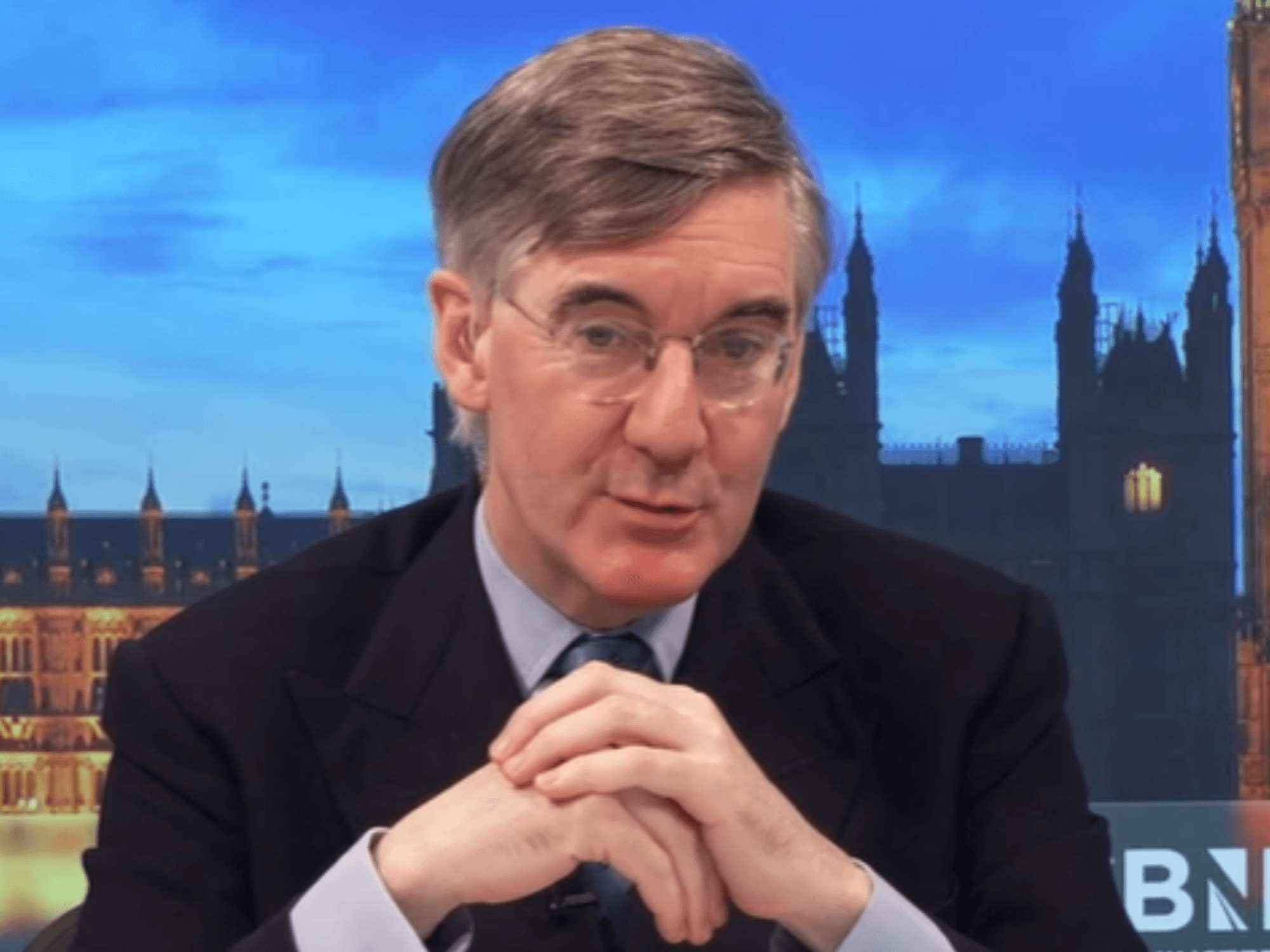

Stop taxing people out of Britain, otherwise we will pay the price for Labour’s socialist agenda, says Jacob Rees-Mogg

Jacob Rees Mogg slams Labour as record numbers of wealthy taxpayers flee the country and stunt wealth creation

|GB NEWS

'Young people with ambition and potential are leaving Britain in record numbers, as living costs continue to rise, home ownership becomes further from reality every day, and taxes increasing inexorably'

Don't Miss

Most Read

Trending on GB News

Britain’s wealth exodus is getting worse, the great sucking sound of wealth departing can be heard all the way to Dubai, and the economic impact is going to get worse.

Two days before the Budget, the Business Secretary Peter Kyle has admitted that tax changes have prompted wealthy entrepreneurs to leave the country.

He said: "Some of the decisions we’ve made… caused some people to feel the need to leave."

This is an admission of a failed economic policy.

TRENDING

Stories

Videos

Your Say

An acknowledgement that Labour’s tax rises and ending of non-doms are driving the rich out of Britain, taking their money with them.

Lakshmi Mittal, a former Labour donor and a generous benefactor of Great Ormond Street Hospital, having donated £15million in 2008, worth £28billion has quit Britain after Labour’s crackdown on non-doms.

Charlie Mullins, the founder of Pimlico Plumbers, has publicly discussed his decision to move abroad after Labour’s tax burden made it too expensive to stay here.

This is what Labour fails to recognise - wealth means mobility.

Jacob Rees-Mogg slams Labour as record numbers of wealthy taxpayers flee the country and stunt wealth creation

|GB NEWS

People with money can leave as and when they choose, taking their tax contributions, their investments and their businesses with them.

Increasing taxes on wealth does not increase revenue - it depletes it. Arthur Laffer is right.

The Business Secretary insists that the non-dom exiles are being replaced by people coming here because of other attractive opportunities such as investment in artificial intelligence and funding for startups.

But it is not just the ultra-wealthy that Labour’s tax burden is driving away. Britain is suffering from a chronic brain drain.

Young people with ambition and potential are leaving Britain in record numbers, as living costs continue to rise, home ownership becomes further from reality every day, and taxes increasing inexorably, making the prospect of living, investing and building a life in Britain unappealing.

According to data from the Office for National Statistics 257,000 Britons emigrated in the year ending December 2024 - more than three times the previous estimates of 77,000.

The Budget coming up on Wednesday is expected to include more wealth taxes, including a new mansion tax on properties worth more than £2million.

Meanwhile, welfare spending is expected to rise by £15billion, the strivers pay for the skivers.

Labour’s left-wing economics are crippling the economy. Increasing taxes to fund huge spending plans for those out of work, whilst introducing ideological attacks on wealth creation is not going to harm the rich.

It will harm those who rely on jobs, on reasonable living costs and on public services.

The Chancellor and the Business Secretary must address and rectify Britain’s wealth exodus. Stop taxing people out of Britain, and change course to bring in measures that encourage wealth creation and enterprise.

Otherwise, the British people will pay the price for Labour’s socialist agenda.

More From GB News