Retirement warning: How millions could lose out on £93,000 over their working lives

Greg Smith on the unfair tax on pensioners

|GB News

Women are most at risk when it comes to falling victim to pension shortfalls, new research has found

Don't Miss

Most Read

Latest

Persistent wage disparities looks set to rob millions of Britons more than £93,000 throughout their professional lives, according to damning new analysis.

The research from Instant Offices demonstrates that whilst half of all workers express dissatisfaction with their remuneration, women face particularly severe financial disadvantages.

Based on the firm's analysis, this lifetime deficit emerges from systematic pay inequalities that persist across every career stage between the sexes.

The cumulative impact extends far beyond immediate earnings, affecting pension contributions, savings potential and overall financial security.

the true cost to British women is likely to surpasses £100,000.

| GETTYAnalysts claim these figures underscore the urgent need for comprehensive workplace reforms to address this enduring economic injustice facing women in the UK.

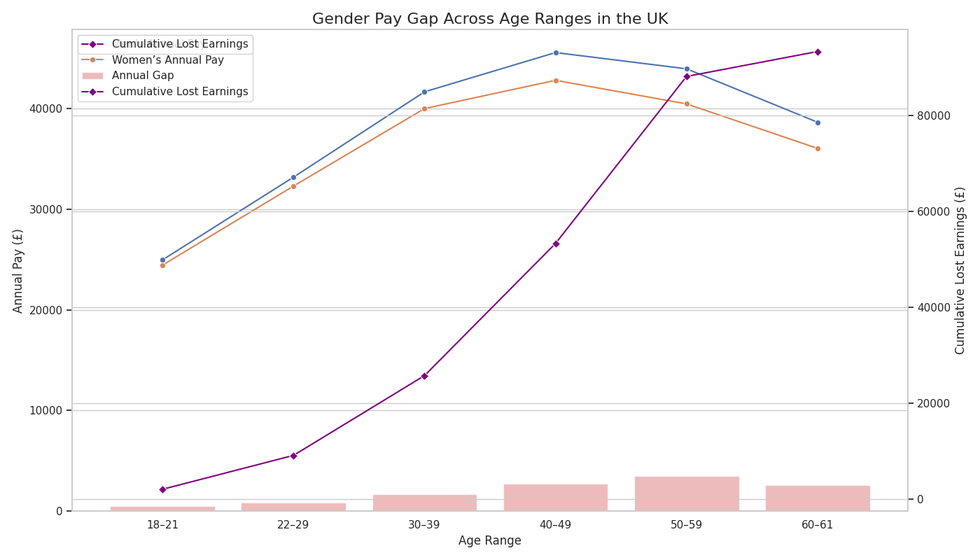

The earnings disparity becomes particularly pronounced as women advance through their careers. Whilst the initial gap appears modest at £520 annually for those aged 18-21, it balloons dramatically by middle age.

Women in their forties face the steepest disadvantage, earning £2,756 less than their male counterparts each year.

This represents the peak earning decade when salaries typically reach £42,796 for women, yet men of identical age receive £45,552.

Do you have a money story you’d like to share? Get in touch by emailing money@gbnews.uk.

The pattern continues into the fifties, where the annual shortfall widens further to £3,484. Even as careers wind down past sixty, women still trail by £2,600 yearly, demonstrating how inequality persists throughout working life.

The financial toll accumulates relentlessly across a woman's working life. Beginning with modest disparities in early careers, the shortfall compounds through each decade of employment.

By their thirties, women have already forfeited £25,792 in cumulative earnings. This figure more than doubles to £53,352 by age forty-nine, before soaring to £88,192 as they approach retirement.

The forty-year career trajectory reveals how seemingly minor annual differences transform into substantial wealth gaps.

The chart illustrates how women's lost earnings accumulate over time due to the gender pay gap, with each age bracket adding to the total shortfall.

|Co-Pilot

These calculations reflect only basic salary differentials, excluding performance bonuses and pension contributions tied to earnings levels.

When such additional factors enter the equation, the true cost to British women likely surpasses £100,000, representing a profound economic disadvantage.

Retirement experts from Instant Offices claim businesses possess multiple tools to combat these persistent wage disparities.

They cite regular salary reviews can identify and rectify gender-based pay differences across organisational levels.

LATEST DEVELOPMENTS:

Women appear to be at a pension savings shortfall compared to men | PA

Women appear to be at a pension savings shortfall compared to men | PAFurthermore, experts acknowledge that clear remuneration frameworks with defined pay ranges ensures transparency and reduces subjective bias in compensation decisions.

Flexible working arrangements and comprehensive parental are widely known policies help maintain career momentum for mothers, as well as structured recruitment processes and diverse selection panels further minimise unconscious bias.

Overall, experts advocate for professional development investments and objective performance assessments, which employers can ensure merit rather than gender determines earnings progression.

According to Instant Offices, fair pay practices, supporting career progression, and addressing structural barriers, businesses can ensure that talent and contribution, not gender, determine earnings.

More From GB News