UK interest rates held at 4% ahead of Budget – what it means for your mortgage and savings

How can savers stay ahead of inflation? |

GB News

MPC narrowly votes to hold base rate as inflation remains above target

Don't Miss

Most Read

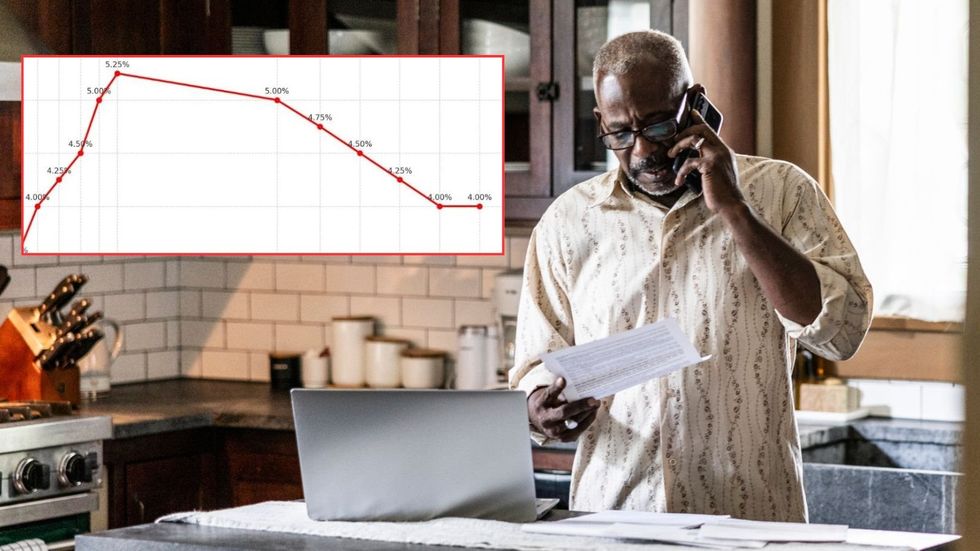

The Bank of England has voted to keep interest rates unchanged at 4 per cent, following a closely contested decision that saw members of the Monetary Policy Committee (MPC) split 5-4.

Four members argued for a reduction to 3.75 per cent, signalling that a turning point in the Bank’s rate cycle could be approaching.

Inflation currently stands at 3.8 per cent, still well above the Bank’s two per cent target.

Policymakers cited lingering price pressures and uncertainty ahead of the autumn Budget as key reasons for maintaining a cautious stance.

TRENDING

Stories

Videos

Your Say

This is the first time since December 2021 that the base rate has remained unchanged.

Governor Andrew Bailey said that while inflation has eased significantly from its peak three years ago, it “continues to exceed acceptable levels”.

Analysts said the close vote shows that momentum is building inside the MPC for a rate cut when members next meet on December 18.

Mr Bailey said the committee’s decision “balanced concerns about persistent above-target inflation against evidence of weakening demand”.

He added that if inflation continues on its current trajectory, the Bank expects to begin gradual rate reductions.

Inflation currently stands at 3.8 per cent

|GETTY/CHATGPT

What the rate decision means for:

Households

For millions of Britons, the decision means continued pressure from higher borrowing costs. Those on tracker or variable mortgages will see no immediate relief, as repayments remain at elevated levels.

Alice Haine, personal finance analyst at Bestinvest by Evelyn Partners, said: “Borrowers – particularly those burdened with large mortgages or heavy debts – face continued strain from elevated repayments on home loans and personal debts.”

Standard variable rate (SVR) customers are paying between seven and 7.5 per cent on average, according to L&C Mortgages.

David Hollingworth, associate director at the firm, said a borrower with a £200,000 25-year mortgage at 7.49 per cent could save around £420 a month by switching to competitive fixed-rate deals currently available around four per cent.

Mr Hollingworth said the latest decision should act as “a trigger to review their options,” warning that waiting while hoping for further cuts “could prove costly”.

The HL Savings & Resilience Barometer shows mortgage payments tend to peak in borrowers’ early forties, meaning this age group could benefit most from securing lower fixed rates as they return to the market.

LATEST DEVELOPMENTS

Buyers are urged to act fast, with Nationwide offering a 3.64% fixed rate deal

|GETTY

Mortgages

Although the Bank has held the base rate steady, the narrow margin has strengthened expectations that rate cuts are on the horizon.

Steve Clayton, head of equity funds at Hargreaves Lansdown, said that the MPC’s comments about viewing inflationary risks as “more balanced” and rates being on a “gradual downward path” have boosted confidence among lenders and investors.

Several major banks and building societies have already reduced fixed-rate mortgage offerings in recent days, anticipating further easing.

Sarah Coles, head of personal finance at Hargreaves Lansdown, said the close vote “cements expectations of rate cuts sooner rather than later,” and suggested that more reductions could follow before the end of the year.

Ms Coles added that those remortgaging or buying property “should move quickly to lock in competitive deals”, noting that the lowest available fixed rate is currently 3.64 per cent from Nationwide.

She said: “Securing a rate now allows borrowers to switch if better deals emerge, while protecting against potential rate rises.”

There appears to be growing optimism amongst economists towards future rate cuts on the horizon

| GETTYSavings

For savers, the rate hold offers short-term reassurance but may signal that returns could fall in the months ahead.

Mark Hicks, head of active savings at Hargreaves Lansdown, said the narrow vote “could be an indication of the MPC’s appetite for rate cuts in the coming months”, suggesting downward pressure on current top savings deals.

Ms Haine said that with inflation at 3.8 per cent, achieving genuine returns “remains challenging for most savers”.

She urged individuals to avoid “sitting on the sidelines waiting for conditions to improve” and instead move funds from poorly performing accounts to more competitive options.

Mr Hicks added that online banks and savings platforms have kept easy access and cash ISA rates attractive through strong competition, though these may begin to edge lower if the Bank signals firm plans for rate reductions.

More From GB News