Labour's VAT raid on religious private schools is NOT discriminatory, Court of Appeal told

Christian and Jewish families argue the charges are a breach of human rights

Don't Miss

Most Read

Trending on GB News

The Labour Government has told a group of Christian and Jewish families they are not being discriminated against during a Court of Appeal hearing about charging VAT on private schools.

Evangelical Christian and Charedi Jewish families argue the charges are a breach of their human rights.

They believe the tax, which Education Secretary Bridget Phillipson confirmed in 2024, is "discrimination" and interferes with their "right to education".

Their claims were initially dismissed by the High Court in June last year, but they are now appealing that decision.

However, lawyers acting on behalf of the Treasury argue the High Court was correct to reject the claims.

Sir James Eadie KC, who is representing the Treasury, HMRC and the Department for Education, said the state has "no obligation to subsidise" the education of religious minority groups.

TRENDING

Stories

Videos

Your Say

"We don’t have to subsidise religious education when there is already state-funded education," Sir James argued.

"They can be homeschooled and there is state education provided."

But lawyers for the group of religious families say the same level of religious education is not available in the state sector.

Bruno Quintavalle, representing Emmanuel School in Derby, and a group of Christian schools, said in a written submission the "state would be engaging in indoctrination” if it were to offer the same level of religious education as the appellant schools, where "Christianity infuses every aspect of the curriculum".

Parents and pupils protested outside the Royal Courts of Justice in London earlier this week

|PA

In this new claim, being heard by Sir Geoffrey Vos, Lord Justice Singh, and Lady Justice Falk, the appellants are seeking a VAT exemption for religious private schools.

Arguing against the claim, lawyers for the Treasury said in a written submission: "Removing tax breaks for private school users was a prominent feature of the Labour Party’s manifesto for the July 2024 general election."

They also argued it enhances "the fairness of the tax system overall" and will raise £1.5billion of revenue this academic year.

However, Bruno Quintavalle told the Court of Appeal raising money is "not a sufficient" reason for the Treasury to charge VAT on religious private schools.

LATEST DEVELOPMENTS

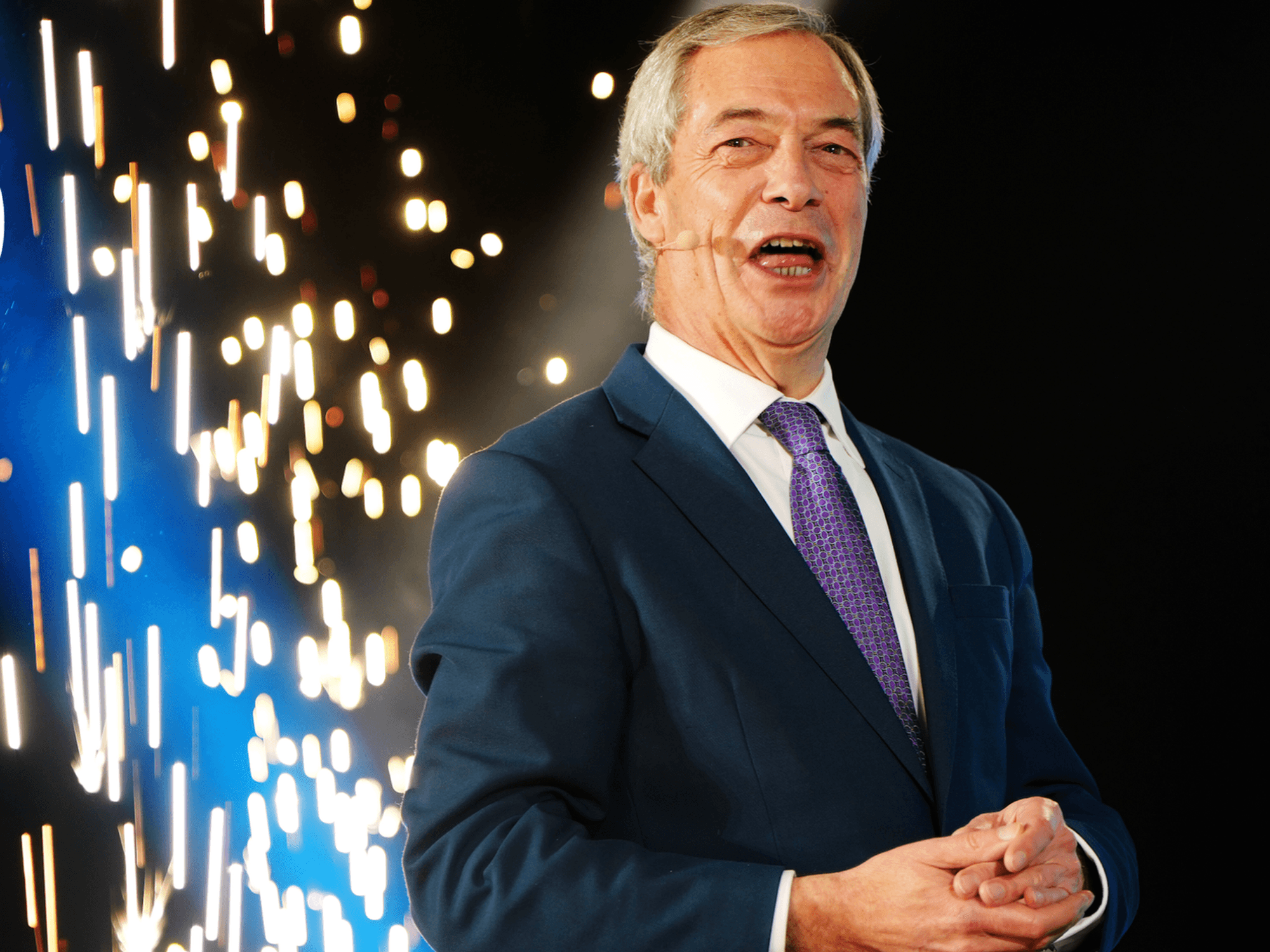

Bridget Phillipson, as Education Secretary, confirmed Labour's plan to add VAT to private school fees in 2024

| GB NEWSThe hearing is due to conclude on Wednesday.

Our Standards: The GB News Editorial Charter

More From GB News