Middle class Britons could be hammered in £2bn tax raid from Rachel Reeves - will you need to pay?

The Chancellor is looking for ways to generate tax revenue for her upcoming Autumn Budget

Don't Miss

Most Read

Latest

Britain's middle class will be hammered as part of a rumoured £2billion tax raid from Chancellor Reeves that will affect legal professionals, medical practitioners and financial advisers.

The Treasury is attempting to grapple with an significant estimated shortfall in public funding of £30billion ahead of the upcoming Autumn Budget on November 26.

This proposed charge would impact more than 190,000 individuals who currently benefit from partnership arrangements, effectively removing advantages that have allowed them to avoid the standard employer's national insurance rate of 15 per cent.

If the change to the HM Revenue and Customs (HMRC) tax regime is implemented, the measure represents a significant shift in how partnership income will be treated for tax purposes.

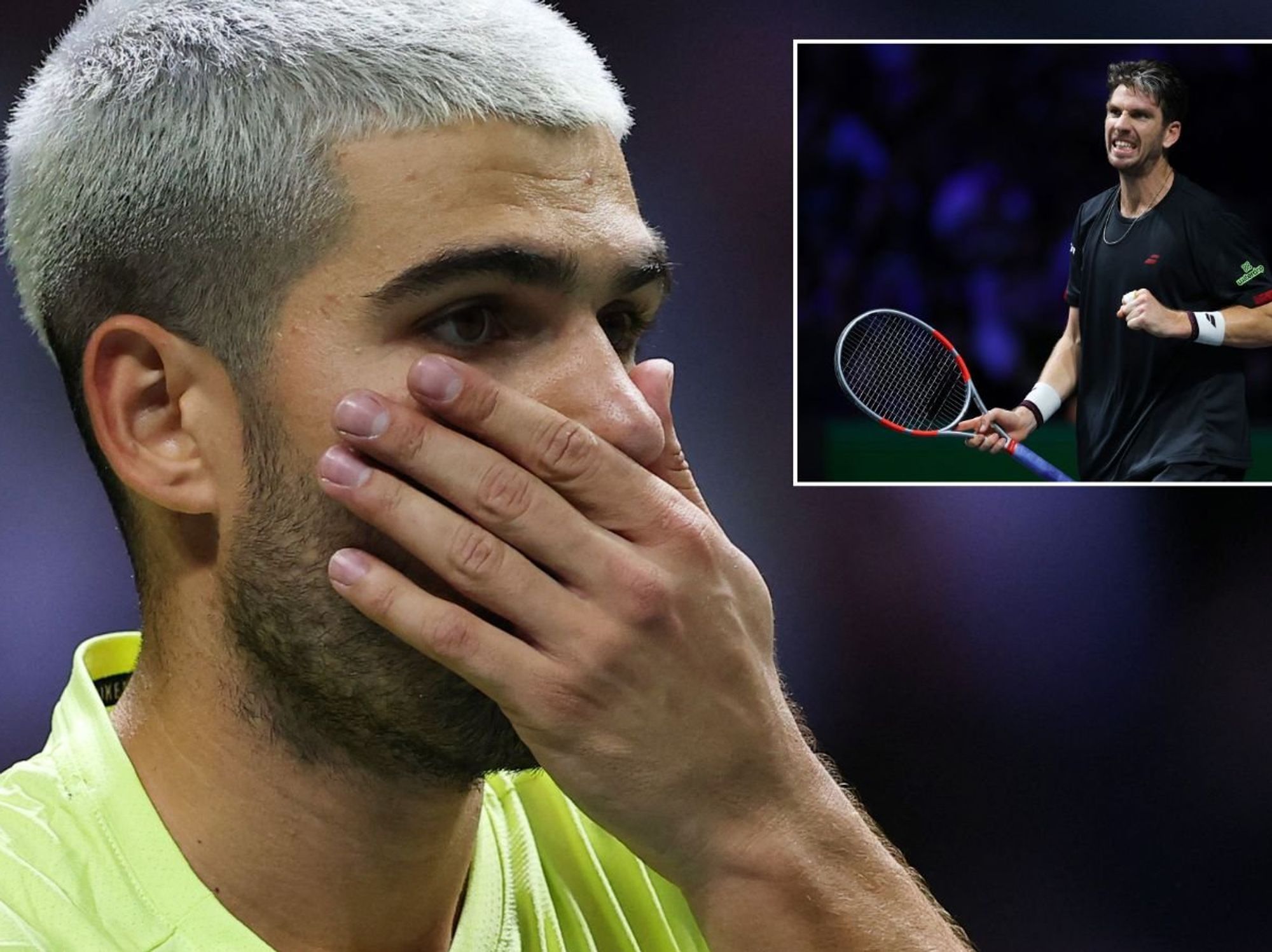

The Chancellor is floating a tax raid on the middle class, reports suggest

|PA / GETTY

Financial analysis from the Centre for the Analysis of Taxation reveals that a typical solicitor earning £316,000 annually would face an additional tax burden of £23,000, resulting in their effective tax rate rising by 7.3 percentage points.

The partnership sector encompasses numerous high-earning professionals, with more than 13,000 partners receiving average annual incomes of £1.25million.

Solicitors typically earn £316,000 per year, while accountants receive approximately £246,000 and general practitioners earn around £118,000 on average.

Legal professionals represent a substantial portion of the partnership economy, contributing one-fifth of total partnership income according to CenTax research.

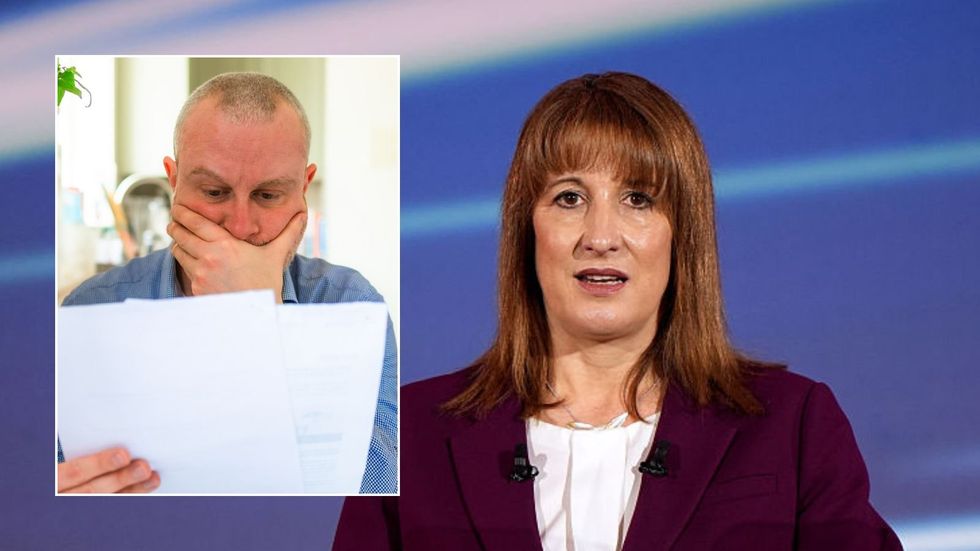

Middle class Britons could pay more money to HMRC

| GETTYThe proposed levy would function as a reduced-rate employer's National Insurance charge applied to partnership profits, fundamentally altering the current tax treatment of self-employed professionals.

Ahead of next month's fiscal statement, the Chancellor has claimed Brexit has made the UK’s economy and productivity “weaker” than initially projected when Britons voted to leave the European Union.

To get the country back on the country, Ms Reeves outlined plans to scrap paperwork and red tape for thousands of UK businesses at the Regional Investment Summit in Birmingham on Tuesday.

This move from the Labour Government came after Government borrowing in September reached the highest level for the month in five years, according to the Office for National Statistics (ONS).

Ms Reeves said: “The OBR do the forecasts for the economy. When we left the European Union, or when we voted to leave, they made an estimate about the impact that would have.

"What they’ve done this summer is go back to all of their forecasts and look at what actually happened compared to what they forecast.

"What that shows – and what they will set out – is that the economy has been weaker and productivity has been weaker than they forecast, despite the fact that they forecast that the economy would be weaker because of leaving the EU…

“I am determined that the past doesn’t define our future and that we do achieve that economic growth and productivity with good jobs in all parts of the country."

LATEST DEVELOPMENTS:

The Chancellor is preparing to outline her plans for the UK economy at the Autumn Budget

| PAThe Office for Budget Responsibility’s (OBR) assessment of the UK economy be published in detail alongside the Autumn Budget, in which the Chancellor is believed to preparing tax rises and spending cuts.

Based on the National Institute of Economic and Social Research (NIESR) has suggested Ms Reeves will need to find around £5 billion a year by 2029-39 to meet her goal of balancing day-to-day spending with tax revenues while maintaining “headroom” of around £10billion against that target.

Ms Reeves added "This year has been particularly volatile in terms of world events, from Ukraine to the Middle East, to the higher trade tariffs that countries around the world including the UK face.

"We’re not immune to that, despite the fact that we’re doing trade deals with the EU, India and with the US."