Parents urged to take action as summer debt costs 'gripping millions of families' - five tips to boost your savings

GB News

British travellers are defying mounting financial pressures to splash out unprecedented sums on foreign holidays, with new data revealing the scale of the spending spree

Don't Miss

Most Read

Latest

A staggering 14 million Britons are now resorting to credit cards, loans or borrowing from relatives to fund their summer breaks, even as household budgets remain squeezed.

Personal finance experts are urging families to action with one providing five practical tips to help limit that 'holiday hangover'.

This summer’s spending bonanza comes despite three-quarters of Britons acknowledging that holidays have become a luxury many can scarcely afford.

Financial experts are sounding the alarm about September’s looming “holiday debt hangover” as credit card statements land on doormats across the country.

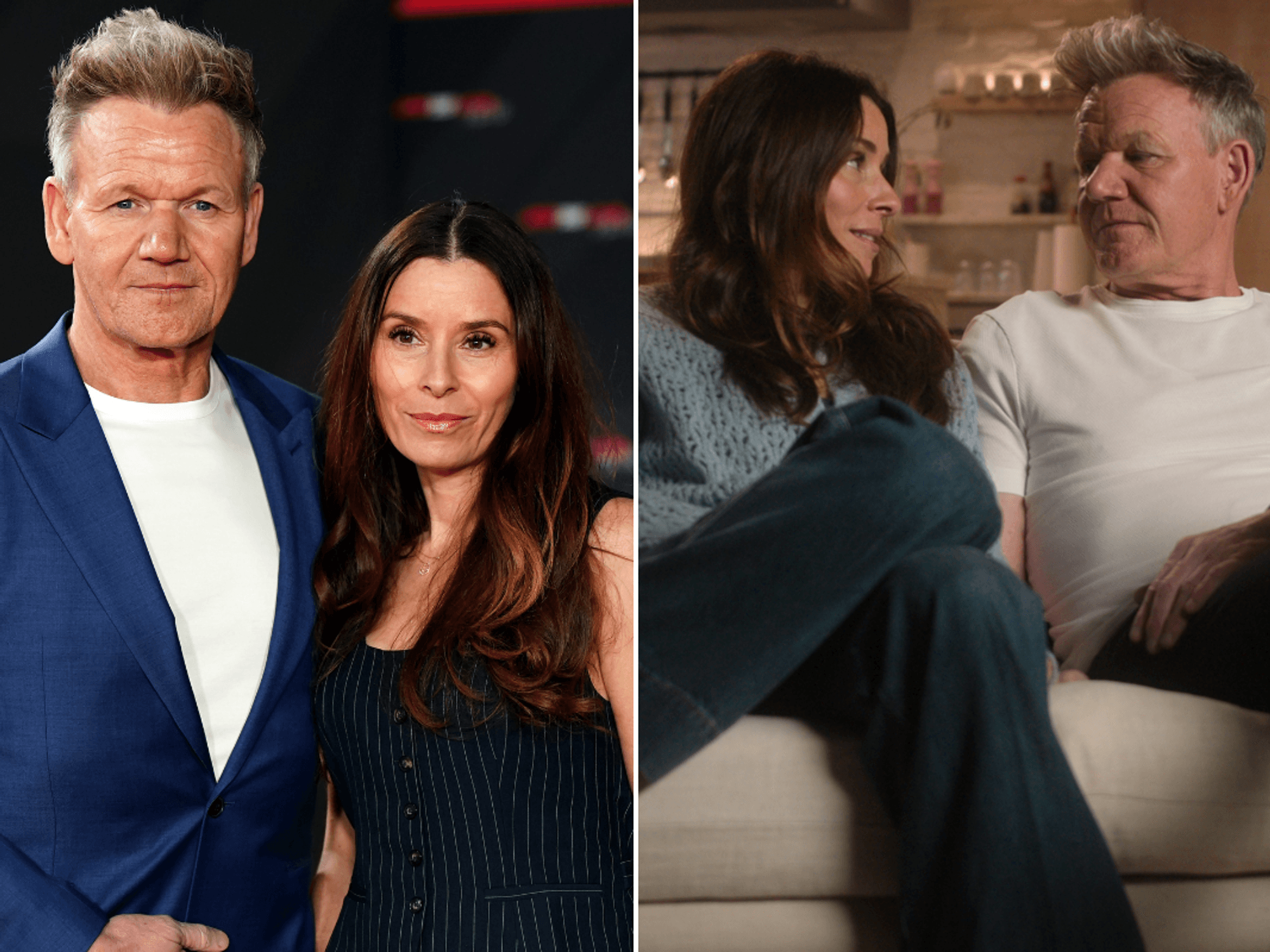

Families are spending fortunes on their summer holidays

|GETTY

The nation’s holidaymakers poured a record £78.6billion into overseas destinations last year, marking a 10 per cent surge since 2023.

The average British tourist now spends £830 per person on each overseas trip, contributing to 94.6 million journeys abroad in 2024, surpassing pre-pandemic peaks.

While Spain, France and Italy continue to dominate as favourite destinations, attracting 17.8 million, 9.3 million and 4.8 million British visitors respectively, travellers are increasingly exploring affordable alternatives such as Croatia, Montenegro and Morocco.

Meanwhile, inbound tourism growth has lagged at just 4 per cent, with Americans leading foreign arrivals at 5.6 million visitors.

This translates to £215million flowing out of Britain daily, and the spending surge has widened Britain’s tourism deficit to an unprecedented £46.1billion.

British travellers now spend nearly two-and-a-half times more abroad than international visitors spend in the UK.

The financial toll on households is becoming increasingly severe, with 56 per cent of those planning summer getaways expressing concern about the costs involved.

Many families are making painful sacrifices to afford their breaks, cutting back on restaurant meals, clothing and social activities.

Some are going further, trimming grocery budgets, delaying haircuts and even limiting their energy consumption to scrape together holiday funds.

One in five holidaymakers relied on credit cards to finance their trips, while others took on additional shifts at work or dipped into savings meant for other purposes.

Do you have a money story you’d like to share? Get in touch by emailing money@gbnews.uk.

More than a quarter admitted feeling pressured by family expectations and media messaging to book holidays despite precarious finances.

Fiona Peake, personal finance expert from Ocean Finance, warns that September is when the true cost of summer hits home.“

"Families are opening credit card statements and realising the dream trip has left them in the red,” she said.

She describes this month as particularly perilous for household finances.

“This is the most dangerous month for holiday debt because bills collide with back-to-school costs and higher winter energy bills.”

Ms Peake highlights how rising prices for flights, accommodation and dining abroad are forcing families into difficult choices.

“Many households are cutting back on food shopping, haircuts, and even heating use just to get a few days in the sun,” she said.

She cautions that while holidays remain the one treat people are desperate to hang on to, increasing numbers are paying for their trip long after the tan has faded.

More than a quarter admitted feeling pressured by family expectations and media messaging to book holidays despite precarious finances.

|GETTY

Fiona shares five ways to avoid a financial hangover:

Check your credit card balances now

Don’t bury your head in the sand. Work out exactly what you owe from summer spending and calculate how much interest you’ll be charged if you only make the minimum repayment.

Create a holiday savings pot for 2026

If holidays matter to you, plan ahead. Treat them like a household bill and put money aside each month so you’re paying for next year’s trip in advance, rather than paying it back afterwards.

Consider a cheaper autumn or winter break

A long weekend in the UK or a budget destination can give you the same lift without overspending. It’s better to scale down than to spend months paying off a summer trip.

Use credit cards wisely

Booking with a credit card offers valuable protection if an airline or holiday company goes bust, even if you only paid the deposit on the card. But beware: only making minimum repayments means interest could leave you paying for one trip for years. Foreign visitors must also now pay £16 for electronic travel authorisations, further deterring tourists.

LATEST DEVELOPMENTS:

The Prime Minister is mulling over the use of controversial digital ID cards for Britons

| PALook for hidden extras before booking

As September kicks off holiday-deal season, always check for baggage charges, transfers and exchange rates before committing. A headline bargain can quickly become far more expensive once add-ons are included.

The tourism imbalance also poses significant challenges for the Treasury.

Economists warn that the growing deficit acts as an “invisible import” that weakens Britain’s economic position.

Travel industry leaders argue that government policies are partly to blame, pointing to the requirement for EU visitors to carry passports rather than ID cards, potentially excluding 300 million Europeans.