UK gas prices surge 40 per cent as fears over household energy bills rise

Wholesale surge raises fears over household energy bills

Don't Miss

Most Read

Latest

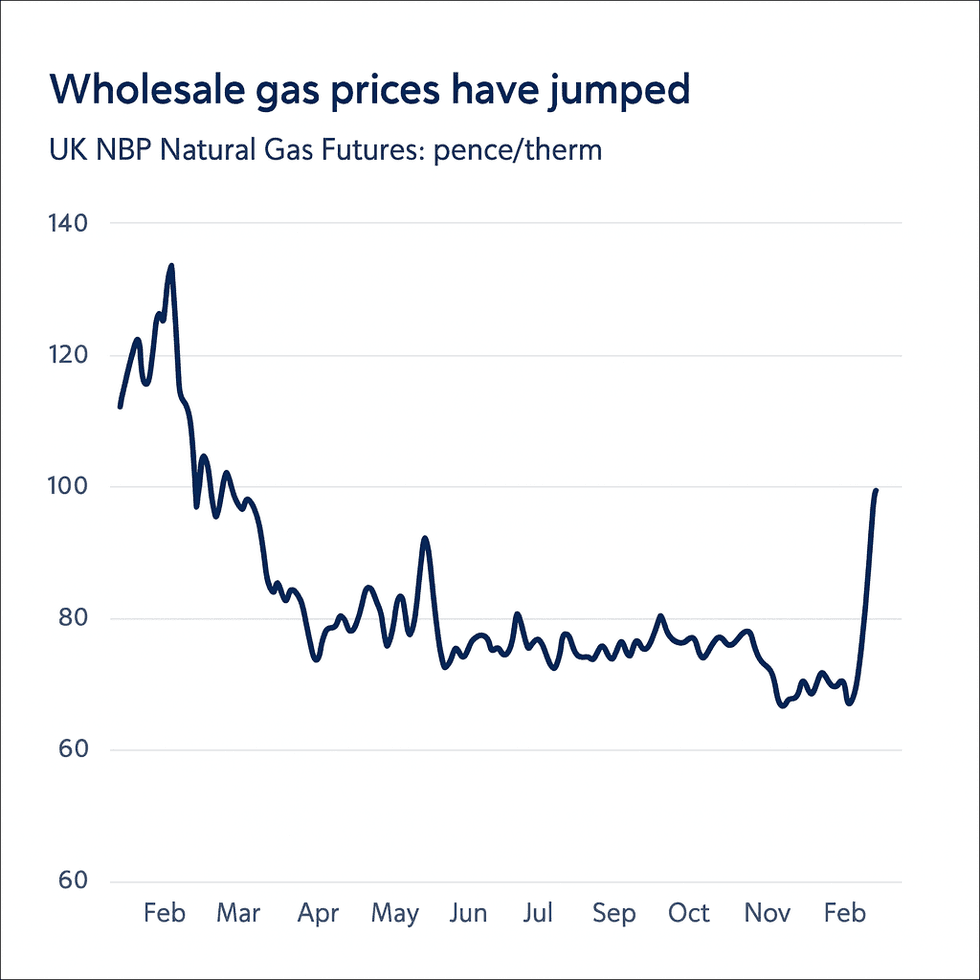

Wholesale natural gas prices have surged more than 40 per cent since the start of January, triggering renewed concerns rising costs will soon filter through to household energy bills.

Day-ahead contracts for UK delivery climbed to their highest level in six months on Friday, after jumping more than 14 per cent in a single trading session, according to figures from financial institution LSEG.

The sharp rise is a significant turnaround from early January, when wholesale gas prices had fallen to their lowest levels since late spring, while storage reserves were being replenished.

Energy markets across Europe have experienced similar upward pressure, as a series of converging factors push prices higher at the same time.

TRENDING

Stories

Videos

Your Say

One industry expert described the situation as a "perfect storm" driving wholesale costs sharply upward.

European gas markets are now facing sustained pressure as the coldest weeks of winter approach.

Several drivers have combined to push prices higher over recent weeks.

Colder-than-average temperatures across northern Europe have led to a sharp increase in demand, while gas storage facilities are now just 52 per cent full, according to data from Gas Infrastructure Europe.

That compares with significantly higher storage levels seen at the same point in recent winters.

At the same time, deliveries of liquefied natural gas have slowed, with cargoes from the United States and other suppliers increasingly diverted to Asian markets where buyers are willing to pay higher prices.

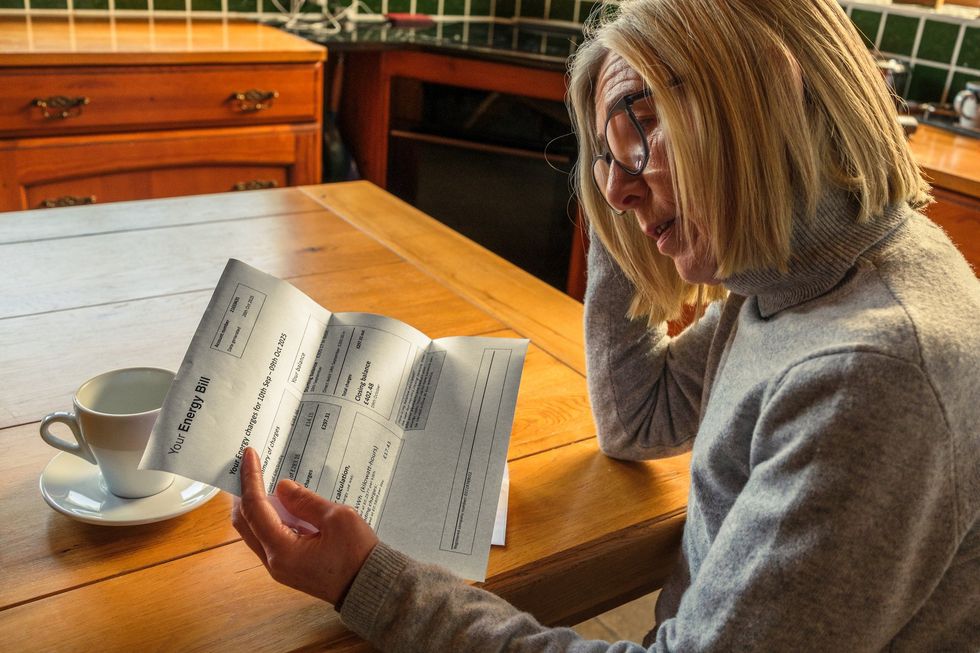

Wholesale natural gas prices have jumped over 40 per cent since January, raising fears of higher household energy bills

|GETTY

Arne Lohmann Rasmussen, chief analyst at Global Risk Management, pointed to additional pressures affecting the market.

"There is a combination of colder weather, geopolitical concerns linked to Iran, and trading activity where speculators are closing short positions," he said.

Weather forecasts indicating a sharp drop in temperatures later this month have added further strain, while lower wind speeds have reduced the contribution from renewable energy generation.

Contracts for February delivery in the UK rose by more than eight pence per therm on Friday, pushing prices above 98p.

LATEST DEVELOPMENTS

Wholesale gas prices have jumped

|LSEG/CoPilot

The surge in wholesale prices has coincided with an increased reliance on gas-fired power stations to meet electricity demand.

During the recent cold snap, gas-fired generation supplied well over half of Britain’s electricity for four consecutive days, according to data from the National Energy System Operator.

On Thursday alone, gas accounted for 36 per cent of the nation’s electricity supply, with wind power providing the second-largest share.

Analysts have warned that sustained wholesale price increases are likely to feed through to consumer bills over time.

Households looking to fix their energy tariffs could face higher prices ahead of the next review of the energy price cap, which is scheduled to take effect at the start of April.

The timing has raised concerns for consumers hoping to lock in deals before spring.

The Government has looked to move away from international gas markets

|GETTY

Jess Ralston, energy analyst at the Energy and Climate Intelligence Unit, said: "Following years of price volatility that have left households with debt and industry with billions of extra costs, it's a reminder that the price of gas is largely set by the actions of foreign actors, beyond our control".

Ms Ralston added that declining North Sea reserves do not provide a long-term solution for lowering bills or ensuring energy security.

The Government has repeatedly cited reducing exposure to gas price volatility as a key reason for accelerating the transition towards renewable energy.

Earlier this week, a record-breaking offshore wind auction concluded, which Ministers said keeps Britain on track to meet its 2030 clean power targets.

However, the auction also saw an 11 per cent rise in strike prices, meaning future renewable projects are expected to be more expensive than previously planned.

Our Standards: The GB News Editorial Charter

More From GB News