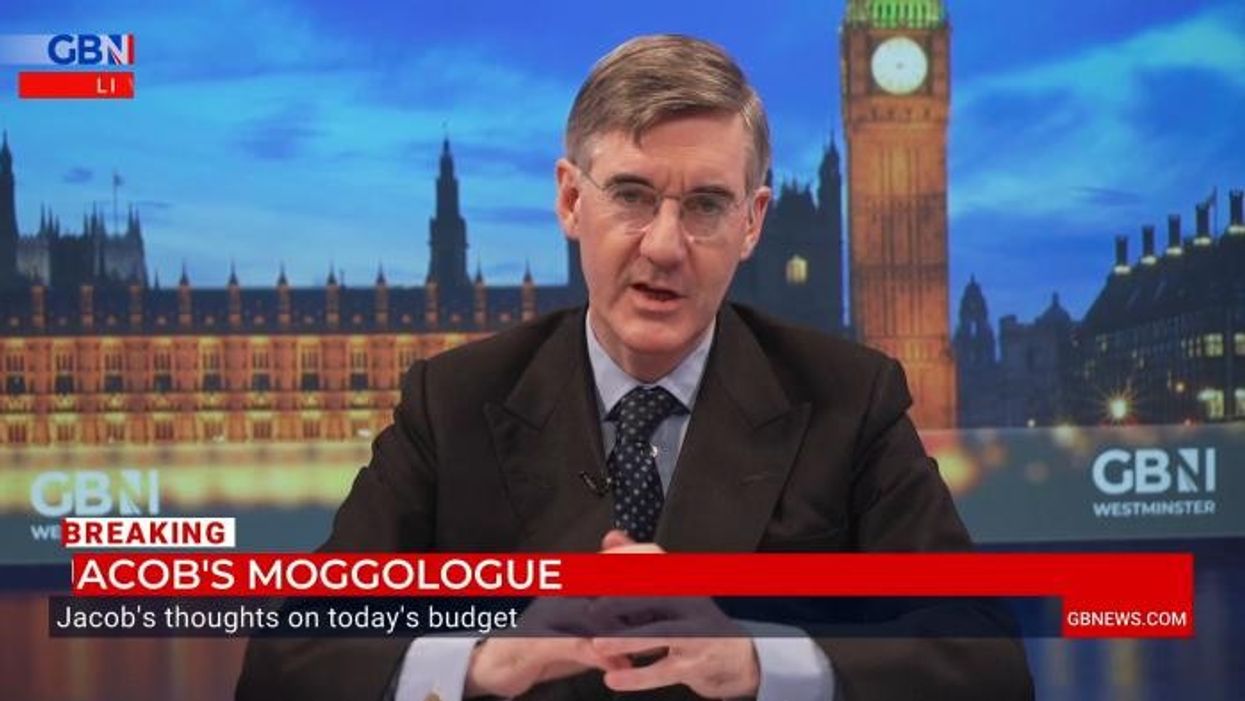

Until we look at fundamental reform, nickel and diming won't make a lot of difference, says Jacob Rees-Mogg

I'm very much in favour of the VAT threshold being increased so that small businesses have an opportunity to grow

Don't Miss

Most Read

My test for today's Budget was could it have been delivered by Rachel Reeves?

Was there really going to be an important difference between what a brave, bold Conservative Chancellor would do and what a cautious, brown eyed Socialist Chancellor would do?

And yes, there was one important difference. That was the cut in National Insurance, the 2 per cent off, reducing it to 8 per cent and with the implication that it may be abolished altogether, which is a really very important implication and would be a fundamental change and improvement in our tax system.

But overall the budget was constrained by the way we now construct economic policy.

Jacob Rees-Mogg reacts to Jeremy Hunt's Spring Budget

|GB News

We have deified the OBR, the Office of Budget Responsibility, which is unfortunately useless.

It gets all its forecasts wrong, as indeed the Chancellor pointed out in his Budget statement and Sir David Davis magisterially explained in his speech on the Budget later.

And that means that you're making these decisions on forecasts that will turn out not to be true and you end up making little decisions thinking the forecasts are right, when actually the little decisions don't really matter.

So I'm very much in favour of the VAT threshold being increased so that small businesses have an opportunity to grow.

Businesses up and down the country turn away opportunities when it gets to February and March because they don't want to go over the VAT threshold.

Taking it up to £90,000 was a good start. It cost £150million but that out of a 1.216 trillion expenditure budget is a rounding error to 0.01 per cent. It doesn't matter.

And the idea that you can make these very precise forecasts and add up little bits here and little bits there and then say we are meeting our rules actually doesn't work. It doesn't make any sense.

You need to look at the big picture and try and get fundamental reform taking into account where you're starting from and where you're starting from is that we are spending too much, 44 and a half per cent of GDP for 2023-2024, the £1.216 billion that I mentioned is more than the country can sensibly afford and it's why we've got taxation at the highest level since 1948.

It isn't going to exceed it. So we won't be able to say it's the highest taxation level in the post war period, but it's not much below.

And until we look at fundamental reform, what we do, nickel and diming, won't make a lot of difference. What we need is economic growth because if you can grow the pie, and this is what Nigel Lawson did, if you can grow the pie, then you have more money to spend on public services and to apply where you want.

But you can also reduce the tax burden. Now, the tax burden is best applied if it's applied sensibly and uniformly. And what I don't like about this budget is the endless tinkering, the little bits here and the little bit there.

So yes, I was pleased that capital gains tax on property, from which I may marginally benefit myself, just so that, you know, went down and that the Treasury and the OBR had agreed that there was a laugher effect and that it would raise more money, but why not take it down to 20 per cent? So you only have one rate of CGT. Why carry on with this muddling?

The tourism tax that we still have would boost the economy if we got rid of it. The silliness over non-doms, non-doms contribute to the economy. They should be welcome. When we've got the OBR forecasting 350,000 immigrants coming in every year, and many of whom make a negligible economic contribution, making it harder for non-doms, who in very small numbers make a very big contribution, is really bad policy.

And then we've got all these costs of net zero and the high cost of energy and entries in the government accounts that are bizarre. They have revenues of 11 billion for environmental charges and costs of 11 billion for environmental charges. What are we doing? Why is the government charging itself this sort of money? What is the point?

We need to have a pro growth economic policy that has simple, straightforward taxation that people can understand. Back to the Lawson model. We need to have cheap energy. We need to control government expenditure. We must get more productivity out of the public sector, which is lower now than it was pre the pandemic and has not increased since 1997. Till we get all this right, the budgets will essentially be tinkering. And yes, there was one thing that Rachel Reeves wouldn't have done, but only the one thing.