Pension shock as HMRC crackdown leaves retirees facing 70 per cent tax bills

Jacob Rees-Mogg blasts the HMRC - WATCH |

GBNEWS

Pension providers had been allowing refunds , but HMRC has now made clear this is not permitted

Don't Miss

Most Read

Pensioners are being hit with shock tax bills of up to 70 per cent after trying to return tax-free lump sums to their pension pots.

HMRC has ruled that savers who took out their lump sums after December 5 and then paid the money back are making an "unauthorised payment".

The move can trigger tax penalties of 55 per cent in most cases, and as high as 70 per cent for some.

The warning has caused alarm among retirees who believed they had a 30-day cooling-off period to change their minds, something usually offered on other financial products.

Pension providers had been allowing refunds in line with Financial Conduct Authority rules, but HMRC has now made clear this is not permitted when it comes to tax-free lump sums.

The tax authority said it will review affected cases individually but admitted it has no clear figure for how many savers are caught up in the crackdown.

HMRC has confirmed that "unauthorised payment charges may apply if contributions to pension schemes are made out of tax-free lump sums and the conditions for the recycling rule are met."

This effectively blocks savers from reversing withdrawals of their tax-free allowance, even if they try to act within days.

The ruling hits hardest those who rushed to cash out pensions amid speculation that the Chancellor’s autumn Budget could cut tax relief.

Reports that Rachel Reeves might slash the tax-free allowance from £268,275 to £100,000 fuelled a dramatic spike in withdrawals.

State pensioners are at risk of paying more tax to HMRC | GETTY

State pensioners are at risk of paying more tax to HMRC | GETTY FCA data shows pension cash-outs surged by £20 billion in 2024-25 compared with the previous year, with tax-free withdrawals alone jumping 63 per cent to £18 billion. Under current rules, over-55s can withdraw 25 per cent of their savings tax-free, up to the £268,275 cap.

Many retirees rely on these lump sums to pay off mortgages or support children at university. Yet not all providers offered cooling-off periods to reverse decisions, with Aviva among those that did not allow lump sum returns.

A pension provider source expressed surprise at HMRC's enforcement approach: "I am aware that some firms in the UK promoted this [putting back your lump sum], some firms were saying, 'This is a great idea.'"

Britons are concerned about future tax rises from HMRC | GETTY

Britons are concerned about future tax rises from HMRC | GETTYThe source questioned whether HMRC possessed data indicating significant numbers were affected, warning of "huge ramifications for those individuals".

Another industry source highlighted that providers requiring professional advice before cash access likely experienced fewer cancellation requests than those without such requirements. They identified a "consumer protection gap" that had "caught them off guard".

The FCA clarified that whilst some pensioners might possess cancellation rights through their provider contracts, these would not supersede HMRC's tax regulations.

A spokesmansaid: "Our rules give people the right to cancel certain contracts; however, accessing tax-free cash is not a cancellable contract in its own right. Our position on this has not changed."

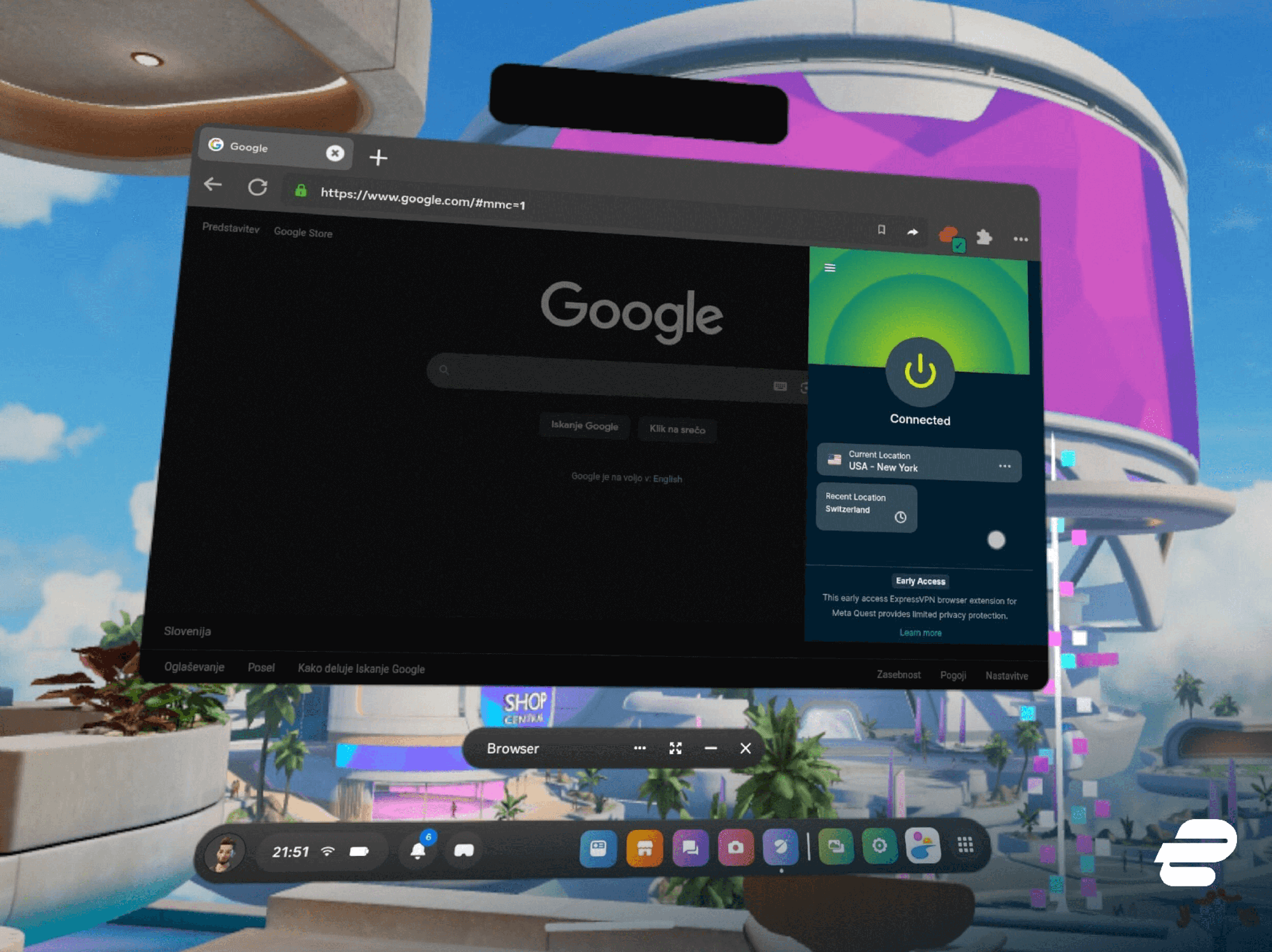

HMRC confirms customers should carefully consider their options before taking out tax-free lump sums

| GETTYAndrew Tully of Nucleus criticised the decision: "For HMRC and FCA to determine that there are, in practical terms, no cancellation rights for those who want to reconsider their decision a few days later, belies belief.

"We run the risk of some people not understanding and ending up facing a 70 per cent tax charge on what they expected to be a tax-free lump sum."

HMRC maintained its position, with a spokesman stating: "Speculating on any changes to taxes carries risks and customers should carefully consider their options before taking out tax-free lump sums."

More From GB News