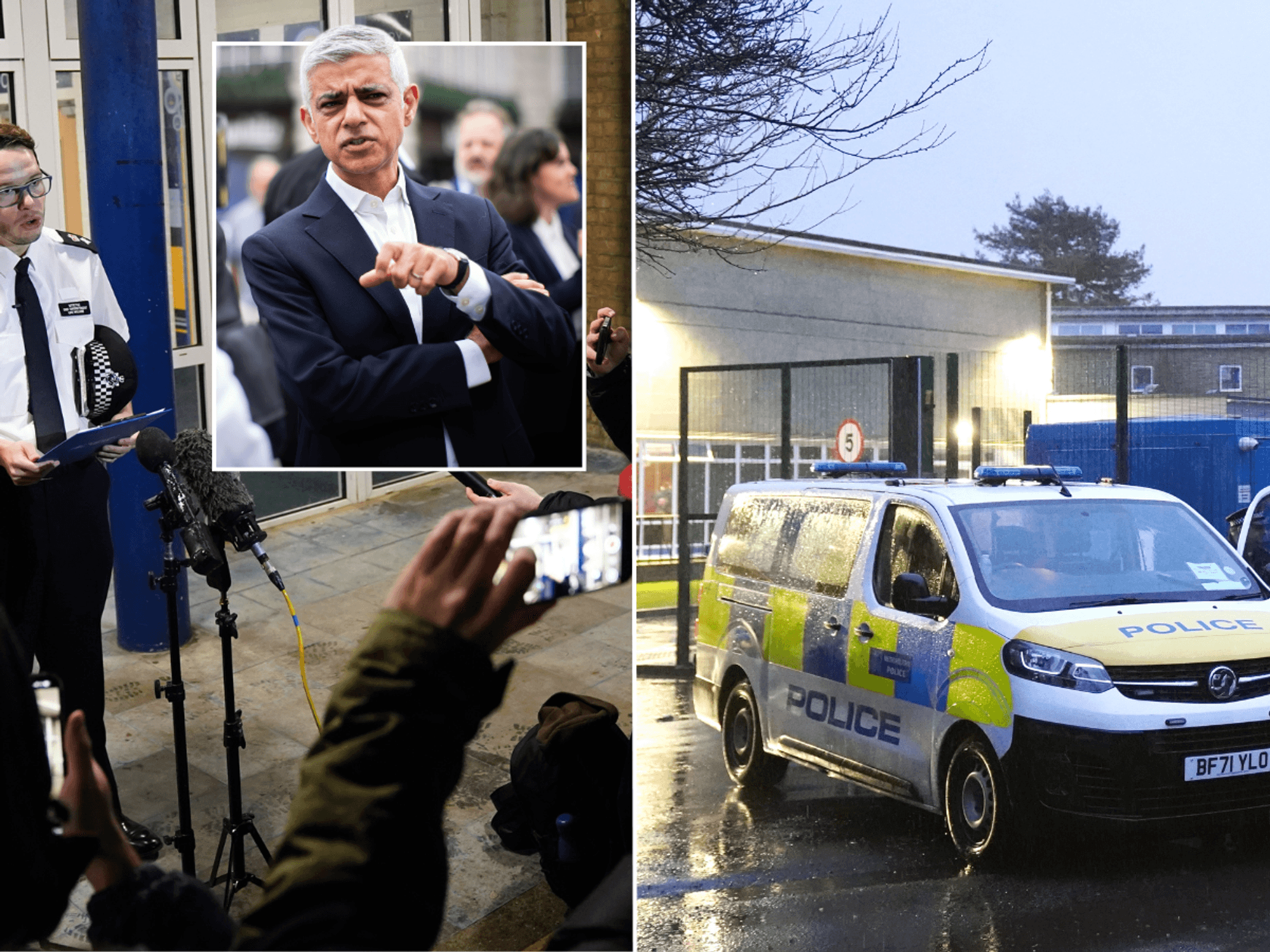

- Sadiq Khan’s mask has finally slipped — why hasn't Reform called it out? I'm genuinely shocked - Susan Hall

- MAPPED: The six flat tax hotspots that inspired Nigel Farage's 'Robin Hood' non-dom plan - will YOU benefit?

If you have to pay the full costs of raising children but never reap any economic benefits (because all the tax your children pay goes into welfare for others), then why have children? Why not rely on other people’s children to support you in retirement? Why not claim sickness benefits if it’s someone else’s family that has to pay to support you?

And why lose weight and do more exercise if strangers will pay the full costs of your healthcare? If Britons had more children, if more people cared for their elderly relatives, if more of us looked after our health and fewer people claimed sickness benefits, then the welfare state might be sustainable. But the welfare system itself has reduced the incentives for behaving responsibly.

It’s a vicious cycle. So what’s the answer? We need radical reform, but it has to be achieved in a way that does not pull the rug from under those who genuinely depend on welfare right now, such as state pensioners, single parents and the physically disabled.

These people must be ‘grandfathered’ in recognition that it is the system itself that has trapped them in dependence on the state. But for the emerging generation, we need a new model, one that uses tax incentives to encourage families to form and endure and to care for one another.

We should expand the workplace pension scheme for those entering the work market, but reward young people with lower taxes to compensate for the fact that they will never be able to draw a state pension. And, while emergency healthcare should remain free for all, we must explore a hybrid system with insurance schemes that reward people for taking care of their health.

None of us are independent beings; we all rely on others to a greater or lesser extent at different points in our lives. But society works best when we rely on our families and communities, and not the faceless taxpayer.

When dependence is based on relationships with our families rather than a contract with the state, we are far more likely both to receive better care and to behave responsibly.

Whether the government wins or loses its benefits vote next week, the welfare state will remain on an unaffordable trajectory. What’s needed is an honest debate about the role of the government and political leaders who can deliver total reform of the welfare state.

More From GB News