State pension 'timebomb' as 25 MILLION retirees at risk if triple lock axed: 'Living in fool's paradise!'

Under the triple lock, state pension payment rates rise annually by either the rate of inflation, average wage growth or 2.5 per cent; whichever is highest

Don't Miss

Most Read

Latest

A former Government minister has warned scrapping the state pension triple lock could put 25 million retirees at risk of having insufficient savings once they reach retirement.

Former pensions minister Sir Steve Webb has criticised those in favour of axing the triple lock mechanism for "living in a fool's paradise" and not comprehending the state of Britain's pension crisis.

This comes after the state pension triple lock has been labelled a "large financial risk" by the Office for Budget Responsibility (OBR) earlier this year in a damning assessment of the policy's spiralling costs.

The fiscal watchdog revealed the scheme now costs taxpayers £15.5billion annually, representing a staggering £10billion increase beyond original projections.

Getting rid of state pension triple lock would turn Britain into a 'fool's paradise', a Government minister has warned

|GETTY

When the Conservative-Liberal Democrat coalition introduced the measure over a decade ago, it was expected to cost approximately £5billion per year.

The findings deliver another blow to Chancellor Rachel Reeves, with the OBR warning that the UK's public finances remain in a "relatively vulnerable position" following years of abandoned spending consolidation efforts by successive governments.

However, Mr Webb has issued a stark warning about the consequences of scrapping the triple lock mechanism which guarantees the state pension rises every year by at least 2.5 per cent.

Speaking at a Society of Pension Professionals webinar, the LCP partner highlighted that Government data suggests around 15 million people currently face inadequate retirement income.

How much will the state pension triple lock cost the British taxpayer? | OBR

How much will the state pension triple lock cost the British taxpayer? | OBR However, this former Government ministers noted this assumes the triple lock remains in place indefinitely.

Should the policy be replaced with annual increases tied solely to inflation, Mr Webb warned the number of people with insufficient retirement funds would surge beyond 25 million.

He described the situation as "living in a fools paradise", suggesting the true scale of the pension crisis is being masked by current policy assumptions.

The OBR assessment paints a troubling picture of Britain's fiscal trajectory, noting that repeated Government U-turns on spending consolidation have caused a "substantial erosion of UK's capacity to respond to future shocks".

According to the watchdog, the state pension represents one of the heaviest burdens on public expenditure, with projections indicating it will consume 7.5 per cent of the nation's entire gross domestic product (within half a century.

This marks a dramatic increase from historical levels, when the retirement benefit accounted for just two per cent of GDP during the 1950s.

Currently, the Department for Work and Pensions (DWP) retirement benefit costs approximately five per cent of national output.

Stuart Earle, a partner at Eversheds Sutherland, who chaired the SPP event, offered a sobering assessment of the pension landscape.

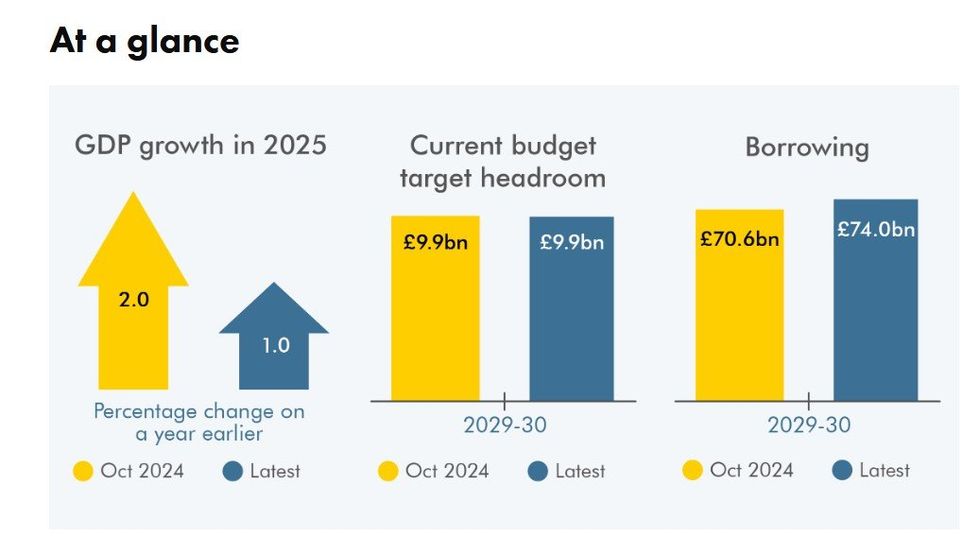

In March, the OBR provided its previous forecasts for GDP growth in the UK | OBR

In March, the OBR provided its previous forecasts for GDP growth in the UK | OBR Mr Earlier said: "Hearing about the past, present and future of both state and occupational pensions and how they interact proved genuinely illuminating.

"We are moving ever closer to the original state pension age of the early 1900's (70) and as Sir Steve highlighted the ticking time bomb of inadequate pension saving is probably worse than the government and others think."

The webinar attracted approximately 200 pension professionals and traced the evolution of retirement provision from the Old Age Pensions Act of 1908 to present day challenges.

Older Britons will receive a state pension triple lock to their payments in April 2026.

More From GB News