US interest rates FALL for first time this year after pressure from Donald Trump

Policymakers voted to reduce rates by 25 basis points

Don't Miss

Most Read

Latest

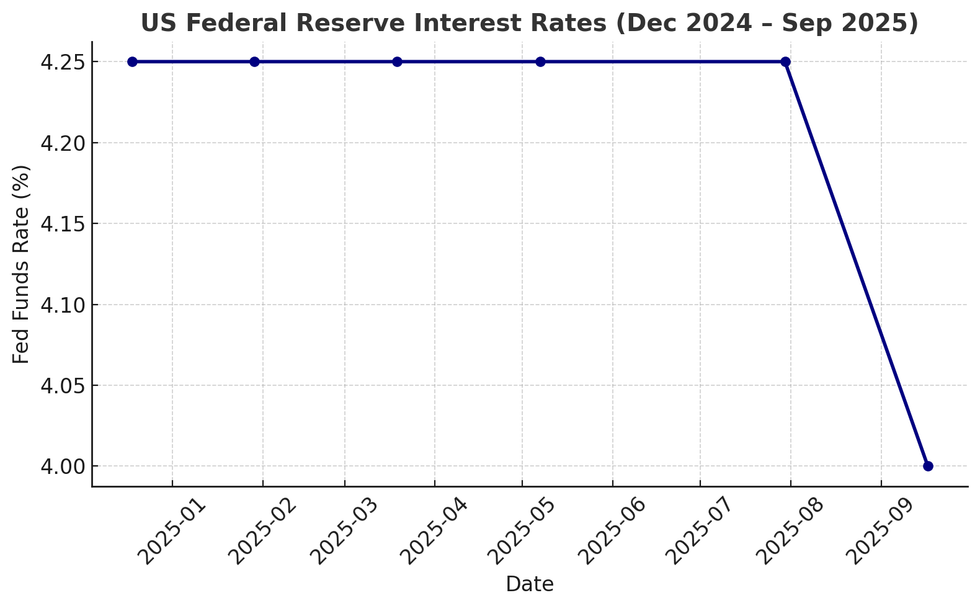

The US Federal Reserve has cut interest rates for the first time this year after sustained pressure from President Donald Trump.

Policymakers voted to lower the rate by 25 basis points to a range of four to 4.25 per cent, the first reduction since December 2024.

Officials had resisted moves for nine months amid concerns Mr Trump’s tariffs could fuel inflation.

In its policy statement, the Fed said the balance of risks had “shifted”, citing weak job gains, higher unemployment and slowing growth.

The US economy added just 22,000 jobs in August, raising fears of a weakening labour market.

The Fed’s move comes after months of pressure from Donald Trump to bring down borrowing costs

|GETTY

TRENDING

Stories

Videos

Your Say

“The Committee is attentive to the risks to both sides of its dual mandate and judges that downside risks to employment have risen,” it said. “Job gains have slowed, and the unemployment rate has edged up.”

David Rees, Head of Global Economics at Schroders, said: "The Fed’s decision to press ahead with interest rate cuts at a time when the solid economy is close to full employment raises the risk of higher inflation becoming ingrained.

"We now think that the Fed will deliver another two 0.25 per cent cuts by the end of 2025. But rates are unlikely to fall further from there, as solid growth drives a rebound in labour market activity and causes inflation to rise.

"As such, we continue to believe that market expectations of rates going below three per cent are too aggressive."

Only new Governor Stephen Miran dissented at the meeting, pressing for a half-point cut.

Mr Miran, who joined the Fed this week while on leave from his role at the White House Council of Economic Advisers, argued for a larger reduction as colleagues backed the smaller move.

Mr Trump has grown increasingly frustrated with the central bank’s caution. He has repeatedly attacked chairman Jerome Powell, calling him “too late” and a “numbskull”.

The President has also sought to remove Governor Lisa Cook and raised the prospect of ousting Mr Powell. His interventions have fuelled concern about the Fed’s independence as he seeks to install more of his own allies on the board.

The US President has repeatedly criticised the central bank, sparking concern among economists and investors about its political independence

|GETTY

Officials at the Fed signalled they expect to cut rates twice more this year, in October and December, though policymakers suggested only one cut is likely in 2026.

Markets had previously anticipated as many as five reductions over the same period, highlighting the more cautious outlook.

The so-called “dot plot”, which charts individual policymakers’ views on future interest rates, showed one official preferring to hold at the previous level, while another indicated rates could fall as low as three per cent by year-end.

In its statement, the central bank noted: “Recent indicators suggest that growth of economic activity moderated in the first half of the year. Job gains have slowed, and the unemployment rate has edged up but remains low. Inflation has moved up and remains somewhat elevated.”

US Fed CUTS interest rates for first time this year

|GBNEWS

The Fed added: “The Committee seeks to achieve maximum employment and inflation at the rate of two percent over the longer run. Uncertainty about the economic outlook remains elevated.

"The Committee is attentive to the risks to both sides of its dual mandate and judges that downside risks to employment have risen.”

It confirmed the decision to lower the federal funds rate by a quarter point to between four and 4.25 per cent, stressing future moves would depend on incoming data and the evolving balance of risks.

The Committee also pledged to continue reducing its holdings of government and mortgage-backed securities and reiterated its commitment to the two per cent inflation goal.

“The Committee would be prepared to adjust the stance of monetary policy as appropriate if risks emerge that could impede the attainment of the Committee’s goals,” the statement said, adding that assessments will take into account labour market conditions, inflation expectations and global developments.

Our Standards: The GB News Editorial Charter

More From GB News