Tax trap EXPOSED as stealth HMRC raid pushing millions of workers to 'sabotage their future'

'End the doom loop!' Zia Yusuf blasts Rachel Reeves for pre-Budget tax warning |

GB NEWS

Analysts are sounding the alarm over how fiscal drag is impacting workers outside of stealth tax hikes

Don't Miss

Most Read

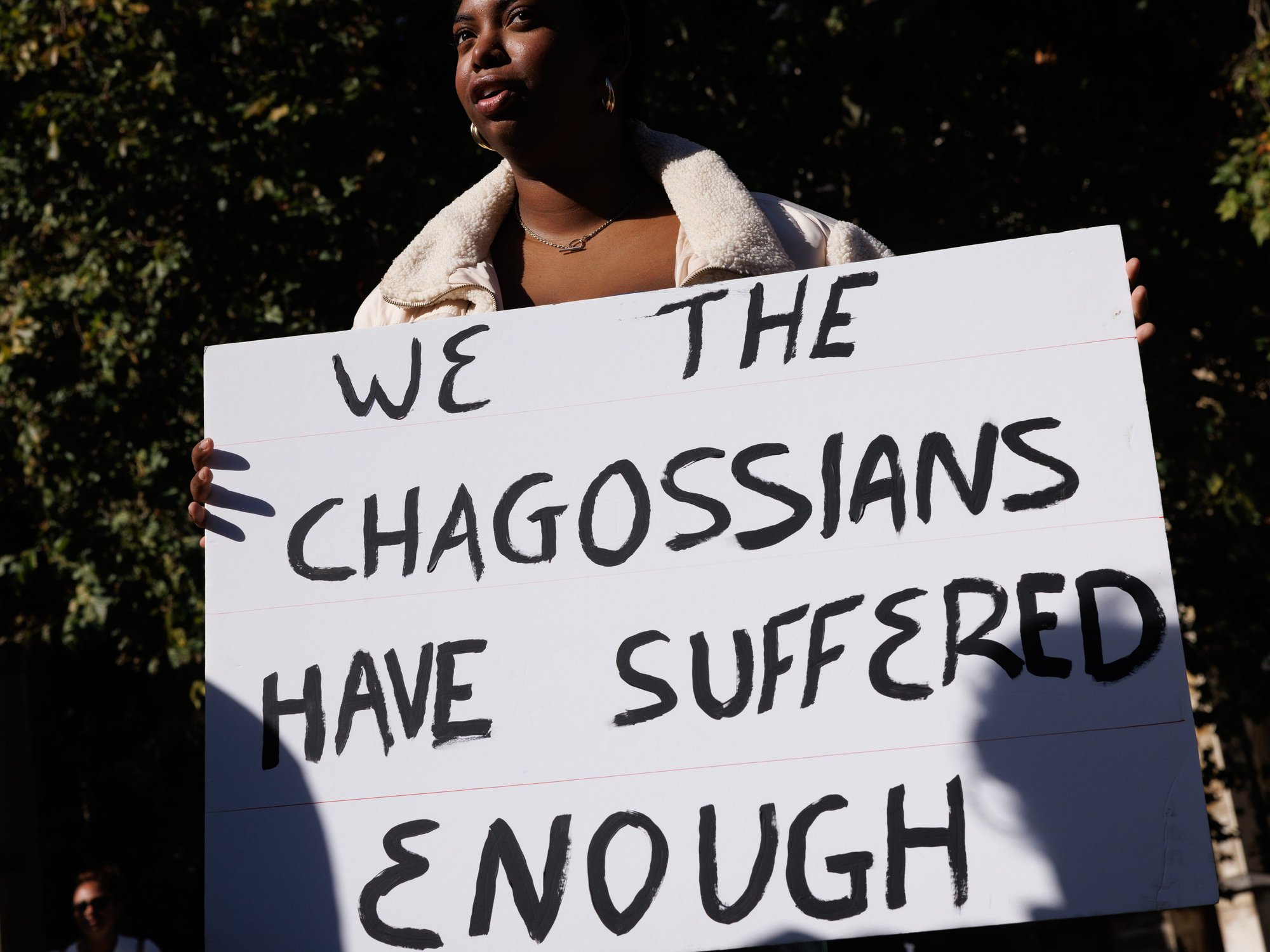

Millions of British workers could "sabotage their future" by not pursuing career progression to avoid a stealth tax trap from HM Revenue and Customers, analysts warn.

Fiscal drag is pushing Britons into elevated tax brackets, which occurs when income tax thresholds remain static while wages and inflation surge.

According to experts, employees have been actively declining career advancement to avoid paying more high tax since the Government froze tax brands in April 2021.

The freeze affects key thresholds including the £12,570 personal allowance and the £50,270 higher-rate boundary, where taxation jumps to 40 per cent.

Workers are 'sabotaging their future' to avoid a stealth tax raid, experts claim

|GETTY

With average wages climbing over 20 per cent during this period, workers find themselves automatically shifted into more punitive tax categories despite no real increase in purchasing power.

SalaryGuide co-founder Josh Peacock highlighted a growing trend has emerged across online platforms and workplace discussions, with employees openly admitting they are declining salary increases and advancement opportunities.

Social media forums, particularly Reddit, have become confession spaces where workers share their decisions to reject promotions rather than face higher taxation.

The phenomenon coincides with mounting speculation about potential income tax rises in upcoming budgets. Workers express particular anxiety about crossing into the 40 per cent tax bracket, with approximately 1.3 million employees currently positioned near these threshold boundaries.

Jeremy Hunt introduced the current freeze to tax thresholds during his tenure as Chancellor

| GB NEWSMr Peacock warns that such decisions could "quietly sabotage their future far more than the extra tax ever could."

He emphasises that workers should consider the compounding effects over the coming decade rather than focusing solely on immediate tax implications.

"If you say no to a promotion or pay rise right now, you shouldn't just look at the extra income, you should look at what that number compounds into over the next decade," Mr Peacock states.

He cited how bonuses, pension contributions and interest transform these decisions into life-altering choices with the career implications extending beyond immediate finances.

"Employers often notice who among staff leans into growth. If you refuse progression, you're signalling you've stopped being ambitious and that perception can follow you," Mr Peacock warns.

"The fear of entering a higher tax band might save you some money today but the real cost is career stagnation and the loss of compounding potential that can snowball into hundreds of thousands over a lifetime."

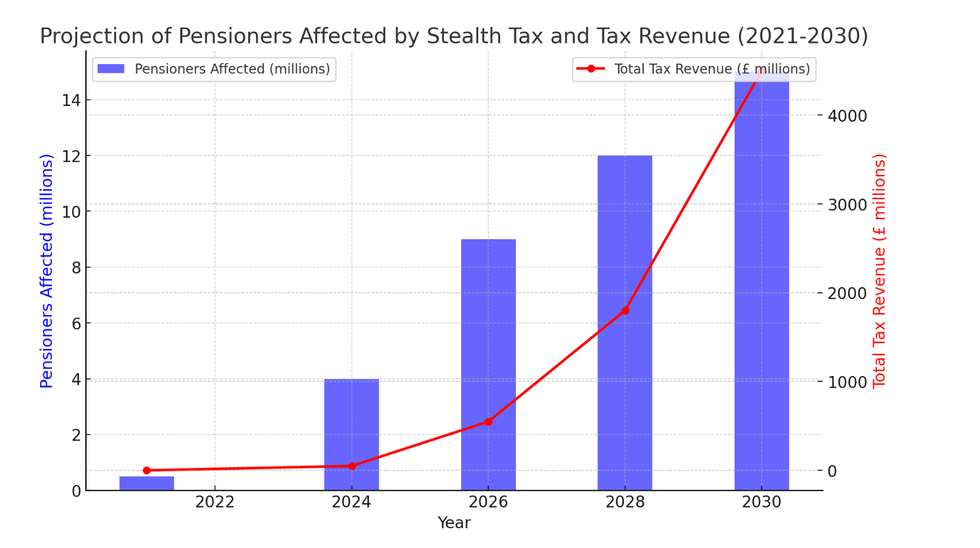

Approximately four million additional Britons have been drawn into income tax payments since 2021, with projections from the Institute for Fiscal Studies (IFS) suggesting this figure will reach 5.6 million by 2028.

The higher-rate taxpayer population has expanded dramatically, surging from roughly 4.3 million in 2020 to more than 6.5 million in 2024. Forecasts indicate this could surpass 7.5 million within four years.

Graph projects the number of retirees facing a stealth tax on their state pensions will rise in the coming years | Chat GPT

Graph projects the number of retirees facing a stealth tax on their state pensions will rise in the coming years | Chat GPT Originally intended for society's highest earners, the 40 per cent rate now captures middle-income professionals including teachers, nurses and journalists.

The Office for Budget Responsibility (OBR) calculates that this passive revenue generation will yield approximately £40-45billion annually by 2028, exceeding any deliberate tax increase in recent history.

Mr Peacock added: "Even when you move into a higher tax band, you only pay the higher rate on the portion above the threshold, not your entire income. Many people still misunderstand this.

"By rejecting pay growth, you're freezing your own earning potential. Over a career, that can cost hundreds of thousands. Top companies reward people who think about adding value to a business, not avoiding tax."

More From GB News